A quote often attributed to the Prussian statesman Otto von Bismarck in the mid-1800s says something to the effect that laws are like sausages—it's better not to see either of them being made. It's a clever quip, and it's not entirely inaccurate, but the truth is that if you serve on the board of your condo, co-op, or homeowners association, or if you manage any kind of multifamily community, you should have at least some awareness of the laws and legislation affecting you, your neighbors, and the residents you serve. This awareness not only enables you to do your job better, but it can help save your community money by planning in advance, avoiding fines, and keeping compliant with emerging regulations. With the state legislature is in session in Albany once again, there are many housing bills on the agenda. Some of them deal directly with co-ops and condos, while many more impact all types of housing, including co-ops and condos.

A Fistful of Bills

Albany isn’t the only legislative arena where housing is considered in New York, of course; housing-related measures are also often introduced in the New York City Council. Even where the Council doesn’t have power over a particular issue, it sometimes passes resolutions urging the legislators in Albany—or even those in Washington, D.C.—to adopt a particular position. And the opinions of people in most important city in the world carry considerable weight.

The website of the state Assembly, one of the two houses of the state legislature (the other being the state Senate) has a “bill search” feature. When this writer typed in “housing” in March, 350 bills came up (many of these bills also have counterparts before the Senate). Some are specific to one particular agency—quite a few deal with the beleaguered New York City Housing Authority. Others deal with one geographical location, such as a bill for affordable housing in the city of Yonkers. Many deal with rent increases, senior housing or tax credits.

If one searches for “condo,” one, at the time this article is being written, will find 54 bills. Many of these bills deal with important issues for Cooperator readers. For example, A00305 would mandate that in co-op and condo conversions, the majority of the board members must be shareholders or owners. Another, A08971, also S02291 in the Senate, would enact a condo owners’ bill of rights. Still another, A00034, the same as S03152 in the Senate, would create an office of “cooperative and condominium ombudsman.” Yet another, A00372, would create a special co-op and condo part in the New York City Housing Court.

If you search for “co-op,” 17 bills come up. Several deal with warehousing of co-op apartments, a common problem. One would authorize the voluntary dissolution of Mitchell-Lama co-ops. And three deal specifically with Co-op City in the Bronx.

Assemblyman Jeffrey Dinowitz (D-81, Bronx) says that the Housing Committee tends to avoid many co-op-related bills “because many of these issues can be addressed internally by co-op boards, and rather than the Assembly meddling in their business, their own elected boards can take actions themselves.”

A search of the City Council website as this article was being written in March showed fewer housing bills than in Albany. Mary Ann Rothman, executive director of the Council of New York Cooperatives & Condominiums (CNYC), explained, “We’re in a new City Council term that started in January. It is very early in the year.”

Key Issues

There are several issues that housing-related organizations are following on this year. Michael Slattery, senior vice president of the Real Estate Board of New York (REBNY), says REBNY is keeping a close eye on the Brownfields Cleanup program and the proposed tax incentives for Lower Manhattan. Brownfields are former industrial sites where toxic materials have polluted the soil. These sites need to be cleaned up before development can proceed there, adding expense to the developer. As far as Lower Manhattan is concerned, Governor Andrew Cuomo’s amended budget includes an extension of discounts for electricity and gas in the area, an extension of incentives to lure tenants to the area, and more property tax abatements.

Rothman says her group is following a proposal that buildings be retrofitted with a communications device for fire safety. “We’re concerned that these loudspeakers will easily malfunction and not be understood, and will be costly,” she says. Instead, she supports better education and training on fire safety for building residents.

Bob Friedrich, board president of Glen Oaks Village, and the founder of the Presidents Co-op & Condo Council, which represents almost 100 co-ops and condos, mainly in Queens, says that in the state legislative arena, his group is seeking to create a new classification for co-ops so they would be taxed the same as single-family homeowners (right now they’re taxed more).

“Until that happens,” he says, “we want some rate protection. Last year, the Cuomo administration passed a bill limiting tax increases to 2 percent, except New York City. We want an 8-30 bill, which would limit assessment increases in New York City to eight percent a year, or 30 percent over any five-year period.”

Another measure, this one in the city arena, that Friedrich’s group is following deals with energy audit requirements for co-ops. Right now, these audits are scheduled arranged by block and lot umber. Since “horizontal co-ops” (Friedrich’s term for garden apartment-type co-op developments) are spread over many blocks and lots, these audits can drag on for years. City Councilman Mark Weprin has introduced a bill that “horizontal co-ops” can merge blocks and lots for audits, speeding up the process.

One type of legislation that was proposed several times in both the state Legislature and the City Council and is worrying many in the co-op community, is the so-called “written rejection” bill, specifying that co-op boards would have to specify their reasons for rejecting a buyer. Assembly Housing Committee Chairman Keith Wright (D-70, Manhattan) says, “There are two bills containing the requirement of a written rejection. Neither has been amended or acted upon recently.”

Tax relief is always a big issue. Wright’s Bill A03354, which was signed into law last year, expanded tax relief for condo and co-op owners. “Additionally, the Assembly has included a circuit-breaker for property taxes that would affect condominium and cooperative owners in its proposed budget [A08559C],” said Wright. Such a “circuit breaker” would take into consideration property tax burdens in relation to a homeowner’s income.

