Remember in 2020, when everyone was so excited for 2021, “when all of this instability and uncertainty will be over”? Right. Well, while there was some relief from pandemic pandemonium as Americans started to get vaccinated against COVID this past spring and summer, the virulent delta variant threatened to override the country’s hard-won progress and untold sacrifices. And while the overall economy seems to be on an upswing with businesses reopening and consumers more inclined to leave their bubbles to make purchases, the major economic shifts needed to make enduring investments in our infrastructure, institutions, and the future of our planet are just starting to emerge from a Congressional quagmire.

What did all this mean for the multifamily market in 2021, and where do the pros see things heading in 2022? In a nutshell, it’s still a topsy-turvy world out there. Cities, which some declared ‘dead’ when population density was thought to be a major driver of coronavirus contagion, have shown a strong homebuying revival in recent months as lockdowns and restrictions eased and vaccinations continue to be administered. The bidding wars that sent suburban home prices skyrocketing in 2020 and early 2021 have resumed in the urban markets—even in the luxury sector, which dipped significantly when the pandemic and other economic factors chilled high-end homebuying.

Adding to all this complexity is the reckoning that has come in the wake of the tragic collapse of the Champlain Towers South condominium in Surfside, Florida, this past June, which has prompted a wave of reforms and a recognition of the advancing age of a large portion of the country’s housing stock, as well as the role that climate change plays on structural integrity and the pitfalls of deferring building maintenance for the sake of short-term financial savings.

It’s the Economy, Stupid

Every bit as true as it was 20 years ago when campaign strategist James Carville made it a central theme of Bill Clinton’s successful bid for the presidency, the U.S. economy dictates the country’s direction. In terms of residential real estate, overall economic conditions are both a driver and a byproduct of transactions. A confluence of several economic factors played into the rollercoaster year that 2021 was, and is likely to keep 2022 dizzying as well.

According to residential real estate expert Jonathan Miller, president of New York-based appraisal firm Miller Samuel, the urban exodus brought about by the COVID-19 pandemic was preceded by more of a trickling, starting in 2018 when the Trump administration lowered the cap on the amount of state and local tax (SALT) deductions allowable on federal income tax returns. This legislation inspired residents of high-tax states like New York to take up residency in states like Florida with lower taxes, especially those from Manhattan, “because of the greater wealth and mobility [there] than any other market in the region,” says Miller. “During the lockdown, there was a tremendously significant pattern of outbound migration—not just to the suburbs, but anywhere in the United States, driven by the SALT tax.”

The trend accelerated in 2020 and early 2021, after the pandemic-driven abandonment of (and arguably, elimination of the need for) offices. Working remotely became the de facto norm in many fields. If regularly commuting to a centrally located office was no longer a necessity for many workers, those who could decamped to second homes (what Miller now terms “co-primary homes”), or to entirely new environs altogether.

According to real estate experts, 2022 might see more of an inward migration and a more robust outlook overall. Among the reasons for their optimism, the pros cite remarks from the Biden administration about raising the SALT deduction cap, as well as the general economic recovery, bolstered by hopes of further reductions in COVID infections, hospitalizations, and deaths. There’s also the prospect of the easing of travel restrictions bringing foreign and out-of-state buyers back to urban markets.

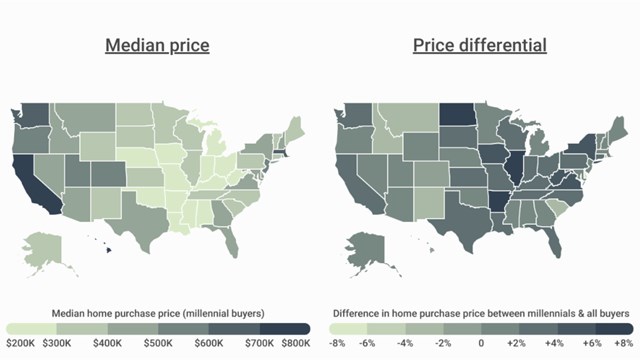

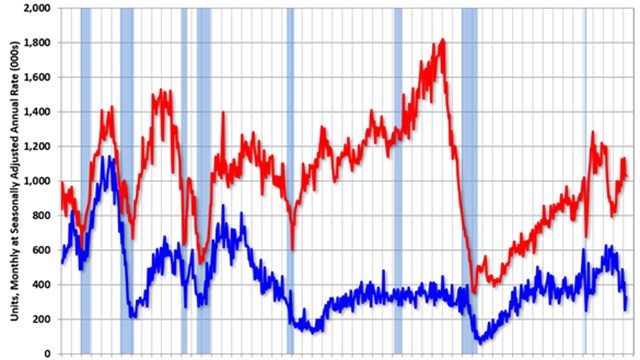

Yet another factor in play is the rise and fall of interest rates, which significantly affect sales volume. That’s particularly true in the co-op and condo market, which tends to attract first-time homebuyers and others using financing to make home purchases. With interest rates falling to record lows over the past 18 months, along with rents rising considerably in many areas, younger and newer buyers are entering the purchasing market at a greater pace.

“I don’t think enough credit is given to the intense demand that has been fueled by record low rates,” says Miller. “Prior to the pandemic, the 30-year fixed over two years fell from around 5% to a little over 3%. And then after the lockdown, because of the pandemic, rates fell from the low to mid threes down to the mid twos.” And with the 2008 economic recession and foreclosure crisis as pretext, lenders have enacted stricter standards and tighter underwriting procedures to mitigate another housing bubble, which Miller contends bodes well for market recovery as we head into 2022, especially if demand remains high.

