In short, the past year was a good one in the real estate market as far as condos and co-ops were concerned. Both buyers and sellers were confident, brokers were enthusiastic, and properties moved quickly. All in all, things seemed to be on a roll, and real estate professionals forecast more of the same for 2016.

Some Basic Numbers

According to the Real Estate Board of New York (REBNY)'s residential condo and co-op sales report for the fourth quarter of 2015, while the average sales price of a condo in Manhattan in the fourth quarter was $2,185,000—a 7% decrease over the year prior—the average Brooklyn sales price went up 13% to $879,000, and the average price in Queens was $526,000 from the previous year’s fourth-quarter average.

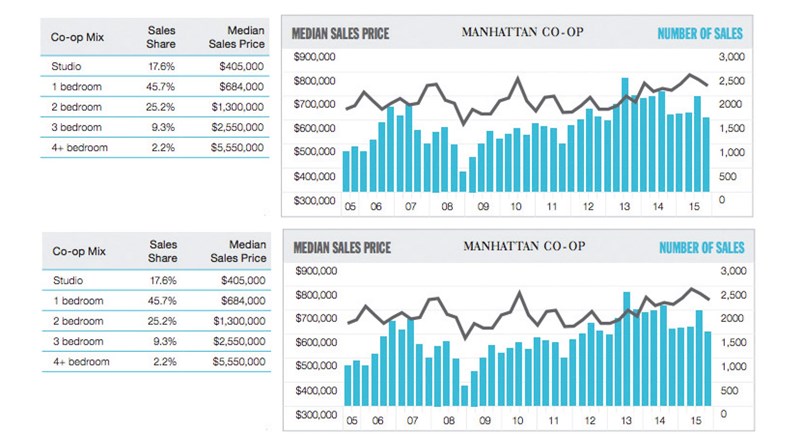

As far as co-ops are concerned, the average sales price of a Manhattan unit was $1,226,000, up 12% from 2015’s fourth quarter. Brooklyn saw an increase of 18% to $489,000; the average sales price in Queens rose 8% to $259,000, and the average price of a Bronx unit also increased 8% to $245,000.

According to Lee Williams, a broker with the Level Group, “Well-priced properties in prime areas are still moving rapidly. Those in adjacent areas are selling as well, but at a slightly slower pace. The entry-level and 'move up’ segments continue to perform.” While the super-luxury market has experienced some softness, Williams says, “Hopefully, that will not trickle down to the rest of the market.”

Although the economy has been on an upswing, its occasional ups and downs continue to concern many in the real estate profession. Nevertheless, the general mood continues to be upbeat.

“The stock market fluctuations in August certainly gave some pause to the real estate market in September and October, but by November, buyers realized that the U.S. economy and the local New York economy remain strong and that interest rates continue to be low,” says Richard Grossman, executive vice president and senior managing director of Halstead Property, LLC.

Impact of City Policies

Besides the national economic scene, the city’s political landscape also directly affects the real estate market. Much of the early unease in the upper-end luxury market over some of Mayor Bill de Blasio’s more populist-leaning rhetoric has dissipated, but there are other concerns.

One important issue concerns the expiration of the 421-a tax abatement program. This city-sponsored program, which started in 1971, was an incentive for developers to build multifamily housing in the city. Eligibility has varied with location, how much affordable housing was created and other factors. Of course, not all developers use the program—some elect to avoid the paperwork—but it was a big part of the city real estate scene for years.

While in the past, the program was always renewed in Albany, it expired in 2015 after disputes. The most recent extension required developers to provide union-level construction wages, something real estate executives resisted. Gov. Andrew Cuomo tried to mediate the issue, but the parties were not able to come to an agreement, and the abatement lapsed.

As Grossman says, “Right now, it’s not in effect for the first time in 40 years.” Williams adds that “without the 421-a, many developers will not be able to move forward, making development currently in the pipeline more valuable.”

Turning to another issue, the fact that last year the city’s Rent Guidelines Board approved the first rent freeze for one-year leases in its history could have an impact on the co-op and condo sector as well, says Williams. “I’ve spoken to many small landlords. Given the last decision by the Rent Guidelines Board, more than a few are considering converting their existing properties to condos or co-ops.”

Rick Schulhoff, CEO of the Brooklyn Board of Realtors, says that the threat of the City Council passing a “written rejection” bill, meaning that co-op buildings would have to give applicants the reason they were rejected, bears watching. “I don’t think this will happen in New York City,” he says, although bills have been introduced numerous times. “But in Suffolk County, boards now have to give a reason for rejecting an applicant.”

On the positive side, Michael Slattery, vice president of research for REBNY, praises the de Blasio administration’s successful crime-fighting efforts, continuing the work of previous administrations. “The administration’s successful efforts in continuing to make New York City the largest safe city in America is an essential ingredient in a strong residential market,” he comments.

Sandy: Some Areas Recover,

but Problems Linger

Also on the positive side, those neighborhoods closest to the shoreline seem to be on the road to recovery from the damages wreaked by Superstorm Sandy, despite frustration with the slow-moving federal bureaucracy.

