The national housing market for 2023 will likely be remembered as one of converging challenges, especially for the multifamily sector. A recession possibly looming, ballooning interest rates, steady inflation, global instability, and a strict legislative landscape in several markets have led to financial strains for both buyers and sellers—in addition to condominium/homeowners associations and cooperative corporations themselves.

According to those in the business of making real estate predictions, 2024 looks to be just as challenging—particularly when it comes to making those self same predictions. Jonathan Miller, president and CEO of Miller Samuel Inc., a national real estate appraisal and consulting firm, quips that “Coming up with a catchy name for next year proved impossible, even though I reached out to a thesaurus and my AI app for assistance.” He characterizes 2023 as “tumultuous,” with “mortgage rates surging, prices holding, and listing inventory falling. All the rules of thumb we started the year with ended up broken.”

Nevertheless, some potential bright spots shine for 2024.

The Mortgage Rate Factor

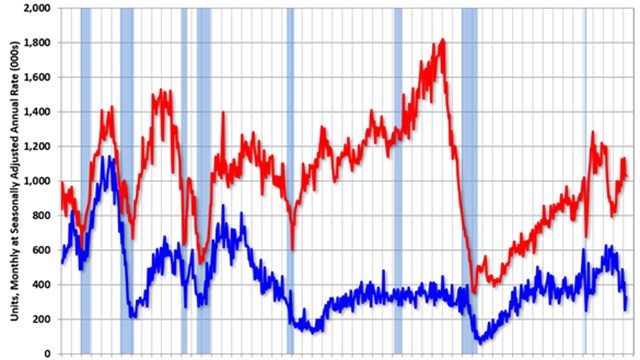

Arguably the biggest driver of hesitation for both buyers and sellers of residential real estate has been the mortgage rate environment. Miller notes that sellers whose current mortgages are in a comfortable 3% to 5% range (or even lower, if they happened to purchase in 2021) are holding onto their properties as they stare down the current rates, which reached 8% in October 2023. This leads to a tighter listing inventory, driving both prices and total ownership costs up for buyers … if they can even get a mortgage at current rates and stricter qualifications—again, both for the applicants and the communities they are looking to purchase in; this year condominiums, HOAs, and co-ops learned that they may be on a secret Fannie Mae ‘blacklist’ of properties that are ineligible for conventional financing.

Interest rates have also been a limiting factor for residential developers, adding to the scarcity of listings and the overall housing crisis throughout the country. Projects in the works stalled as they failed to obtain bridge financing, or to sell spec units to cash-strapped buyers. New projects have been slow to break ground for the same reasons, with local legislation and community opposition in certain areas making it harder for some projects to even get past the planning stage.

While many housing market experts forecast mortgage rates to remain elevated through the first part of 2024, they also see a likelihood of rates coming down as the year progresses. “Our modeling suggests a gradual, steady decline,” says Danielle Hale, chief economist at Realtor.com based in Washington, D.C. “The primary factor for mortgage rates is ongoing improvement in inflation.”

Of course, there is no guarantee that inflation will ease as it seems poised to do. “If we don’t see that progress on a sustained basis, we would be looking at a very different, higher interest rate environment,” Hale continues.

Noam Ziv, CEO of El-Ad National Properties, a real estate development company based in Boca Raton, Florida, predicts that in either case, buyers will adapt to higher mortgages and eventually jump back in the market as supply slowly increases. “As condo inventory rises and new listings increase,” he says, “we should begin seeing a more balanced seller-buyer condo market.”

Environmental Concerns

The effects of—and responses to—our rapidly warming planet and the woefully insufficient mitigation of human contributions to it are having “perfect-storm” (no pun intended) consequences for multifamily buildings across the country. Structures, mechanicals, utilities, and materials in and around buildings are getting damaged or deteriorating at higher rates, thanks to frequency and intensity of severe weather events, storm surge in coastal areas, multiple freeze-thaw cycles in seasonal areas, and extreme temperatures everywhere. In places like New York and Florida, inadequate building maintenance in such environments has led to tragic structural failures, which in turn have led to legislative reactions that put even more burden on the owners and operators of multifamily properties. And, as Multi-Housing News recently noted, issues regarding climate change and flood protection—particularly the rising seawater levels for buildings on the waterfront and on low-lying land—are putting increased pressure on new projects as well.

While tighter emissions regulations are adding costs for compliance retrofits and/or steep penalties for non-compliance in cities like New York, says Kelly Dougherty, president of FirstService Energy, the energy efficiency consultancy arm of FirstService Residential in New York, as multifamily buildings and their residences become more energy efficient, these communities are also seeing lower utility and maintenance costs.

“We’re seeing communities come together to invest in sustainability programs, from installing EV chargers to investing in water conservation measures,” says Dougherty. “[But] these low-hanging-fruit projects will not be enough to meet their climate goals, and larger, more expansive projects like the conversion to electricity of heating and domestic hot water production will have to be planned.”

