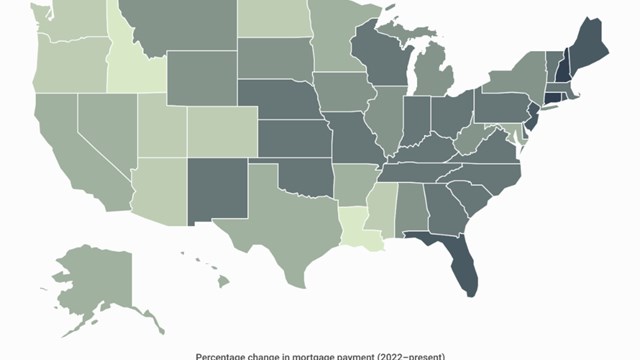

With mortgage rates still up about 80% since 2022, the typical U.S. homeowner pays nearly $700 more each month—and, in some markets, an additional $1,000 or more. The 2025 edition of Construction Coverage’s U.S. Cities Most Impacted by High Interest Rates report looks at where buyers have been hit hardest by this jump in borrowing costs. In the New York metro, the numbers are especially striking:

NY Metro Homebuyers Pay $1,387 More Today

The median home price in the NY metro moved from $585,631 in 2022 to $679,756 today.

Taking this and the average 30-year fixed interest rate together, estimated monthly mortgage payments in the NY metro have increased by 63.9% in just three years.

Prospective homebuyers today face an estimated mortgage payment of $3,560 per month, compared to $2,172 in 2022.

Overall, prospective homebuyers in the NY metro have experienced a larger increase in monthly mortgage payments since 2022 (+63.9%) than the nation has as a whole (+59.0%).

The full report covers 369 U.S. metros and all 50 states, with a detailed breakdown of mortgage payment increases, current and historical home prices, and estimated monthly costs for median-priced homes between February 2022 and February 2025.

Leave a Comment