It’s no great secret that America is getting older. The birth rate in the U.S. has fallen by more than half since the early 1960s, and the typical life expectancy in the U.S. has increased by around a decade over the same span. Put another way, the last members of the Baby Boomer generation, which totals more than 75 million members, will hit their 60s starting in 2024.

These developments are all pushing older Americans to be an increasingly large share of the population, with far-reaching implications for society and the economy: a decreased labor force, strained government budgets, and an increased need for health and social services.

A Look at the Numbers

The data used in the report is from the U.S. Census Bureau’s American Community Survey 1-Year Estimates. To determine the most rapidly aging locations in the U.S., researchers calculated the percentage-point change in the 65-and-over population between 2012 and 2022. In the event of a tie, the location with the greater percentage change in the 65-and-over total population was ranked higher. To improve relevance, only cities with at least 100,000 people were included. Additionally, cities were grouped based on population size: small (100,000–149,999), midsize (150,000–349,999), and large (350,000+).

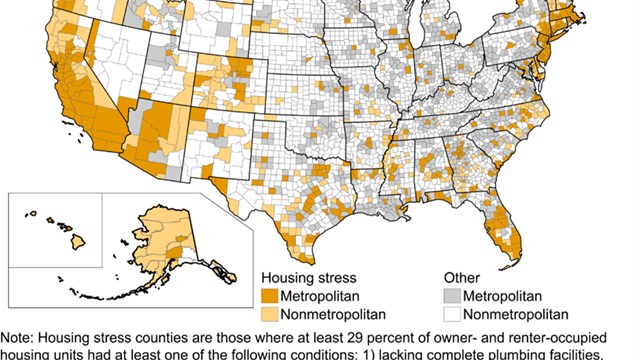

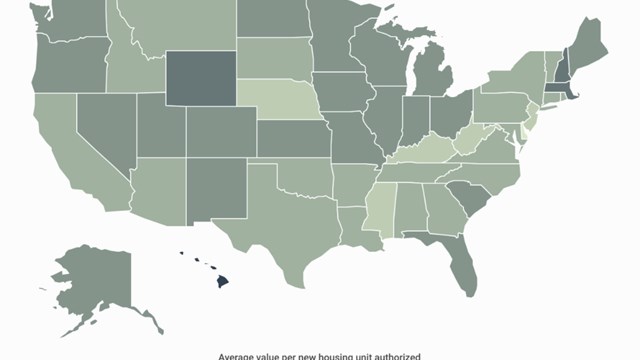

The report notes that “Within the U.S., some regions are aging more rapidly than others. In particular, the New England states of Vermont, New Hampshire, and Maine stand out for the rapid growth of their 65-and-over population. Vermont leads the nation with a 5.9-percentage-point increase in its senior population between 2012 and 2022, followed closely by Maine at 5.6% and New Hampshire at 5.5%. Western states including Wyoming (+5.6 percentage points), Hawaii (+5.4%), and Alaska (+5.3%) also rank highly for their growth rates.”

At the metro level, the most rapidly aging cities in the U.S. are spread throughout the country, with Sun Belt destinations proving to be attractive retirement locations that in many cases are bringing more older Americans into their populations. In others, economic decline has limited the number of younger people moving in or families adding children, allowing the existing older population to grow.

There are a few key takeaways from the report for the New York metro area, including:

- In 2012, seniors made up 12.5% of the population in NYC.

- By 2022, that figure was 16.7%—an increase of 4.2 percentage points.

- Looking only at large cities, NYC experienced the 6th greatest increase in its 65-and-over population in the country.

U.S. Money Reserve is an Austin, Texas-based distributor of government-issued gold, silver, platinum, and palladium.

Leave a Comment