While experts predict an improvement in mortgage markets and builder outlook for the U.S. housing market in 2024, the number of new communities and existing home sales will be subject to a series of domestic and international issues. The general housing market probably will have some volatility, but the community association housing market should remain as the buyer’s choice for a new or existing home.

The number of new condominium communities and homeowners associations is expected to increase by 3,000-4,000 this year, according to projections by the Foundation. Community associations are home to 75.5 million Americans and represent 30%-33% of the U.S. housing stock, according to the Foundation for Community Association Research (FCAR)’s U.S. National and State Statistical Review for Community Association Data. The Foundation estimates the number of U.S. community associations will grow from 365,000 to as many as 370,000.

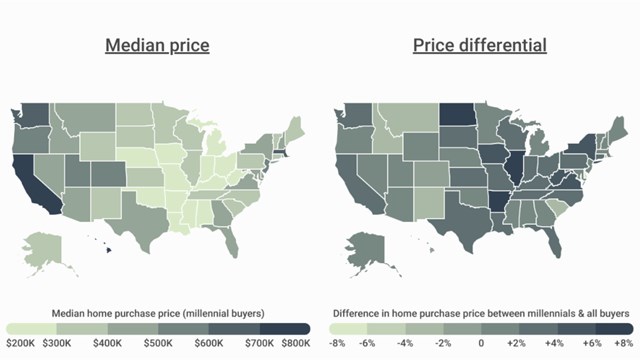

“While we’re optimistic about the continued growth of community associations, we also are closely monitoring the dramatic increase in U.S. home prices and increase in mortgage rates that has cooled the housing market,” says Dawn M. Bauman, CAE, executive director of the Foundation and CAI’s chief strategy officer.

Bauman adds that “The demand for housing continues to outpace the number of sellers in many states such as Florida and Texas, where increased mortgage rates are impacting housing affordability. Another real concern is how labor and supply chain issues remain a real problem for homebuilders.”

Since the 1970s, community associations have been a popular housing choice for people around the world—especially for condominium buyers seeking proximity to city centers, public transportation, and schools. Planned communities also give local municipalities the ability to transfer the obligation of providing services such as trash and recycling pickup, snow removal, sidewalk and street maintenance and lighting, storm water management, and more to homeowners. For more community association statistics, visit the Community Association Fact Book.

Comments

Leave a Comment