The coming year will challenge co-op, condo, and HOA boards and residents throughout the country to plan for climate-related events, mitigate current conditions, address emergencies, and comply with ever-evolving laws—all while maintaining affordability, efficiency, and quality of life for their communities.

New Amenities at Play

Ziv also weighs in on amenity trends, forecasting that buyers are now more interested in having top-shelf amenities and modern residences in 2024 and beyond. Across the country, must-haves include fitness centers, swimming pools, work-from-home spaces, and dog parks, he says. He also notices that health and wellness amenities are gaining in priority for residents.

Business Insider recently reported on a new racket sport that is making the newly ubiquitous pickleball seem obsolete: padel, a racket sport with origins in Mexico that date back to the 1960s. According to the outlet, it is played with a tennis ball in a walled court, like squash, but with a net, like tennis. A standard-sized court is 66 feet by 33 feet—bigger than a pickleball court, but smaller than a doubles tennis court.

Members-only clubs like Reserve Padel have been popping up in swanky locations throughout the U.S., says Business Insider, leading the outlet to predict that it will be the hot new amenity in luxury condos, co-ops, and HOAs throughout the country.

Marko Gojanovic, a real estate agent with One Sotheby’s International Realty in Miami Beach, said padel is becoming so big there because it’s familiar to foreign homebuyers, some of whom are driving sales at pricey condo towers with the amenity. The sport is gaining ground in other wealthy metros, too. New York City’s 111 West 57th Street, part of so-called Billionaire’s Row, has a private padel court for residents. And Enclave, a gated community about 35 miles from Chicago in South Barrington, Illinois, will also have a communal padel court as well, according to Business Insider.

Gojanovic warns that padel plays differently than sports like tennis or squash, and it requires cunning as well as athleticism that aren’t as necessary in sports like pickleball. It’s also a doubles sport. “I think 90% of tennis players will convert to padel versus pickle,” he says—something for boards to consider if they’re toying with the idea of installing a new court, or converting existing space to create one.

Relocation, Relocation, Relocation

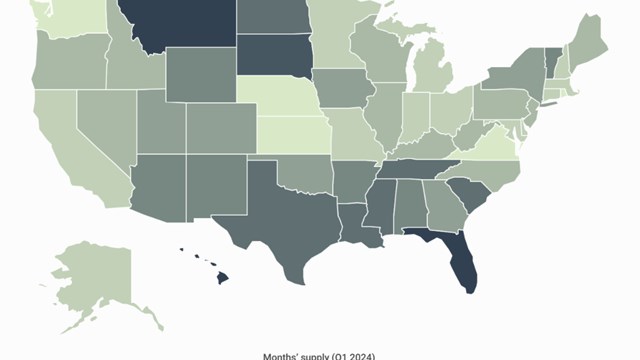

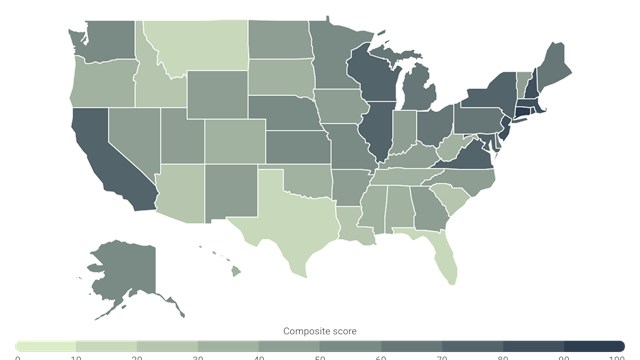

Housing analysts also note an ebbing of the tide of relocations that began in response to covid. Data from listings aggregator Redfin suggest that the share of homebuyers moving to a different metro area is coming down from a peak as it becomes less feasible to work remotely. For those who are relocating, the most popular destinations are relatively affordable places like Sacramento, California; Las Vegas, Nevada; and Spokane, Washington.

Still, the migration rate remains above pre-pandemic levels as some Americans are still chasing affordability. All 10 of the most popular migration destinations have lower prices than the most common origin of buyers moving in.

Curbed summarizes the pandemic fallout as it relates specifically to New York: “the rich fled, then they trickled back. Midtown emptied, but this year it was the most-searched neighborhood on StreetEasy. Median prices soared to over $1 million, but largely because interest rates shut out buyers under $1 million. No one could afford to rent, and no one could afford to buy, except for the people who could afford pretty much anything. Rental and sales inventory has remained stubbornly low. But at last, the dust seems to be settling.”

Overall, real estate and housing analysts weren’t too keen on 2023, but believe that 2024 could have a slightly rosier picture. “And maybe that’s just fine to have 2023 represent the bottom and 2024 see slow improvement,” says Miller, “with falling mortgage rates, slightly rising listing inventory, and stable pricing. The expected better year 2024 isn’t akin to the 2021 housing boom, but it will satiate many.”

Darcey Gerstein is Associate Editor and a Staff Writer for CooperatorNews.

Leave a Comment