With the expiration of Governor Andrew Cuomo’s moratorium on evictions on June 20, New York’s Housing Courts began hearing new eviction cases on Monday, June 22. How this transition will play out in practice remains to be seen.

On one hand, there is a significant backlog of existing eviction cases that were commenced prior to the closure of the courts and the governor’s moratorium in mid-March -- thousands of them, according to recent postings on Law360.com, part of the LexisNexis network of academic research and publications. Among those are both nonpayment cases, for which there are continuing restrictions based on a number of COVID-related parameters, and holdover proceedings—a broad category of eviction cases that can be brought against tenants who rent month-to-month, or who have allegedly violated a lease term, which according to Law360 are outside of the COVID-related restrictions.

Many have found the guidance surrounding the two types of evictions to be confusing, and in some cases, contradictory. Additionally, as the 30-day notice period for warrants of eviction has elapsed, the languishing cases may need to be re-served. This will add another 14 business day delay before a marshal can actually execute an eviction.

A June 15 letter from Bureau of Marshals Director Caroline Tang-Alejandro states that a notice cannot be re-served "until the petitioner has received leave of court to enforce the warrant of eviction"—a process landlord attorneys say could make it more difficult for them to evict tenants whose cases predate the pandemic.

However, the Department of Investigation (DOI), which oversees the Bureau of Marshals, indicated to Law360 that this directive applied only to nonpayment cases -- or at least those that meet the standards of protections related to COVID-19. As for holdover proceedings, the article states that "DOI is awaiting further direction from the court regarding holdovers and will update DOI's guidance if appropriate.”

Another wrinkle in the pending guidance, notes the outlet, is that marshals will not resume business until Chief Administrative Judge Lawrence K. Marks lifts his March 16 order stating that "all eviction proceedings and pending eviction orders shall be suspended statewide ... until further notice." While a DOI spokesperson confirmed this order was still in effect on Monday, courts spokesperson Lucian Chalfen told Law360 on Wednesday that New York City housing court is “currently in the process of formulating what will be addressed in Housing Court starting on June 22,” and that he expects to have more concrete guidance “before the end of the week."

New Evictions, Bigger Delays

On a Zoom call with hundreds of lawyers, New York Housing Court Supervising Judge Jean T. Schneider told meeting attendees that they should expect a slow procession of cases upon the June 22 reopening. "Anybody going in to file new cases can expect to be waiting for a long time," Schneider said.

While attorneys will be able to file eviction cases in person for the first time since coronavirus closures in March, only five or fewer people will be allowed to wait at the clerks' counter at any given time. Others will wait on the sidewalk. As Law360 notes, there is no electronic filing in city housing courts.

To avoid the risks that in-person filings pose for exposure to and transmission of coronavirus, Judge Schneider said on Monday, June 22 that the courts will send out postcards to defendants with a phone number to call to schedule their first virtual appearance—which Law360 predicts will likely not occur until the second phase of reopening. If tenants show up in person, clerks stationed outside the courthouse will issue them flyers with instructions to "avoid standing in line," the outlet indicates.

Judge Schneider also noted that "We are aware that people have been tremendously ill and may still be hospitalized" with complications from COVID-19, and stressed that for the foreseeable future, there will be no default judgments in housing court—meaning that a tenant cannot be evicted for failing to appear.

Meanwhile, Schneider indicated that there is no timeline for the resumption of in-person hearings. Those that are scheduled will occur over Skype, with "substantial" adjournments, she said. Plans are forthcoming for pro se tenants who lack the technology for virtual hearings -- but, said Schneider, "We ... are not prepared to say how we're going to handle them yet.”

Tenants in Limbo

The approaching court reopening prompted some state senators to express concerns about the dangers to public health posed by taking things too fast. In response, Chief Judge Janet DiFiore wrote in a letter, "Please be assured that the return of in-person proceedings in Housing Court is not imminent and is subject to no existing timeline."

Nakeeb Siddique, director of housing for the Brooklyn Neighborhood Office of the Legal Aid Society, sees that as a contradiction. "[It's] going to sound pretty damn imminent to many tenants in NYC, especially poor people, who are not going to take any chances when they get eviction petitions, and will come down to the courthouse to answer in person," he said.

As the courts begin to work through an expected flood of new cases, "virtual evictions are still evictions," said tenant attorney Patrick Tyrrell of Mobilization for Justice.

Confusing matters further, there is another order, dated through August 20, that prohibits new eviction cases against commercial and residential tenants who receive government assistance or are "otherwise facing financial hardship" because of COVID-19.

But proving that hardship is itself fraught with difficulty. According to Law360, updated court directives issued on June 12 state that petitioners looking to file a new nonpayment case, or enforce a default judgment or warrant of eviction, must first submit an affidavit from "a person with personal knowledge of the facts" stating they've made a "good-faith effort" to determine if a tenant qualifies for an exemption. Tenant attorneys, meanwhile, said they plan to advise their clients not to share any personal financial information with their landlords.

