According to a recent report from Construction Coverage, a website that compares construction software and insurance, becoming a homeowner remains largely out of reach for many Americans, despite home price growth stabilizing. A recent Cato Institute housing affordability survey found that 87% of Americans are worried about housing costs. Additionally, 55% of homeowners indicated they couldn't afford to buy their current home at today's prices, and 69% are concerned that their children or grandchildren won't be able to afford a home in the future.

Per the report, multiple factors have contributed to the difficulty of buying a home, but most stem from an underinvestment in building new affordable housing. The seasonally-adjusted annual rate of residential construction spending rose by over $700 billion (adjusted for inflation) from its low in February 2012 to its peak in May 2022. However, since then, it has decreased by nearly $150 billion—which means that less money is being allocated towards new housing inventory.

Some States Are Doing Better

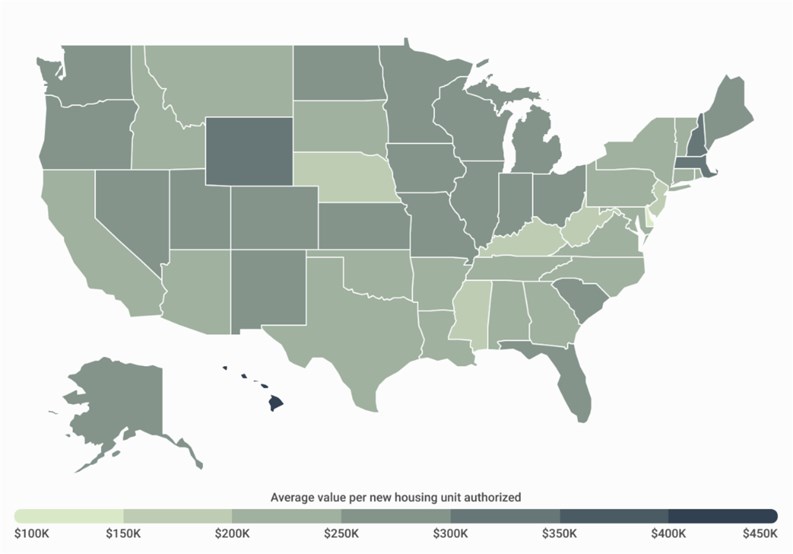

While nationwide construction spending has declined, some states and cities are managing to build more affordable housing units. Researchers ranked locations by average construction value per new housing unit authorized in 2023.

These are the main takeaways from the report, highlighting some key stats for the New York-Newark-Jersey City, NY-NJ-PA metro area:

- Decades of low levels of residential construction have now created a national shortage of at least 5.5 million homes. This shortage intensifies competition, driving up prices: between February 2020 and May 2022, the median home sale price surged from $303,000 to $415,000, a 37% increase in just over two years.

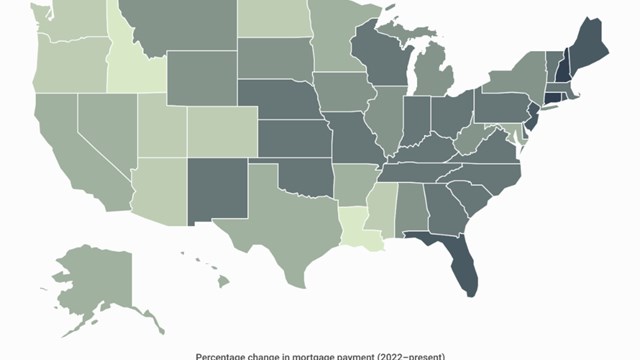

- Today, home prices are about 40% higher than pre-pandemic levels—but with mortgage rates doubling, the monthly mortgage payment for a median-priced home has more than doubled since early 2020.

- At the state level, Delaware has the lowest average construction cost per new residential unit authorized at $143,579, followed by New Jersey and West Virginia at $157,141 and $189,464 per unit, respectively.

- At the opposite end of the spectrum, Hawaii is building the most expensive new housing, at an astonishing $423,609 average per unit. Other states with especially high new construction costs include Wyoming ($342,230) and Massachusetts ($334,280).

- The NY metro area reports an average cost of $177,044 per new housing unit, the 3rd lowest of any large U.S. metro.

Leave a Comment