This past year was a year of contradiction in the real estate industry, both locally and nationally. 2022 began on the coattails of one of the strongest markets for homes in recent history. But by early spring, with inflation rising at a rate not seen in four decades, and stratospheric price increases in both owned and rented homes and apartments, concern over interest rates being increased to fight inflation was in the air. That concern was well founded; over the course of the year, the Federal Reserve has raised interest rates four times, doubling the available interest rate for home purchases from around three percent to near seven percent. Yet for now, according to industry analysts and experts, housing prices have not declined.

A Deeper Dive

Despite the Fed’s hikes, the story of 2022 is not solely one of rising interest rates; it’s the culmination of multiple factors stemming from 2020 and the arrival of the COVID pandemic. One of the defining features of that crisis was frenzied homebuying by city dwellers relocating to suburbs—not just in our region, but throughout the country. The availability of financing at historically low interest rates accelerated that trend. While the marked exodus from cities to suburbs was big news, by 2021 urban markets began to spring back. The appetite for apartments all over New York City was ravenous.

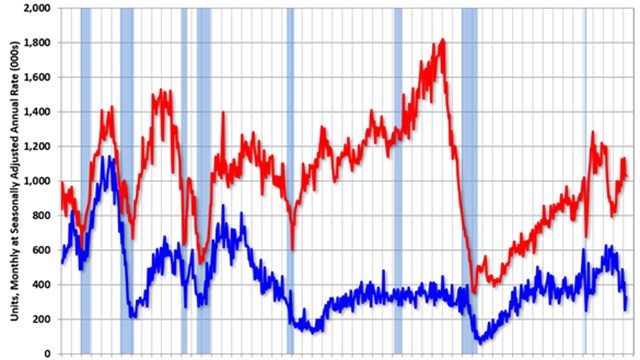

The year 2021 was a rocket ship for sales,” says Jonathan Miller, CEO and principal of NYC-based Miller Samuel Real Estate Appraisal and Consulting. “With the tremendous surge in sales activity in New York City, inventory was obliterated. It was scraped clean because mortgage rates were too low for too long. This led to record home prices throughout the region, bidding wars, huge sales volume, and ultimately inventory collapse. A year later, in the spring of 2022, mortgage rates began to rise. The New York region though, is still characterized by prices rising, but at a slower rate.”

The result of the record sales, even more so than the increase in interest rates, is that the volume of sales dropped in 2022. “Sales go negative on a year-over-year basis,” says Miller. That’s the number of properties sold relative to the number sold in the same period in the prior year.

“What was somewhat unexpected in the New York metro area is that inventory is flat, and/or declining,” he continues. “Some subsets are rising, but overall we are seeing falling inventory. It’s unusual historically, but the trend we see is that because mortgage rates were at record lows prior to Spring 2022, many people either purchased during the pandemic or refinanced, and are now wedded to their rates and therefore reluctant to become buyers.” Resultantly, they are not listing their homes or apartments for sale.

“In a lot of markets,” reiterates Miller, “inventory is half what it was before the pandemic. The metric to focus on for 2023 is this lack of inventory. The inventory picture to focus on to understand the problem is as follows; Using Darien, Connecticut, as an example, pre-pandemic inventory was floating at around 200 units, depending on seasonal factors. After lockdown, inventory dropped to say 50 units in the same market. A year later, before rates went up, inventory fell to 12 units.”

More on Interest Rates

The increase in interest rates was meant quite specifically to drive down inflation —and the Fed viewed the overheated housing market as part of the inflation problem. While homeowners may be celebrating a level of equity they might never have imagined in their homes, that same inflated price is disrupting other aspects of their home economics. That’s not to say that the run-up in home prices caused by an overheated market is the main culprit in inflation, but it reflects the overall problem.

The Fed is expected to continue raising interest rates into 2023 to battle inflation. The question is, how has that affected - and how will that continue to affect - the market for homes? “The Fed expected to continue raising rates,” says Miller. “Increasing rates create uncertainty in the market. Buyers can wrap their heads around higher rates, but if it happens every six weeks, it’s a problem.”

