According to a new study by Construction Coverage examining where and to what degree homebuyers are most impacted by rising mortgage interest rates, those rates are now more than double what they were in early 2021. As a result, spiraling home prices have started to slow down—but not by enough to offset the increased borrowing costs.

Location, Location, Location

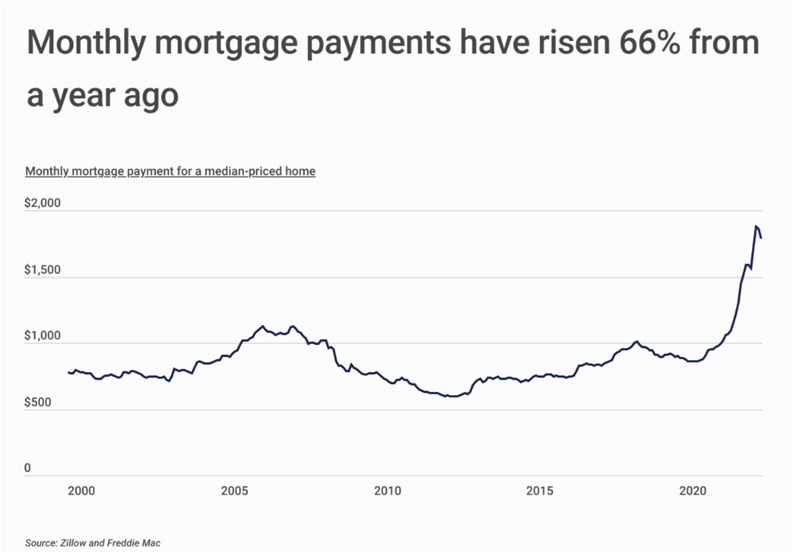

Home prices rose dramatically across the U.S. during the pandemic, and now homebuyers in some parts of the country are feeling the dual burden of expensive housing and high mortgage rates. According to the study, mortgage payments have also increased rapidly: the monthly mortgage payment for a median-priced home is now 66% higher than a year ago.

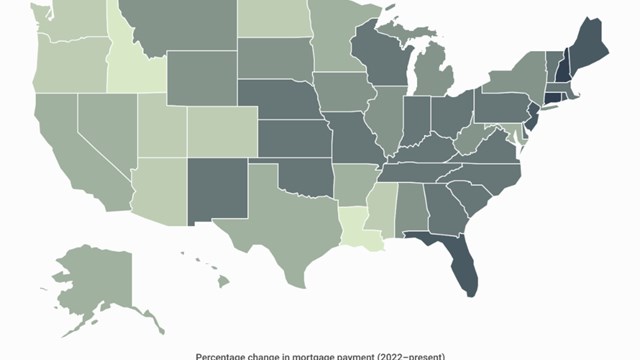

Mortgage interest rates and home prices both vary based on geography - so to determine the locations where homebuyers are most impacted by rising interest rates, researchers analyzed the latest data from Zillow and Freddie Mac. The researchers ranked metros according to the percentage change in the monthly mortgage payment for a median-priced home from 2021 to 2022. Researchers also calculated the total change in mortgage payment from 2021 to 2022, the mortgage payment for a median-priced home, and median home price.

Researchers found that mortgage interest rates are now more than double what they were in early 2021. The study revealed that the monthly mortgage payment for a median-priced home in the New York metro area was $1,949 one year ago, but has since risen to $3,120—a year-over-year increase of 60.0%. Home prices have started to slow down as a result, but not by enough to offset the increased borrowing costs caused by higher rates.

The Fed Factor

At the beginning of the COVID-19 pandemic, the Federal Reserve took aggressive actions to help keep the economy afloat. Mortgage interest rates fell steadily, and the average 30-year fixed rate reached a historic low of 2.65% in January 2021. However, inflation began climbing rapidly, and the Fed started raising interest rates in March. When gradual rate hikes weren’t enough to tamp down inflation, the Fed began moving more aggressively. In November, the average 30-year fixed rate briefly topped 7% - the highest it's been in more than two decades.

Due to both the drive up in home prices that began in 2020 and rising interest rates, mortgage payments have increased rapidly over the last year. According to data from Zillow, the national median home price increased from $318,432 to $357,544 from late November 2021 to late November 2022. At the same time, the average 30-year fixed mortgage rate went from 3.11% to 6.49%.

On a regional level, the Southeast has experienced some of the largest increases in mortgage payments from last year. Out of the entire U.S., Florida homebuyers have been the most impacted by rising interest rates: mortgage payments for a median-priced home in Florida have increased by over 80% from 2021. The increase has been the smallest in Idaho and California, where mortgage payments have gone up by 52.3% and 56.3%, respectively.

The analysis found that the mortgage payment for a median-priced home in the New York metro area was $1,949 one year ago, but has since risen to $3,120—a year-over-year increase of 60.0%. Here is a summary of the data for the New York-Newark-Jersey City, NY-NJ-PA metro area:

- Percentage change in mortgage payment (YoY): +60.0%

- Total change in mortgage payment (YoY): +$1,170

- Mortgage payment for median-priced home (current): $3,120

- Mortgage payment for median-priced home (1 year ago): $1,949

- Median home price (current): $617,629

For reference, here are the statistics for the entire United States:

- Percentage change in mortgage payment (YoY): +65.8%

- Total change in mortgage payment (YoY): +$717

- Mortgage payment for median-priced home (current): $1,806

- Mortgage payment for median-priced home (1 year ago): $1,089

- Median home price (current): $357,544

For more information, a detailed methodology, and complete results, you can find the original report on Construction Coverage’s website.

Leave a Comment