After nearly a decade of expansion, New York’s luxury co-op and condominium market has taken an undeniable downturn—and it’s not a gentle slope either. According to several prominent industry players, prices at the high end of the market have experienced a drop of approximately 25% from their peak in 2015. Of course, this begs the question: what’s behind this double-digit decline? Overbuilding? Tax policy? Economic confidence? Other factors? Perhaps it’s a combination of all those and more.

The Perfect Storm

Jonathan Miller is the president and CEO of Miller Samuel, a real estate appraisal and consulting firm located in Manhattan. His firm compiles quarterly and annual reports on market conditions in cities around the country. “Since 2014-15,” he says, “in the luxury market north of $10 million, you’re talking a 25% drop for new development units. The overall range is 15% to 40%, depending on how aggressive the pricing was at the peak of the market. Pricing on existing product, or resales, is also down approximately 25%.”

“This decline is a result of several factors coming together at one time,” Miller continues. “They include the changes to state and local tax (SALT) deductions and mortgage interest deductions in the 2017 tax law, the increase in the New York State mansion tax, and the unintended consequences of the new rent law and guidelines passed into law by the New York State legislature this past year. The new rent law has crushed investors who bought a lot of these units.”

The 2017 Tax Act

At the time of its passage, 2017’s Tax Cuts and Jobs Act inspired a great deal of discussion over what effects its changes to the provisions for deducting SALT and qualified mortgage interest charges would have on NYC’s co-op and condo market. New York is a particularly high-tax state and locality that benefited from the prior tax regulations. The general consensus seemed to be that these deductions were less of a consideration for the luxury end of the market, since buyers at that level were less concerned about and dependent on the tax benefits of ownership than middle-class buyers. According to a fair number of market pundits, the very wealthy had different needs and considerations in making their purchasing decisions; it now appears that those market-watchers were dead wrong.

Market experts surveyed by The Cooperator indicate that contrary to those earlier opinions, the savings from SALT deductions on their units were in fact important to luxury purchasers. With SALT deductions now capped at $10,000 per unit, tax savings are capped as well. Consider a tax bill of $1,500 per month, equal to $18,000 per year; at the low end of the spectrum for a luxury condominium in Manhattan, the owner loses $8,000 per year in deductible expenses, equating to at least $3,600 per year. And keep in mind, this calculation doesn’t take into account whatever state and local income tax deductions the owner has lost as well as a result of this change. The resulting tax savings has fallen in most cases by tens of thousands of dollars.

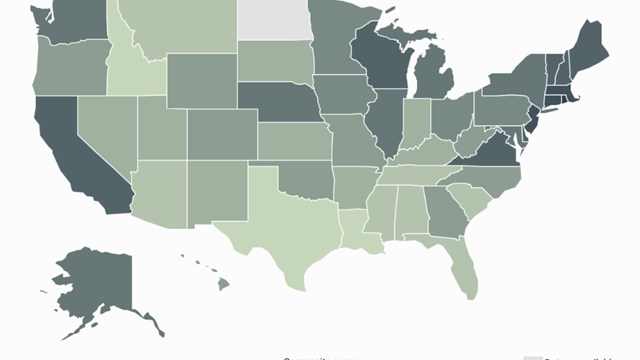

One fascinating side effect of this change is that increasing numbers of owners in New York are choosing to sell their units and move to lower-tax states like Florida to take greater advantage of the new tax provisions. Terence Tener, founding partner of Manhattan-based KTR Real Estate Advisors, suggests that we are experiencing the beginning of a flight of capital from New York to other markets by those high-income individuals able to make the move.

Additionally, the new tax law limits mortgage interest deductions on loans up to $750,000; the limit was previously set at $1,000,000. The conventional wisdom among the same pundits who believed SALT deductions weren’t a consideration for luxury buyers also held that those same buyers purchased their units with cash or nearly all cash, and therefore wouldn’t be deterred by limits on mortgage interest deductibility. Apparently, this opinion was unsubstantiated as well. Luxury buyers do encumber real estate purchases with debt, and they have reacted to the loss of some portion of this tax benefit by reconsidering purchases that previously would have provided them with substantially more tax savings.

New Rent Laws and the Mansion Tax

While a revision of New York State’s rent regulations was long overdue, the intention of the law wasn’t to affect the co-op and condo markets—yet it has done just that. While a legislative fix may be on its way at some point in the future, at present, new limits imposed on things like security deposits, late fees, and credit and background checks have dampened purchasers’ enthusiasm for luxury condo units. In simple terms, investors at this level don’t want to contend with additional rules and regulations for the leasing of a single condominium unit. They don’t want to be considered landlords. Until recently, “About 25% of the high-end condo market units were purchased by investors,” says Miller, but “Since June 2019 when the law went into effect, we’ve seen a significant softness across the high end of the market. The new rent law has affected this market because there has been a tremendous increase in liabilities to the landlord. Restrictions on security deposits, etc., make the law anti-investor.”

The third component in the luxury market’s slide is the increase in the so-called Mansion Tax, a New York State law that taxes sales of units over $1 million. “The wealthy are very aggressive at tax avoidance,” says Miller. “They pay advisory services large sums of money to assist them.” An increase on what is effectively a tax on capital growth makes many reconsider whether real estate as an investment is the best vehicle to grow their money.

International Factors

According to Tener, the luxury market is also susceptible to changes in the international climate—particularly to shifting political tides and global economic tensions and trends. “Money from Asia has pulled back,” he says, noting that this pullback is primarily the result of restrictions placed on Chinese investors through the Chinese government’s currency laws. These regulations are in turn partly due to the ongoing trade dispute with the United States under the Trump administration. “These changes are cyclical, though,” says Tener. “The situation will eventually turn around.”

Other factors affecting the market include some overall changes in social conditions in New York, including what many see as government mismanagement and an accompanying uptick in crime statistics. These issues make the New York City market—and particularly the luxury end of it—less attractive to foreign buyers, who for years previous had been the backbone of the luxury sales market.

And finally, some Economics 101 forces are at work as well. The result of all the above mentioned variables has been an overall increase in the supply of available units. While not at the level of a glut, there are too many units available, which in turn is forcing prices downward. That’s simply the law of supply and demand.

Ultimately, “It’s all about pricing,” says Tener. “The level of prices a few years back was unsustainable. As the market adjusts, the oversupply will disappear and the market will return to equilibrium.” In the meantime, it might be a good time to buy, if you have the ability.

A J Sidransky is a staff writer/reporter for The Cooperator, and a published novelist.

Leave a Comment