One of the other problems in today’s market is that it’s clearly less affordable with higher rates. On the other hand, for most current buyers, it doesn’t make sense to fix their monthly costs on a 30-year basis, as these days few people and families live in a home for 30 years. “Adjustable rate mortgages such as 7/1s, 5/1s, and other hybrids with conversion down the road are still low and as low as before the spike,” says Miller.

Some Numbers

While co-op sales in Manhattan have fallen in volume by between 10.9% and 13.4% for sales over and under $3 million respectively, Miller does not report a drop in prices. “What happens is, initially there is an external event—in this case rates going up—and sales slow. Then normally, inventory rises. Next, prices fall. Except in this case it takes a year or more for this to happen. People who don’t have to sell, just don’t sell—they wait. There are fewer bidding wars, but we are not seeing a crisis correction. Prices aren’t falling, nor are they rising, but if this continues for another year, they may. At least at this point, there’s no apparent suggestion of a correction, because inventory is not bloated.”

Overall this year, co-op sales fell a statistically insignificant two percent, but are still over pre-pandemic levels. For condominiums in Manhattan, the number of sales overall are down 24.3% but compared with pre-pandemic 2019, sales up 46.9%.

What’s Ahead?

Miller’s ‘crystal ball,’ which he jokes is “held together with duct tape,” suggests that what happens in 2023 depends on whether rates continue to rise. “You can’t predict the Fed,” he says. “But the expectation is that there will be at least a couple more increases. Ironically, the reason for continuing to increase rates is that the economy is showing strength. We are expecting less units will be sold overall in 2023 than in 2022. But that depends on the direction of rates. Normally, we don’t over emphasize rates, but because they have gone up so dramatically, and the economy is still robust, it’s not a dire situation for the housing market yet—just less activity. We don’t see a strong expectation of negative price trends. If any, they will be modest if current conditions remain the same.”

The View From the Trenches

Nicole Beauchamp is a broker with Engel & Volkers, located in Manhattan. She has worked through the ups and downs of the past year and observes the following. “Keeping the pulse of a quickly shifting market requires a commitment to education, collaboration, understanding and interpreting market conditions—micro, macro and global—and providing accurate context as you make your decisions, driven by data. Coming into 2022, there was an exuberance in the market, buoyed by the record-breaking volume of transactions in 2021. The market started to shift around mid-April, as the whispers of interest rate hikes began. The subsequent hikes, and those yet to come, will continue to make people pause. The impact on affordability and the impact of inflation cannot be understated. All of that said, there are pockets of opportunity, but getting deals done will require creativity, collaboration, and teamwork to get to the meeting of the minds.”

Beauchamp notes further that “realistic pricing is key, openness to concessions, considering the various financing products available to you if borrowing, or leveraging cash. My expectation is that those who will choose to transact will be more need-based, and hopefully there is less of the aspirational testing of the market. In just the last week, I’ve noticed more variations on price reductions, and also have noticed more discussions around the idea of a buydown as a seller concession. That may be the solution versus significant price reductions—particularly important since our market is dominated by co-ops, where there’s the potential of a board turn-down based on price, for example.”

“The market is still active for the same reason the Fed keeps raising rates,” says Joanna Mayfield Marks, a broker with Brown Harris Stevens in Brooklyn. “There is a lot of cash still out there. Our 3rd quarter report shows that co-ops and condos in certain neighborhoods like Bed-Stuy and Crown Heights have been hit hard with average 11% price declines year-over-year - which I attribute to greater inventory - but quality products that tick all the boxes and are turn-key, even in those neighborhoods with more housing stock, are fetching at and above their asking prices. Money is more expensive now to borrow, but with low inventory in prime locations, discerning cash buyers are still competing and want to win. It’s not a bad time to sell in New York City, especially if you are well located or beautifully renovated. I just had a condo in Williamsburg with lovely original finishes go 7% higher than the last trade, two floors above, a year ago.”

Another factor that was underway as this article was being written is the 2022 midterm elections. Market-watchers tend not to opine much on how the political landscape might impact the housing market, but it’s safe to say that with tight, contentious races being run between candidates on deeply opposing sides of the political spectrum, how November 8th impacts Washington on down will be felt by both buyers and sellers in 2023 and beyond.

A J Sidransky is a staff writer/reporter for CooperatorNews, and a published novelist. He can be reached at alan@yrinc.com.

Leave a Comment