Bob Dylan famously sang, “The times, they are a-changin’,” and they sure have with Pew Research finding that for the next 17 years, 10,000 Baby Boomers will turn 65 every day. This staggering statistic, which includes the 71-year-old iconic troubadour, spells good news for retirement communities. However, this same demographic, the Woodstock generation, is redefining retirement while adjusting to a new social order.

While some New Yorkers still opt to head south to escape winter blasts and enjoy Florida’s year-round golf season, most seniors make housing decisions based on the opportunity to stay connected, says Robert Weisenfeld, a New York City-based educator and real estate expert. “People want to go where they’re connected, where their friends and their children are,” he says. “Some might move to stay connected with their golf buddies … at the end of the day, they most of all want to be with their friends and family.”

That desire to “stay connected” has led to a growing interest in staying put—creating naturally-occurring retirement communities, or NORCs. A NORC is generally described as a community, building, or development that was not originally built for seniors but now has a sizable elderly population. The first NORC services program in the country officially opened on November 14, 1986 at the Penn South Co-op complex in Chelsea. The 10 building, 2,800 unit complex located between Eighth and Ninth Avenues and East 23rd and 29th streets, was built in 1962 by the International Ladies Garment Workers Union (ILGWU) and underwritten by the United Housing Federation (UHF). Designed as a social experiment to provide affordable housing for moderate-income workers, many of the original residents were union members, who once walked to work in the nearby garment center and chose to stay in New York after retirement. By the early 80s, around 70 percent of the shareholders in the complex were over 60.

“People came into their homes in their 20s, and have stayed into their 70s,” Weisenfeld says. In some cases, that transition requires renovations to kitchens, bathrooms and other features to make their condos and co-ops more user-friendly, he acknowledges. But those “universal design” features that were so cutting-edge a few decades ago are now almost expected components of homes. “Everybody today understands about ADA, accessibility, adaptability,” he says. “If you go into a modern development, you’ll see all of these things without them being stamped as ‘senior housing.’”

And in an interesting move, programs growing out of the federal government’s recognition of NORCs are moving into the general housing sector. “Co-ops and condos in the city of New York are not in the business of getting involved with the government,” Weisenfeld says, “but what’s happened in these private development co-ops and condos, they’re finding they have to reach out to government, because services—things like blood pressure tests, exercise and wellness programs—have to be brought on site. So something that had its intended purposes in terms of government housing is now turning to the private sector.”

Communities Defined

For those who do choose to move into communities designed for seniors, there’s no shortage of choices for housing options. The concept of active adult, “over-55” or retirement communities can mean different things to different home-buyers, but the terms really do carry specific meaning.

By definition, active adult communities are real estate developments that offer independent, relatively maintenance-free living to residents aged 55 and over. Thomas Wetzel, president of the Redding, CT-based Retirement Living Information Center, Inc., explains that in “age restricted” active adult communities, 80 percent of homeowners must be 55 and over, while “age-targeted” communities simply market to the 55 and over crowd.

The enactment of the federal Housing for Older Persons Act allowed communities to restrict ownership of homes based on age. “HOPA requires that at least 80 percent of occupied units must be occupied by at least one person 55 years of age or older,” says attorney Patrick Brady of the Massachusetts law firm of Marcus, Errico, Emmer & Brooks. ‘The minimum is 80 percent, but in the governing documents, there could be a requirement of a higher age or a higher percentage (of occupants). You do have some where the requirement is 100 percent of the units have to be occupied by at least one person 55 or older. You can be more stringent, but not less stringent” than the federal requirements, he says.

Not surprisingly, Baby Boomers are changing the way in which “retirement” communities are viewed. “Many of the residents continue to work part or full time, which is why the term ‘active adult retirement communities’ is less accurate. The residents are not opposed to children or grandchildren, either,” says Wetzel. “Rather, the 55-plus component simply assumes that people at the same stage of life probably share a few leisure-time interests and pursuits.”

For example, an “active adult” community essentially means that residents are considered independent. As such, active adult communities generally offer no assistance with daily living activities (e.g., meals, medication, housekeeping and personal care). “They do usually present a variety of on-site activities and easy access to natural or cultural attractions, shopping, nearby medical facilities, and large metropolitan areas,” he says.

Across the country, states and municipalities have different laws governing “age-restricted” communities. For example, there might be a requirement that the first person be 55 and the second at least 48, or a prohibition against residents under the age of 18. The HOPA restriction, Patrick Brady notes, is based on occupancy, not ownership—so a younger person might be able to purchase a unit in an age-restricted community, but not be able to live there without the community losing its restricted status. Because of that, association boards become the “gate-keepers” to ensure that their occupancy levels meet the federal requirements.

The concept of an age-restricted active-adult retirement community began with Delbert Eugene “Del” Webb, a construction contractor and real-estate developer who co-owned the New York Yankees baseball team from 1945 to 1964. He started building the first such community, Sun City, Arizona, in 1960. Later his company built others in Arizona and near Tampa, Florida. Today Webb’s firm is a subsidiary of PulteGroup, Inc., a public company traded on the New York Stock Exchange.

