Just as it was last year, the real estate market–including the market for co-ops, condos and HOAs–is on an upswing. The economy seems to have largely (if not completely) recovered from the 2007-08 recession, and professionals don’t see any new downturn in the near future.

To some extent, the real estate market did slow down somewhat during the lead-up to last year’s presidential election. Now experts say things are looking up not only in local markets but nationwide. Still, people are concerned about the long-term impact of the tax bills currently being contemplated in the House and Senate.

The View From New York City

“There is much talk about the tax policy changes,” said Julie Park, a sales agent at Level Group, a real estate brokerage firm in New York City. “Whether or not the water will experience subtle ripples or a tidal wave is anyone’s guess,” she says. “What is concrete is that key economic indicators point to a healthy outlook going forward; interest rates are still low, and Wall Street bonuses are projected to be up. Furthermore, the `affordable’ market has always been resilient, even through uncertain times such as the present.”

Kirk Henckels, Vice Chairman of Manhattan-based brokerage company Stribling, deals exclusively with the New York City luxury market – units that sell for $5 million-plus. ”What I’m seeing in the $5 million and up market is that the number of closings are up compared to last year because of last year’s election pause,” he says.

Summarizing the market in New York City as a whole, the Real Estate Board of New York (REBNY)’s third-quarter report (the most recent available at the time this article was being written), showed that new records were set for average co-op sales prices in Manhattan, Brooklyn, and Queens. Citywide, the average price for a co-op in the third quarter was $836,000.

The average sales price for a condo in Manhattan was $2,524,000, a 14 percent decrease year-over-year but still high, according to REBNY. On the other hand, the average sales price for a condo in Queens hit an all-time high at $723,000, boosted by the borough’s strong residential market as well as high-priced sales at several new developments.

Chicagoland and Miami

Like Park in New York, Jon Broadbooks, Director of Communications for the Illinois Association of Realtors (IAR), says there have also been concerned about the impact of the Republican tax plan being reconciled in Washington, D.C., at the time of this writing. “Illinois is a high tax state,” he says. “The current proposals in the House and the Senate aren’t particularly friendly to high tax states.”

Looking at the past year, however, Broadbooks says that “Across the state and in Chicago, you’re basically seeing decent increases in median prices, but sales have been pretty choppy all year, driven by inventory. Buyers in the spring were out earlier – they wanted to be there before the rush of buyers. Driven by lack of inventory, demand is really still high.”

IAR data for the number of condo sales in the city of Chicago in September showed a decrease of 5.8 percent, but median sales prices increased 3.7 percent to $310,000. Similar data for the nine-county Chicago Primary Metropolitan Statistical Area (PMSA) showed a volume decrease of 4.6 percent and a price increase of 4.1 percent to $192,000.

Turning south and eastward to Miami, the Miami Association of Realtors reported in late November that sales of existing condos increased 1.5 percent year-over year, and $1 million-plus condo sales in particular jumped 9.8 percent. Delays in getting cleanup crews, inspectors, and appraisers out to properties after Hurricane Irma stalled the market for several months, according to the group, but now re-inspections are being completed and tree debris has mostly been removed.

All in all, November’s statement from the Miami Association of Realtors says that Miami real estate (both condos and single-family homes) remains a bargain. A 120-square-meter condominium in Miami-Fort Lauderdale-Miami Beach cost $170,000 in 2016 Q3—far less than other high-profile cities like San Francisco or New York.

Trends Among Buyers

What about trends among condo, co-op and HOA homebuyers? In the past, this publication has reported a high demand for amenities, especially as one moves toward higher-priced units. Among the must-haves reported by realtors are ‘art walls,’ or large expanses of blank wall to showcase an art collection; fitness centers and spas; movie screening rooms; children’s playrooms; wine cellars; and even golf simulators.

The Virginia-based National Apartment Association (NAA) is an organization that deals with both rental and condos/co-op apartments nationwide. Paula Munger, Director Industry Research and Analysis for the NAA, said that community association developers and owners nowadays are providing more community spaces, such as rooftop decks and outdoor kitchens, as well as holding special events such as concerts, picnics, and so forth within their buildings or associations. They are also offering “things like online payment options, ride-sharing incentives, and more,” she says.

Similarly, speaking of New York, Park says, “There are more options to choose from, and developers are going big and bold in an effort to make their product stand out – swimming pools in living rooms, soaring ceilings, pet spas – buyers are enjoying the dog and pony show.”

And Jeremy Swillinger, another sales agent for Level Group, says that in his opinion, buyers are more willing to do renovations on just-purchased units. “I think it comes down to buyers being more picky and realizing that the limited supply of property doesn’t satisfy their priorities,” he says. “Therefore, they are more open to doing the work to get the space to meet their comforts. I’m also finding that developers are moving away from the large, extravagant kitchens and redesigning them to be efficient, but still with top-of-the-line finishes.”

According to Rebecca Thomson, President of the Chicago Association of Realtors, “Homebuyers are interested in move-in-ready properties. We’re seeing a lot of interest in amenities such as rooftop decks, doormen, and common spaces for communal gatherings. Urban gardening continues to grow in popularity as well. Buyers want to know that when they pay their assessments monthly, they’re getting something for their dollars. Smart home technology, like Nest and Google Home, is more popular too; the key is to find the system that works for the consumer.”

