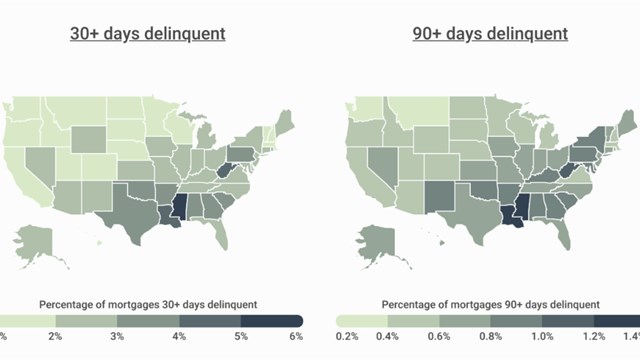

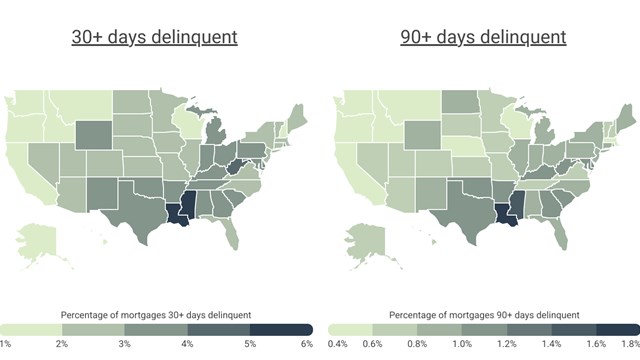

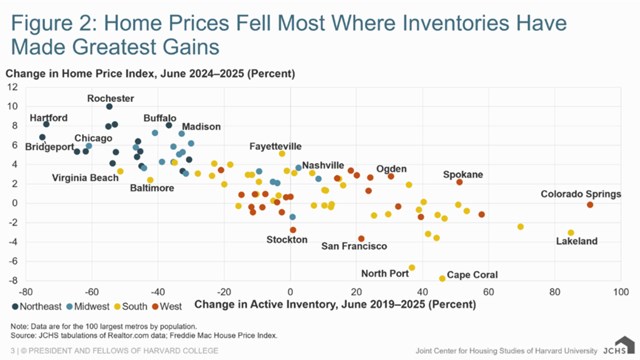

With inflation still elevated, home prices parked near record highs (despite some recent softening, particularly at the higher end), and insurance costs climbing, more homeowners are running out of cushion—heightening the risk of mortgage delinquencies, as well as broader ripple effects on consumer spending and credit conditions. As budgets thin, questions about the sustainability of homeownership and the broader economic fallout are getting harder to ignore.

In the 2025 edition of its Cities With the Most Mortgage Delinquencies report, construction industry watcher Construction Coverage analyzed the latest data from the Consumer Financial Protection Bureau, Census Bureau, and Zillow to reveal the locations with the greatest percentage of mortgages at least 30 days delinquent.

Leave a Comment