American families are facing a convergence of economic pressures that are redefining what it means to live comfortably. After years of elevated inflation, the cost of essentials, from housing and groceries to transportation and health care, remains persistently high. At the same time, the rapid adoption of artificial intelligence in the workplace is introducing new uncertainty in traditionally stable white-collar industries, adding to financial strain for many middle- and upper-middle-income earners.

In this environment, understanding how much income is needed not just to get by, but to live comfortably, is top of mind for many Americans. This report from Upgraded Points, a company that provides advice on credit card reward programs and other financial products, applies the 50/30/20 budget rule — a widely used framework for balancing needs, wants, and savings — to estimate the income required to maintain a comfortable standard of living across the largest U.S. metro areas and all 50 states.

How Much Do Americans Need to Live Comfortably?

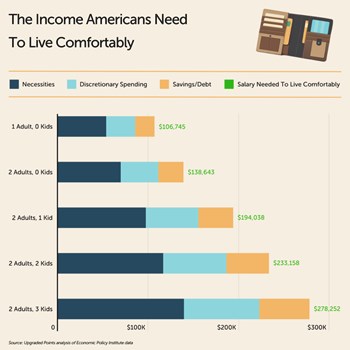

According to the 50/30/20 rule, a well-balanced budget allocates 50% of income to necessities, 30% to discretionary spending, and 20% to savings or debt repayment. When paired with cost-of-living data from the Economic Policy Institute (EPI), this framework provides a benchmark for determining the minimum income required to sustain a financially comfortable lifestyle.

Nationally, a single adult with no children in 2025 would need $106,745 per year in pretax income to stay within this budget structure. For two adults with no children, the threshold rises to a combined $138,643. Costs increase significantly with the addition of children: a two-parent household would need $194,038 with one child, $233,158 with two, and $278,252 with three.

These figures offer a national baseline, but living costs vary dramatically by region. The next section looks at how much income is needed in the country’s largest metro areas, where expenses like housing and child care are often far above the national average.

What it Takes to Live Comfortably in America's Largest Cities

Living comfortably in the United States looks very different depending on where you are. Among the country’s largest metropolitan areas, the income needed varies by more than $75,000 for a single adult — and more than $250,000 for a family of five — depending on the local cost of necessities such as housing, child care, and taxes.

At the top of the scale are three California metro areas: San Jose, San Francisco, and San Diego. In the San Jose-Sunnyvale-Santa Clara metropolitan statistical area (MSA), a single adult needs to earn $163,045 per year to live comfortably, the highest among the nation’s largest metro areas. For a two-parent household with three children, that figure climbs to $478,630 — over $200,000 more than the national average for the same family type. Similarly, the San Francisco and San Diego MSAs require incomes of $148,441 and $146,080, respectively, for a single adult to stay within the 50/30/20 budget. This high-income requirement reflects the outsized cost of living across coastal California, where housing and taxes are particularly expensive. On the East Coast, Boston and New York are not far behind.

At the other end of the spectrum are cities in the Midwest and South, where living costs are significantly lower. In Cleveland, Pittsburgh, and Tucson, a single adult can live comfortably on less than $87,000 a year. For a family of five, the required income ranges from $240,709 in Pittsburgh to $250,997 in Cleveland — roughly half the income needed in the highest-cost metro areas. These regions tend to have more affordable housing markets and lower daily living costs for everything from gas to groceries.

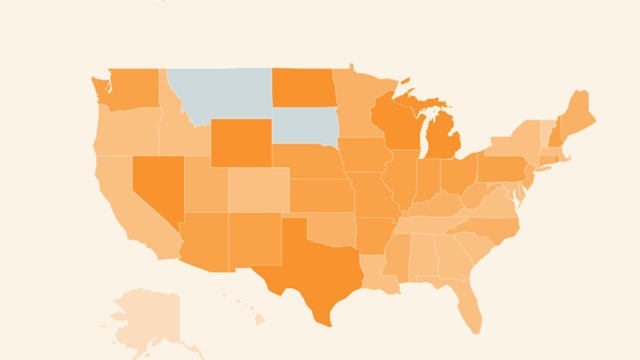

Living Comfortably in Every U.S. State

Similar trends hold at the state level, where the nation’s most expensive states are concentrated along the West Coast and Northeast. Hawaii, New York, California, and Massachusetts top the list, with single adults needing over $130,000 per year to live comfortably. For a two-parent household with three children, the income required exceeds $330,000 in all four states. Other high-cost, coastal states include Washington, New Jersey, Maryland, and Connecticut.

Meanwhile, the most affordable states are found in the Midwest and South. In North Dakota, a single adult needs just $83,144 — the lowest among all states. Ohio, Iowa, Arkansas, and Indiana also all fall below $88,000 for individuals, with family income needs far lower than in coastal states.

Here is a summary of the data for New York-Newark-Jersey City, NY-NJ:

- Salary needed to live comfortably (1 adult, 0 kids): $140,709

- Combined salary needed (2 adults, 0 kids): $177,657

- Combined salary needed (2 adults, 1 kid): $256,104

- Combined salary needed (2 adults, 2 kids): $301,090

- Combined salary needed (2 adults, 3 kids): $352,727

- Median personal income (actual): $56,588

- Median family income (actual): $123,540

For reference, here are the statistics for the entire United States:

- Salary needed to live comfortably (1 adult, 0 kids): $106,745

- Combined salary needed to live comfortably (2 adults, 0 kids): $138,643

- Combined salary needed (2 adults, 1 kid): $194,038

- Combined salary needed (2 adults, 2 kids): $233,158

- Combined salary needed (2 adults, 3 kids): $278,252

- Median personal income (actual): $48,012

- Median family income (actual): $103,558

Leave a Comment