Hot and Warm-ish Markets

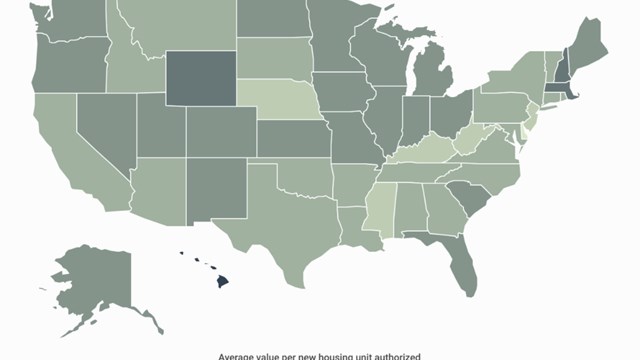

In every area of the country, there are some geographical areas that are expected to hold or increase their property values, and others that are more sluggish. This is true even for the nation as a whole. For example, Munger of the NAA says that markets in the Southwest, South Central and Mountain West, with strong job growth, have room for growth in values. “Luxury properties in urban cores of gateway cities are more sluggish.”

In New York City, the Second Avenue subway opened on the first day of 2017. People are beginning to take notice of the surrounding area—the eastern part of the Upper East Side of Manhattan, often known as Yorkville. “It was the top-selling neighborhood for new development this year, and for good reason,” says Park. “There has been a proliferation of trendy restaurants flocking to the neighborhood, new organic food markets, better retail, and it’s only getting better.”

Comparing the neighborhood with other areas, she continues, “A one-bedroom condo in Tribeca or the West Village easily costs $1.5 million. If you’re lucky, it won’t be a shoebox, and at such a premium per square foot, there isn’t much room for appreciation down the road. On the Upper East Side or even in Murray Hill, you can find a one-bedroom for a fraction of the price with plenty of room for the property to accumulate in value.”

Her colleague Swillinger mentions other neighborhoods that are expected to hold and increase value. He points to those with established infrastructure—shopping, restaurants, schools, and transportation—such as the Upper West and East Sides; Park Slope, Boerum Hill, and Brooklyn Heights in Brooklyn; and Long Island City in Queens. He also sees Long Island City as one of New York’s fastest-growing neighborhoods, especially with the opening of the Cornell Tech campus on nearby Roosevelt Island.

However, keeping with the theme of infrastructure, he believes Brooklyn’s Williamsburg might see “flattened values” due to the coming 15-month shutdown of the L train, the only direct link between much of that neighborhood and Manhattan.

Henckels, speaking of the luxury market in particular, says, that “Prospective buyers have been looking from the East River to 3rdAvenue, from the 50s up to the 90s.” He also notes some changes in the types of units available, as well as geographical areas. “The empty-nester apartment has basically evaporated on the Upper East Side because developers are not targeting that market,” responding to changes in demand.

In Chicago, says Thomson, “Every neighborhood is recovering [from the Recession] at its own rate. Some of our neighborhoods may be considered more `post-recession,’ but others are still very much recovering. The great thing about that is there is still value to be found in every neighborhood.” She’s enthusiastic about Windy City living in general: “Robust public transportation, ample green space, and diverse commercial offerings are all incredible perks of living within the city limits, and just think about our restaurant scene and shopping options!”

Going Forward

What are some possible scenarios for the condo, co-op and HOA market going forward? How do professionals see prices, availability, buyers’ expectations/demands, and so forth going in the next year or two?

“I think prices will continue the same pace they’ve seen over the past 18 months,” says Swillinger. “Nothing drastic, but the high-end luxury will see flat to slightly lower values. The overall condo market below the $4M range will continue to report strong sales, despite the increased supply. There is still a demand for NYC property that is investor-friendly. But I believe savvy investors will look toward the equities markets, which have been and are expected to continue making a greater return than what is expected in the local NYC real estate market.

“I think the co-op market will hold strong, as the clientele that is purchasing them are typically local New Yorkers who aren’t purchasing co-op apartments for the quick appreciation and flip opportunity,” he adds.

Henckels adds that “In Manhattan, condos will dominate. The market responds to value. Where condos go, co-ops will follow.”

For Chicago, Thomson says that inventory will continue to be tight, and although construction is up, many of those units will be out of range for millennial buyers. As a result, she says, pricing will have to be strategic and buyers must be prepared to act when they find a home they want. “We could see many homeowners, wary of competing with other buyers in a limited market, choosing to renovate instead of moving.”

Nationwide, says Munger, prices are already at peak for the urban luxury market, but “Class B/C properties have been performing better in many markets, and will continue to do so given the demand/supply imbalance in this segment.”

Still a Good Investment

All in all, those interviewed agreed that real estate would continue to be as a stable investment, especially compared to other markets. It will continue to be a safe haven for homeowners and investors alike.

In particular, says Park of the Level Group, the Manhattan market has been an excellent place to invest. “If you purchase in the right neighborhood at the right price, you can use leverage (if necessary) to acquire an income-generating asset that will appreciate over time.”

Thompson of the Chicago Association of Realtors says that “As the market continues to recover, real estate will continue to grow in value and security” particularly as millennials who are entering the market make big life decisions.

And across the entire country, says Munger of the NAA, “The low interest rate environment is expected to be a longer-term phenomenon, so even at moderate levels, return on investment and net operating income in the apartment sector will remain very attractive compared to other asset classes.

Raanan Geberer is a New York City-based freelance writer, reporter, editor, and contributor to The Cooperator.

Leave a Comment