According to landlord attorney Nativ Winiarsky, partner with Kucker Marino Winiarsky & Bittens LLP, "There is absolutely no guidance on this important issue. I think some guidance would be helpful to all concerned since some direct instruction would avoid motion practice consuming the court's resources."

The National Picture

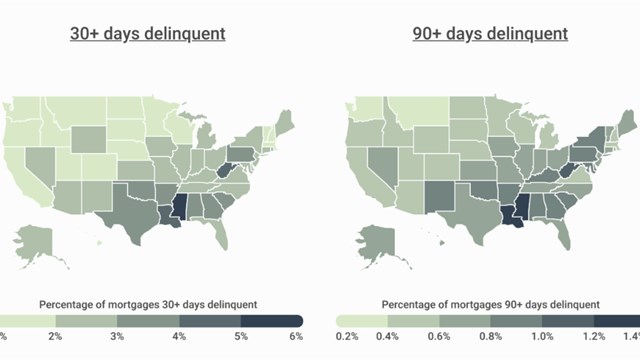

Meanwhile, the four-month federal moratorium on evictions, fees, and penalties for multifamily tenants receiving federal assistance or homeowners with government-backed mortgages that was enacted in March with the Coronavirus Aid, Relief and Economic Security (CARES) Act expires in July -- as do supplemental unemployment benefits that added up to an additional $600 per week for some of the more than 40 million Americans laid off since March thanks to the pandemic.

According to housing experts, many of the newly unemployed live in subsidized housing units and have used the one-time $1,200 federal stimulus payment they received to cover their rent. The House passed $100 billion in emergency rental assistance in June, but the Republican-led Senate has not taken up the bill, suggesting instead that funding from the CARES Act - as well as $12.4 billion it provided the Department of Housing and Urban Development to address housing needs during the pandemic - should be applied to other sectors of the U.S. economy.

With both the eviction moratorium and supplemental unemployment benefits expiring on the same timeline, many housing advocates are asking what will happen to the tenants who have relied on both to stay afloat during the last four months.

As Law360 explains, housing tax credit owners generally operate on lean margins, with lower levels of cash reserves than market-rate properties, because state housing agencies don't want to over-subsidize affordable housing developments. Jennifer Schwartz, Director of Tax and Housing Advocacy for the National Council of State Housing Agencies says she believes that owners will try to keep tenants in their housing while still meeting program requirements, maintaining financial solvency, and keeping their properties operating efficiently -- but, she tells Law360, "If we do see a real dropoff in rent payments ... owners may be forced to draw on reserves."

However, according to Emily Cadik, Executive Director of the Affordable Housing Tax Credit Coalition—a national trade group representing syndicators, lenders, and developers, among others—many low-income-housing tax credit property owners “are getting much farther into reserves than expected, or having to defer maintenance so that they can address these new costs and gaps in rental income that are already arising.” An eviction moratorium affects a property’s cash flow, she says, and if allowed to continue, it will affect the properties’ financial viability.

Stalemate on Capitol Hill

Congressional lawmakers continue to debate the best way to address these compounding crises.

Rep. Suzan DelBene, D-Wash., for example, says Congress should provide more relief to keep people from losing their homes during the public health crisis by passing the Health and Economic Recovery Omnibus Emergency Solutions Act—a $3 trillion measure backed by Democrats that was approved by a divided House on May 15, says Law360.

During a hearing of the Senate Committee on Banking, Housing, and Urban Affairs last week, Sen. Jack Reed, D-R.I., suggested that Congress provide money to individual mortgage holders and renters so they can make monthly payments, thereby removing financial pressure from landlords and banks.

In response, Mark A. Calabria, director of the Federal Housing Finance Agency, testified that the fundamental problem facing renters and mortgage holders is a lack of employment income, according to the article. He noted that payments due under federally insured home mortgages would be rescheduled to the end of the loan period so borrowers wouldn't have to pay a lump sum when the moratorium ends.

Rep. Kevin Brady, R-Texas, ranking member of the House Ways and Means Committee, has said that demand for housing assistance has been especially high and that some states and local governments have used CARES Act funding to respond aggressively to residents’ needs. Rather than deciding whether to institute another eviction moratorium, federal lawmakers should continue to watch as communities reopen and measure where those challenges will be occurring in the future, Brady has told reporters.

Cadik, of the Affordable Housing Tax Credit Coalition, says housing tax credit property owners are already looking to state and local governments for additional funding to help curb tenant evictions. "I don't think we have a sense, across the board, for what's going to happen when the eviction moratorium is up, and we'll see what Congress does," she tells Law360. "The concern is that there just won't be an ability to catch up at some point."

Darcey Gerstein is Associate Editor of The Cooperator.

Leave a Comment