Sellers have one overriding goal that is clear to everyone: to achieve the highest possible price for their property. However there is risk and it is this risk that must be minimized to maximize the probability of return.

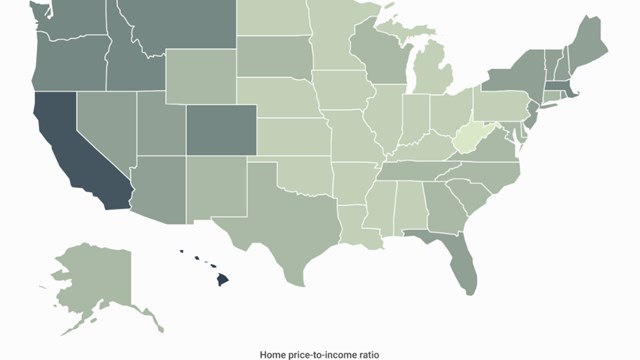

Market risk: Every seller has a perception of value of his or her home

that exceeds current market. This is because sellers, by their nature, are optimists

while buyers are pessimists seeking to pay under current market. The key for

a seller is to stay within a viable bid/ask range in order to stimulate the

greatest buyer interest and create momentum for an auction. If the seller is

priced too high, many buyers will not even be interested in viewing the apartment

and good opportunities may be missed. The key is to test the market by aggressively

pricing initially and then lowering the price to find the proper price break

that generates substantial activity.Transaction Risk: It is essential when you agree to a price that you

don't limit your sales activity until the contract is signed. If the buyer is

getting a mortgage, make sure before you sign the contract that the buyer expresses

his/her qualifications for that mortgage prior to signing the contract. In many

instances, if you call your managing agent, they will give you rough financial

guidelines for what the board has approved in the past. Make sure that the buyer

meets guidelines as well. It may well be useful to actually require the financial

information given by the buyer to be a representation in the contract. This

will insure honesty.

Timing: One of the greatest challenges a seller has is coordinating

the sale with the subsequent purchase. If this feature is not adequately handled,

the seller could find one component pressuring him to lower his price on the

sale or raise his offer on the purchase. What can be even worse is an open transaction

where one component has to close and the other is still unresolved. This nightmare

is particularly evident where there is a board rejection of the buyer and the

seller is compelled to move and carry two apartments without access to the cash

equity from the sold home. One factor that every seller should be aware of is

that New York State law permits either party the right to extend the contract

closing date by 30 days. This can help you with breathing room but may not solve

the full problem. In the current market where board rejections are more common

due to increasingly stringent requirements, it is better to focus on the sale

of your home prior to the purchase. When the contract on the sale is consummated,

then you can begin seeking a new apartment having a clearer perspective of your

economic resources. One viable strategy is to move into a rental property for

a limited term in order to minimize the risk of being caught open-ended transaction.

This technique is particularly useful if, after a purchase, you envision making

improvements prior to moving into the new apartment. Under current circumstances

rentals are readily available and most landlords will let you break a lease

with a specified penalty payment.Ego: The last risk is one that many sellers fail to fully understand.

Your probability of maximizing value is improved if you are perceived as honest,

informative, open and cooperative. To the extent that you are viewed as deceitful,

closed and antagonistic buyers will be afraid of you. A contract is only expression

of the agreement between two parties. It is the people themselves who entered

into the agreement that are the foundation for everything else that happens.

Neil Binder is the co-founder and principal of Bellmarc Realty, an author and broker.

Leave a Comment