New tariffs on building materials are already hitting the housing market hard: according to the NAHB, construction of single-family homes dropped 12% year-over-year in April, and builders now estimate tariffs have added $9,200 to the cost of an average new home. And while New York County has seen growth, it still falls behind the national average in new housing.

Between 2013 and 2023, New York County added 76,085 housing units—an increase of 8.9%, which is lower than the net national increase of 9.4%

New Factors + Lingering Effects

After a dizzying run-up in residential real estate prices and rents in the last few years, housing costs are putting a financial squeeze on renters and homebuyers nationwide as they compete for a scarce, expensive supply of dwellings. Research from federal mortgage backer Freddie Mac estimates that the U.S. is short 3.7 million housing units relative to current market needs, while the National Association of Realtors (NAR) pegs the shortfall even higher, at 5.5 million units. Regardless of the precise number, it is clear that the U.S. housing supply is insufficient.

A recent study from Construction Coverage highlighting the U.S. counties and states that have added the most housing over the past decade cites a variety of factors contributing to the difficulties in adding housing stock. In every state and locality, housing development may be subject to a host of laws and regulations regarding zoning, land use, building standards, environmental protection, historic preservation, and other issues. Developers and political officials may also face organized pressure from “not in my backyard” (NIMBY) interests concerned about neighborhood property values, overcrowding, or disruptions from construction work. Further, rising labor and material costs (alongside the aforementioned tariffs) have made it more expensive to build over time, which impacts the type of units builders can afford to construct, as well as project timelines and costs.

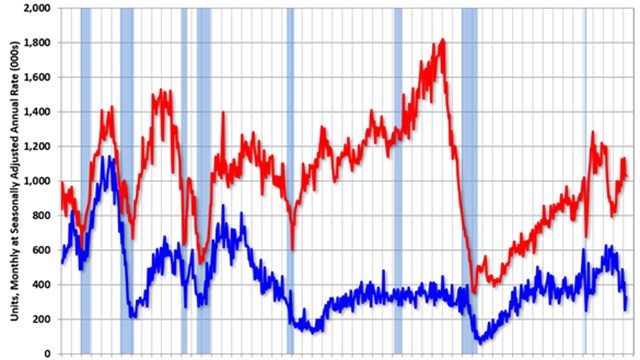

Beyond these conditions, one of the most significant drivers for the current undersupply of housing is the lingering impact of the Great Recession. Following the collapse of the housing bubble in the mid-2000s and the ensuing economic downturn, construction companies were extremely hard-hit. The industry experienced mass layoffs, many firms shuttered or were absorbed into others, and residential construction activity slowed dramatically. The annual rate of housing starts fell from more than 2 million at the height of the housing market in 2006 to just 490,000 at the beginning of 2009. After a prolonged recovery, housing starts did not exceed pre-2008 averages again until the beginning of 2020.

Since then, however, new home construction has decreased back below pre-2008 levels. As of January 2025, the seasonally adjusted annual rate of new housing starts stands at 1.37 million—roughly 25% below the recent peak of 1.83 million observed in April of 2022.

Some Regions Doing Better Than Others

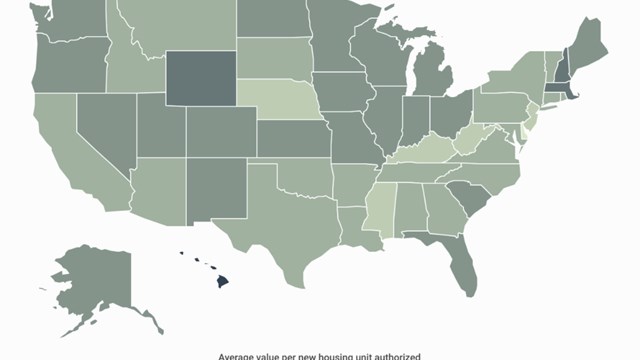

While the national supply of housing has been lagging overall, some parts of the country have managed to add homes faster than others. States that have experienced the most housing growth in recent years are largely found in the Mountain West and Sun Belt regions, which tend to be less expensive than heavily developed coastal markets and have fewer regulations limiting construction.

Utah leads the nation with a 25.1% increase in housing units, followed by Texas at 20.9%. Other western states, such as Idaho (+20.6%) and Colorado (+17.4%), rank third and fourth, respectively. Notably, Sun Belt states like Florida, South Carolina, Nevada, and North Carolina also feature prominently in the top 10, reflecting a broader trend of population growth and housing development in these regions.

By contrast, West Virginia is the only state to experience a net decline in housing stock, decreasing by 1.8%. Meanwhile, Great Lakes states such as Michigan, Illinois, and Ohio have seen relatively slow housing growth, reflecting broader trends of population stagnation or decline in the region.

The Importance of Context

Measuring housing supply growth alone does not fully capture how well a location is meeting current and future housing needs. In some counties, new housing is being built at a faster rate than the population is growing, which helps maintain affordability and prepares these markets to accommodate future residents. This trend is particularly evident in states such as Tennessee, Texas, and Utah, where several counties have added housing stock faster than they have added people.

Conversely, in parts of Florida, South Carolina, and Montana, the opposite trend is unfolding. Population growth in these regions has outstripped the pace of new housing construction, increasing competition for available homes. If this imbalance persists, housing affordability challenges may intensify as demand continues to outpace supply.

Read the full results and methodology of the Construction Coverage report here.

Construction Coverage is a leading online publisher of construction industry research reports. Its work has been featured on CBS, Fox, USA Today, Bloomberg, Nasdaq, and more.

Leave a Comment