Over the past few years, nearly all property owners, including shared interest communities, have seen sharp increases in their insurance premiums. That costs have spiraled and coverage gotten harder to obtain is obvious; the questions are, why have premiums risen so sharply? Has the insurance industry adjusted to these factors, and will premiums stabilize? Have we seen the worst of it, or is this just the beginning? CooperatorNews asked several regional and national insurance experts their thoughts on the subject. Here’s what they said.

A Hard Market

According to most sources, the insurance market started to harden between 2020 and 2022. Alex Seaman, senior vice president for HUB Northeast notes in the insurer’s 2025 New York City Habitational Real Estate Market Outlook report that “Since then, we have seen significant increases that started around the fourth quarter of 2022 and have continued to impact the… real estate insurance marketplace to this day. Although some real estate risks have been lucky enough to receive insurance renewals with relatively small premium increases, most properties are seeing premium increases, even for properties with a favorable loss history.”

“We are coming off one of the hardest markets in decades,” says Gregory Pierce, unit leader with North Star, an Insurance provider located in New England. “It’s improving, but we are still in a difficult market characterized by year-over-year increases. The primary concern for most community association owners and managers remains the availability and cost of competitively priced property insurance.”

Underlying Causes

The causes of the current inhospitable coverage landscape are many and multifaceted, and include factors both natural and manmade.

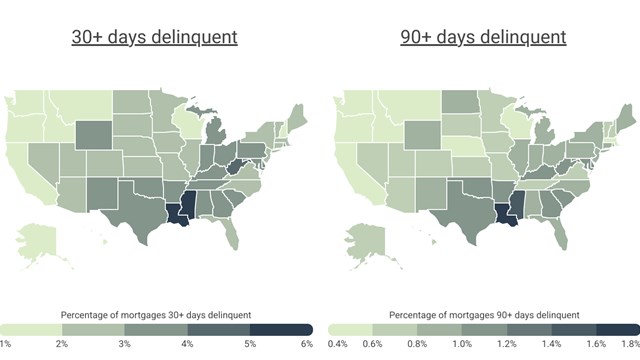

Nearly all pros agree that one of the main culprits is the increased frequency and severity of natural disasters brought on by climate change. Weather events such as hurricanes, floods, and wildfires cost billions of dollars in losses annually, leading to higher claims payouts; this in turn has caused insurers to raise premiums not only in higher-risk areas, but across the board.

The impact of climate-related events has been compounded by inflation, tariffs and supply chain issues driving up the cost of building materials needed to repair and rebuild after catastrophic losses, and still further compounded by a shortage of skilled labor in the construction industry. These higher costs mean higher claim payouts for insurers, which get passed directly on to policyholders in the form of higher premiums.

Other, perhaps less obvious causes of sky-high premiums are the rising cost of reinsurance, and properties being under-insured.

Much like regular consumers, insurers purchase coverage to protect themselves from large losses, and the cost of that coverage has risen for the reasons just cited. Billion-dollar claims are no longer a rarity, and that has led to reinsurers raising premiums on smaller carriers—the cost of which again gets passed down to policyholders.

Regarding the problem of properties not carrying enough coverage, Seaman explains that in the New York market, for example, “Properties have been generally under-insured for many years,” which has led to a review of policies going forward. “Insurance carriers had accepted valuations on fire-resistant high-rise buildings as low as $200-$250 per square foot,” he notes, but today, “Most of these properties cannot be rebuilt for under $500 per foot. Labor, soft costs and material costs have increased dramatically, and insurance carriers now require more accurate insurable values, also known as rebuilding costs.”

And, says Ryan Fleming, a senior partner with the Baldwin Group, a national carrier based in New Jersey, in the world of insurance there is simply only so much risk that can be absorbed. “The fact of the matter is that it’s finite,” he says. “There is only so much insurance available. We went through so much adversity. Florida storms, California wildfires, etc. The astounding amount of claims activity in the last few years was caused by a knee-jerk reaction by insurers and a tightening of capacity. There is just less insurance available. In the end, it’s a math equation. We say ‘OK, there are ‘X’ number of companies with ‘Y’ number of dollars willing to leverage those dollars and take on risk hoping not to pay claims.”

Going Forward

The biggest question for the future is not necessarily whether premiums will decline, (they won’t), but rather what can shared interest communities—or any insured for that matter—do to control the increase in costs. Yotam Cohen, CEO of NYC-based Daisy Property Management, has client communities in both New York and New Jersey and reports that “our main weapon in lowering insurance costs is to reduce risk. In many instances, that means reducing conditions that lead to violations or other situations that may lead to claims. To a great extent, that’s the job of management, particularly in shared interest communities such as co-ops, condos, and HOAs. If you have clear, organized systems for vendors who operate in your buildings, and are reducing the cost of physical maintenance for the building, you can reduce potential risk and perhaps even lower premiums.”