In hard-hit Gerritsen Beach, for example, funds have recently been made available for road and sewer reconstruction projects as well as for shoring up the area’s volunteer fire department building. In the Rockaways, the boardwalk is being rebuilt with additional storm protection measures, such as steel-reinforced concrete, retaining walls and plantings on sand dunes.

Everywhere, thousands of houses have been rebuilt at a higher elevation, another protection measure. And many public facilities, such as libraries and health clinics that were closed by the storm have reopened—as have important businesses such as supermarkets. Still, some areas lag behind, especially low-income areas and NYC Housing Authority developments.

Then & Now, Co-ops or Condos

How does the real estate market, especially the condo and co-op market, compare to what it was five or 10 years ago? Clearly, five years ago we were much closer to the impact of the Great Recession—that’s one obvious difference.

“The market is significantly better than it was five years ago, when the effects of the Great Recession were still being felt throughout the residential sales market in all boroughs,” says Slattery. “Ten years ago, the market was rising significantly, and rose for another one to two years until the financial crisis and the Great Recession slowed market activity dramatically for an extended period of time.”

On the subject of which units are seeing more activity, co-ops or condos, you’ll get several answers, often contradictory, depending on who you talk to. Perhaps Grossman’s comment is most complete: “Co-ops still make up the majority of the sales in the marketplace, but for new construction, condos dominate. There are pros and cons of owning each—it depends on the buyer’s needs and budget.”

Trends in Amenities

Another aspect of the co-op condo real estate market is that of amenities—which ones are hot, and which ones are not. Williams says that business centers are becoming popular once again. “With more people having the ability to work from home, it has become a must.” He adds that families also want more playrooms and pools. “It’s great to get out of the apartment with the kids for a few hours and not have to pack up the stroller,” he explains.

In many cases, a gym or exercise room is practically a necessity for buyers. Additional storage space and bike storage are always popular as well.

Schulhoff also says space is important to many people in his area, with some wanting back yards. “A lot of people want room to plant their herb gardens,” he says. Safety is also important. “A lot more co-ops now have doormen 24/7.”

Retaining Market Value

As always, there are also trends in “hot” neighborhoods, both those up-and-coming and those that have been desirable for many years. For example, according to the aforementioned REBNY fourth-quarter report, the number of co-op sales on the Upper East Side was the most of any Manhattan neighborhood, increasing to 503 from 490 in the quarter a year previous. The average sales price of an Upper East Side co-op also increased 12% over the same period last year, to $1,622,000. A lot of activity was also reported in Chelsea/Flatiron, where the number of condo sales increased from 64 to 80.

In Brooklyn, according to the report, Williamsburg had the highest number of condo sales in the fourth quarter, although at 75, it was a decrease from last year’s 88. In Queens, the Long Island City condo market reported sales of 44 units, an increase over the 32 from last year, even though the average price fell 8% to $932,000.

Williams says “value plays” include the Upper East Side (since values will increase after the Second Avenue Subway opens), properties near the Hudson Yards, and West and Central Harlem. “The A train can have you in Midtown in 20 minutes. Now that there are services and good restaurants, it has made this a superior choice for many.”

Grossman says that there are many neighborhoods that have “great buying power,” namely, “Riverdale and Upper Manhattan have great housing stock and affordable prices. Long Island city and Queens are the new frontier. Bedford-Stuyvesant looks like the West Village at a fraction of the price.”

Schulhoff, referring to Brooklyn specifically, points to East New York, as we’ve mentioned above. He also says that “Bensonhurst is very hot with Asian [buyers],” while Bay Ridge is a “melting pot.”

In general, says Grossman, the best bargain is getting the home of your dreams. “If it is what you want, it is worth paying for, and the additional amount will be forgotten or seem trivial in a year or two.”

Looking Ahead

Let’s look at some scenarios for the co-op and condo market going forward. Williams says that “Buyers think prices are moving too high and too fast. Sellers think prices should be moving up faster. So there has been no change there in a decade.”

Grossman, however, says that “In the long term, prices will rise. It is very hard to build in New York, and the demand will increase because people want to live in an urban environment.” And Schulhoff doesn’t see much change. “Everything is about as hot as it can be,” he says. “Everything is on a steep incline. Days on the market are negligible.”

New York, New York

All in all, the most important thing is not expected to change—the draw of New York City as a magnet for buyers—co-op, condo or single-family alike. At mid-century, the flight to the suburbs was the accepted trend. Later on, Manhattan became fashionable anew. Now, we’re seeing the rebirth of Brooklyn and Queens, and the Bronx may be just around the corner. It's a fact that New York is a world capital. It has the United Nations, the financial district, the department stores, the theaters, the sports teams and the night life. It will continue to be a magnet for young people, families, retirees who want an exciting life, and others for years to come.

Raanan Geberer is a freelance writer and a frequent contributor to The Cooperator.

Leave a Comment