Amid roiling national and international political upheaval, the prohibitive cost of housing for all but the wealthiest homebuyers in nearly every US market remains a cause for great concern. In an October 15 statement, National Housing Conference president David M. Dworkin addressed the issue and touted his group’s annual Solutions for Affordable Housing Conference, to be held this year on December 7 at the National Press Club in Washington, DC.

Remarking on the affordability crisis, Dworkin said, “I appreciate the desire for a simple answer. Unfortunately, there isn’t one. It took a long time and there are many complex reasons why housing costs are so unaffordable to so many. At NHC, our focus is on furthering solutions that are tangible, impactful, and achievable. That’s the subject of our conference on December 7, where we will hear from many of the smartest leaders in housing, including National Economic Council Director Lael Brainard and Federal Housing Finance Agency Director Sandra Thompson. They are looking for new and innovative strategies in addition to those we already support. It’s vital that we all contribute our intellectual capital to developing new approaches while committing our political and relationship capital to enacting the ones on our agenda today.”

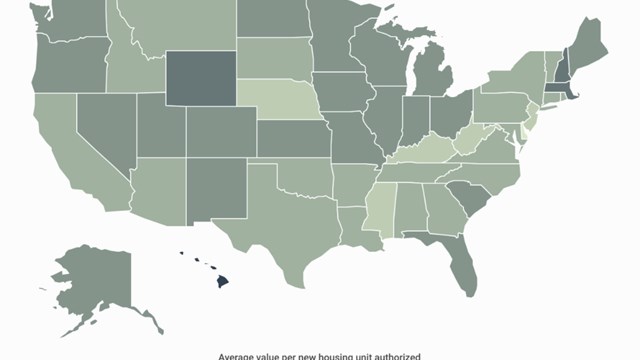

According to Dworkin, NHC’s Paycheck to Paycheck database reveals that “The annual income needed to afford a typically priced home in the United States has doubled from $66,710 to $126,420 over the past four years. This is because median home prices have risen from $242,547 in August 2019 to $349,770 in August 2023, while mortgage interest rates soared from 3.31% to 7.51%. Mortgage rates are even higher today. The cost of renting has skyrocketed as well” - as much as 34% in some markets, leading to housing insecurity and outright homelessness for many.

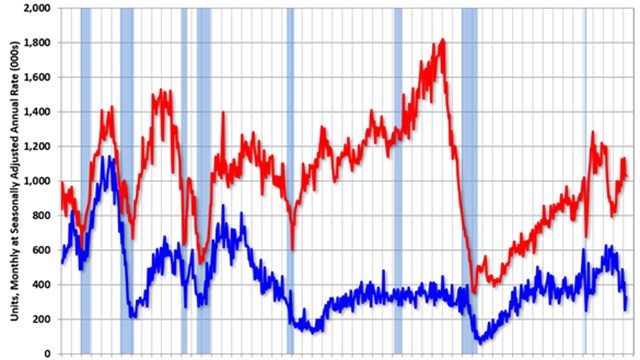

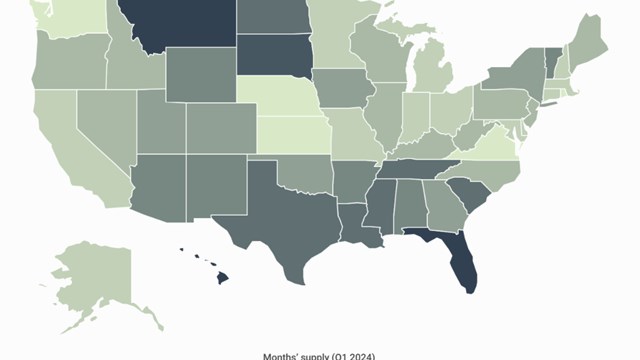

“In its simplest form,” Dworkin continued, “our housing crisis is one of a lack of supply, particularly, the supply of housing that is affordable to most Americans. We also face serious regulatory barriers to building and investing in housing, like the recent proposal to increase the capital required for banks to lend and invest in underserved communities – and people. There are bipartisan legislative solutions that will contribute to increasing supply, like the Affordable Housing Credit Improvement Act and Neighborhood Homes Investment Act. While both bills have strong bipartisan support, we do not live in a bipartisan world. As the House of Representatives can’t even elect a Speaker, Congress quite literally cannot name a post office, yet alone fund the government or pass bipartisan legislation.”

“Without action – tangible, impactful and achievable action,” Dworkin continued, “we will not begin the long, hard road to genuine recovery. Housing has a long history of being on the bottom of the list of ‘top priorities.’ That’s not good enough, and if we don’t change that harsh reality, the problem – and the cost of addressing it – will grow exponentially."

Leave a Comment