Miller goes on to say that inventory in the co-op and condo sector has so far kept up with the demand. A pre-pandemic high-rise construction boom, along with the urban exodus earlier in the pandemic has kept up a steady pace of listings. It’s also kept prices somewhat stable—which has not been the case in the suburban and rural markets, where demand has overridden inventory and prices have soared out of reach for many. This is another reason why many younger and first-time home seekers have shifted their attention back to co-ops and condos in cities. “As the suburban frenzy waned and the market started to normalize, the city woke up,” says Miller. “Whether we’re talking about Boston, New York, or Florida [housing] markets, they still display heavy volume with a return to normal seasonal patterns.” He adds that pricing is creeping up toward pre-COVID levels.

It’s Also the Pandemic

COVID’s initial wave made people leery of dense, crowded living and sent many seeking more space for incorporating work and school (and gyms and media rooms…) into their homes. A year and a half later, with vax rates up and more awareness about the virus and how it behaves, cities have made a comeback—but not without COVID making lasting changes to our built environments, altering everything from ventilation systems to apartment layouts to structural material choices. It has also accelerated the adoption of both technologies and policies that make it possible to conduct much of the nation’s business from anywhere—allowing for the integration of home and work like never before.

“Remote work is here to stay,” says Miller, “and that relationship between work and home is going to go through a process of being sorted out over the next couple of years.” That predicted early fall 2021 return to the office environment keeps getting pushed further into the future, “firming up the relationship between work and home,” as Miller puts it. The further ensconced we get into the home-as-workplace set-up, he suggests, the less likely it is we’ll ever go back to the pre-pandemic status quo, even when corporate vaccination and testing mandates come online in 2022.

The extended need for flexibility in living arrangements has certainly changed buying and selling behavior from coast to coast. Our homes have had to play new roles in our lives, accommodating new activities, arrangements, schedules, and number of residents. In a co-op or condo, where adding another storey or an in-law unit is not an option, the new appeal of “flex spaces” has entered the market, in addition to the always-coveted outdoor space, whether private to the unit or shared with other owners/shareholders. Developers are building with these parameters in mind, suggesting that there is a widely held assumption that housing needs and wants inspired by COVID (if not the virus itself) are here to stay.

Learning From Disaster

As if the multifamily housing industry wasn’t seeing enough tumult in 2021, the sudden, deadly collapse of a South Florida condo building in June focused attention on the dire consequences of climate change, deferred structural maintenance, and questionable construction oversight. The Surfside tragedy that resulted in nearly 100 deaths and scores of lost homes and upended lives might just be the wake-up the industry needed to prevent similar disasters.

Throughout the country, and particularly in urban centers where high-rise living is both appealing and practical, legislators have turned their attention to the oversight and inspection aspects of building integrity. Mayors of cities like Jersey City—which has the largest number of high-rises in the Garden State—quickly enacted laws to intensify inspection and repair requirements for buildings of a certain height.

Brokers throughout the country are also seeing shifts in the concerns and attention to due diligence of prospective purchasers in the wake of Surfside. More are giving close scrutiny to buildings’ maintenance history, reserve funds, and capital planning strategies. Alicia Cervera, managing partner of Cervera Real Estate, a luxury brokerage representing multiple large South Florida developments, and a board member of the Miami Downtown Development Authority, tells real estate publication Mansion Global that she sees more co-op and condo buyers paying out-of-pocket to have such research done as they look to purchase a home or investment property.

“The lesson learned from this horrible tragedy,” says Cervera, “is that closer attention needs to be made to the maintenance of these buildings, and condo associations have to make sure they’re properly funded to meet the maintenance needs. I think that we will emerge stronger and safer as a result of this since there will be stricter guidelines and more caution around building inspections.”

A New Year’s Resolution

With 2022 likely to see more enhanced inspection laws, tighter oversight, and accelerated maintenance schedules, establishing and maintaining a healthy reserve fund should be very much top of mind for every co-op, condo, and HOA in the country. The pros emphasize that this does not necessarily equate to a budget percentage or a set yearly contribution. It has to be tied to a reserve study, conducted every five years or so, that details the useful life of all of the association’s or corporation’s major capital elements—roofs, sidewalks, elevators, mechanicals, tiling, carpeting, fencing, etc.—and how much money to put aside each year so that when that element needs to be replaced, the funds are there to do it timely and well.

Todd Walter, Great Lakes Regional Executive Director of national engineering firm Reserve Advisors, lays this issue bare: “The fiduciary responsibility of the board of directors is not to save people money,” he says. “It’s to maintain the investment of the owners. We want to make sure people pay for the use each year they live in their unit—each year they use that elevator, or they get floor protection from that rug, they’re paying for the use. In general, associations that have reserves available to take on projects in a timely manner, and with a scope of work that doesn’t cut corners, are far better off—and are far better run—than the associations that have to rely on special assessments, because the money is not available to take on a project in timely manner.”

Ultimately, this might be the most important takeaway for boards, managers, and owners/shareholders: make it a new year’s resolution to conduct a professional reserve study and follow its recommendations. Whatever the economic conditions, a healthy reserve is a boost to property value. And coming out of these last couple of years, we know that disasters do happen; there’s no excuse for being unprepared in the future.

Darcey Gerstein is Associate Editor and a Staff Writer for CooperatorNews.

Leave a Comment