“Claims experience has always been a primary factor in negotiating renewal terms,” says Seaman. “Maintaining diligence in loss control and risk transfer will become increasingly important as we move forward. Here at HUB, our Risk Services Team actively assists our insured properties in addressing proactive strategies in risk assessment and loss control, including water mitigation plans for hurricanes and floods. HPD violations should also be addressed on a priority basis, as outstanding violations now often result in an immediate declination from underwriters.”

In short, the straightest path to controlling rising premiums is to make sure your property is in tip-top physical shape. Deferred maintenance is an easy excuse for carriers to increase premiums, or to decline coverage altogether. It’s the board’s responsibility to stay on top of management’s efforts not only to reduce violations, but to clear them from the record altogether. Conversely, it’s management’s responsibility to guide the board down the right path to keep the property in optimum condition. That task is best accomplished by providing accurate information and all options available to resolve issues that could come back to haunt them later.

According to Pierce, “In what remains a difficult marketplace, it’s incumbent upon boards and managers to ensure they’re doing everything they reasonably can to position themselves as a ‘best-in-class’ community to underwriters to ensure they benefit from the most competitive possible terms, conditions and pricing. This means exhibiting a commitment to proactive property maintenance, and a communicative relationship with their broker(s) to ensure there is awareness around key maintenance projects. In the instance where there have been claims, [it means] creating a dialogue with the broker, and by extension, the underwriters, about the details of these claims, and what has been done by the community in order to address the likelihood of similar claims reoccurring in the future.”

The Effect on Saleability

Another significant consequence of the insurance crisis is its effect on individual residents, both in terms of their own coverage, and on the mortgage market.

In an attempt to control community-wide insurance costs and lower premiums, many condo and co-op communities are scaling back coverage and increasing their deductibles; in many cases boards are also requiring individual owners and shareholders to increase the amount of insurance they carry on their units, shifting the burden from the community to individual residents.

Fleming observes that the increase in premiums, reduction in coverage, and shifting of the insurance burden from the association or corporation to individual unit owners can cause problems when it comes to financing of individual units. “If any deductible is over five percent of total value, a unit is no longer eligible for Fanny or Freddy financing,” he says. “If a community association has a per-unit deductible and the carrier says it’s to be per unit, the lender multiplies by the number of units. That may exceed the five percent deductible allowed by both Fanny and Freddy. But in reality, that loss could never be triggered all at once, so their calculations are deceptive. A huge pipe breakage in one unit would never happen in all units at once, for example. So it’s a financial company trying to make a decision about something they don’t really understand.”

A Break in the Clouds?

The impacts of the current struggles in the insurance industry hit on many levels, from global to local. For example, “[Carriers are] mitigating risk by avoiding certain specific markets,” says Cohen. “Because of climate issues, some companies and carriers will not work in New York City or other places—like Florida, for example. We also have to keep in mind local market conditions and local legislation. On the national level, we see the same factors. There’s also the national cost of labor materials and climate to be considered.”

And even if your building or HOA isn’t on a floodplain or anywhere near an area prone to wildfires, your community and the individual residents who call it home aren’t immune to the larger currents influencing the insurance market. “The market is a global marketplace that dictates costs, premiums, and so forth,” says Fleming. “If a carrier has a profit and loss and say they collected ‘X’ and paid out ‘Y’, and indicate they need to increase revenues, the effect of which is to increase rates across the board. That’s how it’s dictated.”

All that being said, the pros say there may be reason for optimism—or at least less alarm—on the horizon. “After the hard property insurance market environment of the last several years, most property insurance underwriters are still exhibiting caution in their underwriting appetite and posture,” says Pierce, “though [that] does seem to be abating somewhat. As these factors continue to abate, I’d expect the marketplace to transition from this hard posture that we’ve seen in the last several years into something a bit more stable, though we’re still a ways away from what would be considered a soft market.”

“It’s been a wild ride for the past seven years,” says Fleming. “Everyone—both insurers and insureds—is tired of the increases. I see the market opening back up a bit, a loosening of capacity.”

Fundamentally, the facts are clear, and the causes are multiple: insurance costs have risen dramatically over the past several years thanks to climate change-fueled natural disasters, deferred maintenance-triggered catastrophes, as well as inflation, labor, and inter-industry pressures. And while we can’t affect the weather (not yet anyway) we can do something about the other causes by maintaining our properties to reduce risk and limit claims exposure. It’s incumbent upon shared-interest community leadership and management to attend to those potential causes to help mitigate costs going forward.

A.J. Sidransky is a staff writer/reporter for CooperatorNews, and a published novelist. He may be reached at alan@yrinc.com.

Leave a Comment