Age-restricted communities may consist of condominium units, single-family homes, or a mix of both. Like other private residential communities, they have an association with a board of directors, and usually a professional manager or management company. Other than meeting the age requirements, the only barrier to entry is affordability, to purchase the residence and pay the association’s periodic assessments covering maintenance and operation of the common areas and amenities.

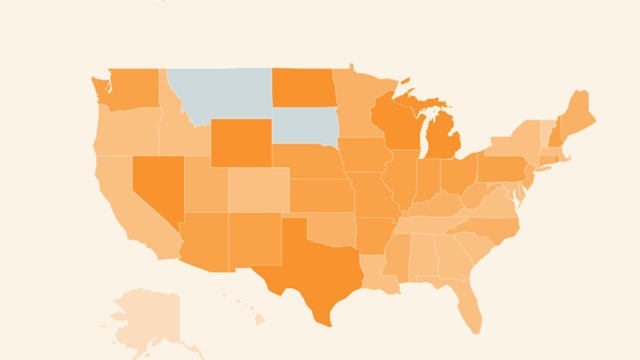

However, many Baby Boomers are looking to create a retirement experience that doesn’t mirror their parents’ view of the “good old golden years.” Topretirements.com is a national service assisting seniors with the all-important choice of selecting a suitable community. In New York, the site highlights more than 25 communities from the waterfront homes of The Tides at Charleston on Staten Island’s south shore, to the villas and townhomes of Meadowbrook Point in Westbury and Park Place Condominiums in Sarasota Springs.

“Many baby boomers would not be happy with the limited retirement choices their parents had—cookie cutter communities don’t appeal to all,” writes John Brady, president of jbEmarketing, which publishes TopRetirements.com and BestAssistedLiving.com. He, along with Roberta Isleib, authored Baby Boomers Guide to Selecting a Retirement Community: 16 Factors You Need to Consider. “Not all baby boomers want to live in an age-denominated community either. They just might prefer living with a more diverse age demographic. Living in a city or in a Norman Rockwell small town are concepts that appeal to many baby boomers.”

As the retirement market grows so does services catering to the demographic. 55Plus-Housing.com released a “55+ Community Finder” online search tool. The 55+ Community Finder tool features 12 specific search options to help narrow down the list of active adult communities, enabling visitors, for example, to quickly find all gated adult communities with a golf course and some home prices below $400,000. Detailed information about each community is also provided and the ability to request more information from a local realtor.

Selecting a retirement community of any given type is a tough choice, and once that task is accomplished residents have to adapt to new rules and regulations. “HOAs in an adult community are not much different in terms of function than those in a non-age restricted community,” Wetzel says. “They set the rules for how the community should be run with the exception of the age restriction.”

Developing the Future

Aside from location (location, location), many retirees are interested in amenities. Over-55 communities are likely to have activities such as pools, exercise rooms, cards rooms, libraries and ball rooms. Clubs and trips are organized by the residents and recreation department.

Like amenities, services vary from community to community. “For example, security might entail a gate with an access card, an on-site security officer or 24-hour surveillance. Sometimes the monthly fee includes insurance and property taxes, but not always,” says Wetzel.

A sticking point for many retirement communities, active or not, is restrictions on children. For many seniors, they have raised a family and want to enjoy peace and quiet. However, other grandparents enjoy having grandchildren visit or the whimsical laughs of children about. This is often a hot button issue for boards, some of which are lenient with visitation and others that are not.

The Baby Boomers Guide to Selecting a Retirement Community: 16 Factors You Need to Consider poses many interesting questions, perhaps the most important of which is: In 20 years would you be happy doing what you are doing now?

“Choosing a retirement location is a basic life decision that needs to be made – ideally an active decision rather than a default. Everyone’s situation is different, but there are a number of common questions that, if you think about them, will help lead to a decision that gives you a better than average chance of success,” writes John Brady. “The good news is that no decision is irrevocable—in retirement you have a simpler life and more time, so starting over again is always possible. If things don’t work out as well as you’ve hoped, it probably won’t be that painful to pull up your shallow roots and begin again.”

But while the options available for the over-55 set have grown in recent years, many Baby Boomers, as Weisenfeld notes, are choosing to stay put in their own homes—which might well be non-age-restricted condominiums, creating a new set of challenges for those associations. “Boomers are staying in their homes, and the older residents are not moving out to assisted living. The senior housing concept is further complicated by the Fair Housing Laws on Reasonable Accommodations for a Handicap which affect all associations,” agrees Ellen Hirsch de Haan, an attorney with the Florida law firm of Becker & Poliakoff and the author of Boomer Shock: Preparing Communities for the Retirement Generation.

Communities will, of necessity, be taking a closer look at those accessibility issues as time marches on. A frequent national speaker on senior housing topics, de Haan says that “with more Boomers living active lifestyles, and staying healthy, I expect these issues to continue to be of concern for many years to come.”

W.B. King is a freelance writer and a frequent contributor to The Cooperator. Pat Gale, associate editor for New England Condominium, a Yale Robbins Inc. publication, also contributed to this article.

Leave a Comment