The Citibank-sponsored panel called “Life Uptown: A Profile of the Washington Heights/Inwood Community” and attended guests—co-op and condo board members, residential property managers, shareholders and unit owners and real estate professionals—were treated to a hosted dinner on the stage of the United Palace, an elaborate Depression-era Art Deco theater that radio and televangelist Rev. Ike supposedly decorated in real gold to hide his accumulated wealth.

Manhattan Market Overview

Panelist Gregory Heym of Terra Holdings spoke about the state of the real estate market in the Upper Manhattan neighborhoods of Washington Heights and Inwood, while Citibank's Todd Meyer, the bank’s home lending officer, discussed the financial profile for buildings.

“Basically, in Manhattan, particularly Upper Manhattan, people are saying that the market is sluggish and there aren’t a lot of buyers. Especially in Upper Manhattan, prices are still rising, buyers are still being frustrated, and sellers are still being aggressive on pricing,” said Heym, chief economist at Terra Holdings.

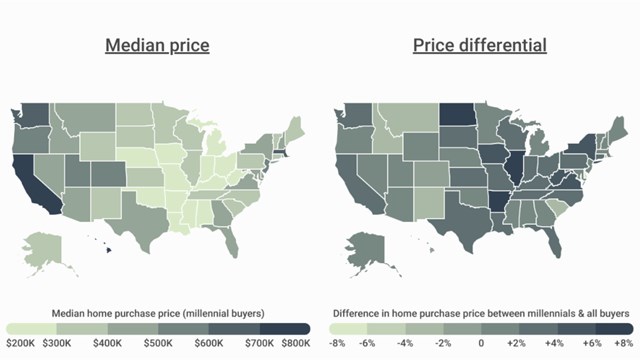

Heym said you look at how long apartments are on the market to determine a typical selling pattern. “Basically for the last couple of years, Upper Manhattan had the lowest resale days in the system. It’s relatively affordable compared to the rest of Manhattan.” People are looking for affordable but quality places to live, he said. “A lot of the growth that we’ve seen over the past year, in fact most of it, in pricing, has been in the middle to the low end of the market,” Heym said.

Considering resale apartments, not new developments, he said, the average price is down over the past year. “But what is moving is the middle. The median price, in which half the sales are lower, half are higher, hit a record high in the first quarter for resales, and are sitting at almost one million dollars right now. “ Demand is still high, he said. If you think of a starter apartment, it’s up here priced at around $300,000 to $600,000.

New York City has added a quarter of a million new jobs. Another positive for the market, he notes, is that mortgage rates continue to be low. “Mortgage rates are lower now than they were in December,” Heym explains. While all things point to a sales boom, you must consider that there are only 5,000 apartments for sale at any given time on the entire island of Manhattan, which is not a lot of inventory to meet demand.

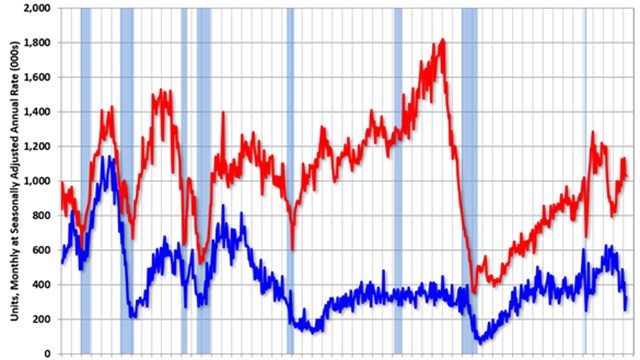

Construction, which is up throughout all five boroughs, cannot keep pace. Part of the problem is a lack of affordable housing. The 421-a exemption program, an incentive for developers to build affordable housing in luxury and market-rate developments, died when the administration could not come to an agreement with the construction industry and unions.

“The challenge in Manhattan, particularly in Upper Manhattan, is can you build enough for the demand? Right now, the answer is no.”

People want to be here, said Heym. “One of the stats that people really shake their heads at is that in the entire island of Manhattan there are less than 2,000 single family homes. That’s it.”

A Building’s Financial Picture

Citibank’s Meyer said lenders not only scrutinize the buyer, but they also look at the whole picture including the co-op or the condo building’s financial profile.

“Obviously, the island of Manhattan is a lot different than the rest of the country and really, anywhere else in the world. Mortgage lending, when you’re dealing outside of Manhattan, is typically based on the borrower. The key is whether the borrower can pay back that mortgage, that’s what we’re concerned about. Most of the properties people are going to be purchasing are condos and co-ops. That adds another layer of risk to a bank.”

“For example, as a buyer you have your financial profile: the bank will evaluate your taxes, your W-2, your credit report. On top of that there’s another layer of risk: the building. Many people may not understand why the bank is concerned about the building if the borrower has a strong financial profile,” says Meyer. “In a building, many things that we look are going to potentially affect liability for the mortgage. As a bank the last thing we want to do is have somebody default on a mortgage. If a bank says a building doesn’t qualify for financing, that’s to protect you as a consumer. It’s not a healthy building.”

Aspects of the transaction looked at include owner occupancy rates. It’s a problem if everybody’s renting and you’re the only owner—that concerns the bank, he says. If rental rates drop and the landlord defaults on their mortgage, the building is in trouble. They will have to do an assessment which affects the buyer or find another way of financing to make up for the lack of income.

“The same holds true with maintenance fees. We’re going to check how many units, how many owners are paying their maintenance fees on time. If there’s a lot of delinquent owners or shareholders that causes a problem for us,” he says, adding that it could also lead to an assessment down the road.

Co-ops traditionally have an underlying mortgage. Meyer explains that any building repairs, any needed renovations by the cooperative, would require financing, which again banks will take a hard look at. “We look at the building’s financials as well. Because indirectly the building’s financials are going to affect you directly and your ability to repay. The proprietary lease, all of these things we look at to protect you as a consumer that the building is financially sound.” Because mortgage rates are low with few defaults, banks these days may assume more risk if the buyer’s credit or financial picture isn’t perfect, he says. “It’s all weights and balances. If the building’s a little more risky we look for less risk on the buyer.”

Doing Your Due Diligence

Real estate attorney Stephane Zwirn, Esq., of Zwirn Law PLLC, explained the value of the attorney in the transaction. She stressed the importance of doing your due diligence and presenting yourself to the board in the best light.

Zwirn advised that the buyer’s attorney should review at least the past two years of financials in the building, plus the past minutes of the board of directors meetings; examine the offering plan, the bylaws, house rules and other governing documents; and closely review any pending litigation and maintenance arrears to determine if there are any red flags with that property.

“If there is a salsa dancer living above you and there’s not 80 percent carpeting in the apartment, you would want to know that—so the minutes are very important,” Zwirn said.

In her case she prepares a risk assessment memo that documents all the findings and reviews the various pros and cons of living in the building. “It is vital. We have to make sure the building is sound.”

Debra A. Estock is managing editor of The Cooperator.

Comments

Leave a Comment