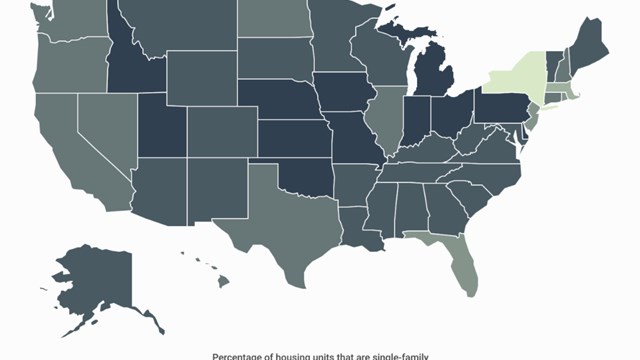

What’s the attitude toward co-op and condo legislation among state legislators from districts where co-ops and condos are few and far between? After all, co-ops are found almost exclusively in New York City, although there are some in Westchester.

Condos are more widespread, especially in Rochester, Ulster, Suffolk and Westchester counties. Condo and HOA-based organizations do exist throughout the state, and many of these make their wishes known to the lawmakers. Still, there are areas where even condos are rare. In general, Upstate legislators are often likely to listen to the advice of their Downstate colleagues on legislation that mainly concerns Downstate residents—such as co-op and condo legislation.

Courts and the Fed

Although the following are not in the legislative arena, Staten Island realtor Dawn Carpenter, former president of the Greater New York Chapter of the Institute of Real Estate Management (IREM), says IREM-NY is following several matters now in the courts.

One of these is a class-action lawsuit that is challenging the New York City property tax system. The suit, she says, has been filed in Manhattan State Supreme Court and claims that the city’s property tax system is unconstitutional because it discriminates against minorities and “unfairly favors owners of cooperatives, condos and single-family homes.” We suspect that renters and the co-op and condo community feel at odds with each other on this one.

IREM-NY, says Carpenter, is also following several federal measures. One of these is House Ways and Means Chairman Dave Camp’s tax reform draft, which proposes limits on the mortgage interest deduction and capital gains, and the repeal of deductions for state and local property taxes. She praises the Homeowner Flood Insurance Affordability Act as a “responsible and balanced solution” to dramatic flood insurance rate increases.

Turning again to the federal arena, many in the co-op and condo community, including Slattery and Friedrich, are very concerned about the Fannie Mae/Freddie Mac guidelines. Starting around 2008, these agencies have introduced tough new rules for granting mortgages. For example, no more than 15 percent of the units in a development can be delinquent, no more than 20 percent of the square footage can be for commercial purposes, and individual units must be separately metered or have a plan to do so. According to Rothman, “Fannie Mae guidelines may make it more difficult to get loans, but if people are interested enough, they still may find a way.”

Making Their Wishes Known

How do groups like IREM, CNYC, REBNY, and others such as the Federation of New York Housing Cooperatives and Condominiums (FNYHC) make their wishes known before the lawmakers?

According to Friedrich, “We [the co-op presidents] speak to each other, we find out from each other what the issues are, what the problems are and we put together a legislative agenda each year. We speak to individual legislators about it.”

Rothman says, “We meet with lawmakers, we ask our members to call them.” While CNYC is a membership, not a lobbying organization, the group does hire lobbyists, and according to Rothman, “our lobbyists are the ones who help us get the various meetings with the legislators.”

Carpenter says, “New York members as a group and/or individually are advocates for their fellow commercial and residential industry property management professionals as a whole and for their clients, for whom they are entrusted to maintain multimillion-dollar real estate investments. Thus, leadership meets with local, state and federal elected officials to discuss emerging issues that affect the industry and the consumer.”

Sometimes, local groups will seek out federal legislators. Friedrich says that because co-ops are ineligible for FEMA grant money in the event of a Sandy-like storm, his organization is supporting a bill by Congressman Steve Israel (D-3, Huntington) that would remedy this situation. And Slattery says that his organization, REBNY, is working with elected officials in Washington “to ensure that any changes to Fannie Mae/Freddie Mac do not harm the production of market-rate and affordable housing in New York.”

Since last year’s version of this article, New York City has a new mayor—Bill de Blasio—who has made affordable housing a key component of his mayoral agenda. Most of those approached for comments say it’s too early in his administration to make a judgment on how—or how successfully—that will play out. But clearly, his goals are shared by others as well. Assemblyman Wright is one of those. “My primary goal is to ensure access to affordable, safe and suitable housing for the residents of New York,” he says, “and I will pursue any reasonable avenue to achieve this goal.”

Indeed, when you enter “affordable housing” into the Assembly bill search, 21 bills come up. One of these wants to create a “Council on Affordable Housing” within the Governor’s Office; another wants to ensure that revenues from the buyouts of Mitchell-Lama developments would be used for affordable housing purposes.

“Mayor de Blasio needs to understand,” Friedrich comments,” that there are already tens of thousands of units of affordable housing. They’re called co-ops—not the ones in Manhattan, but those in Brooklyn, Queens, the Bronx, that you can buy for $100,000 or $200,000. He should take actions that protect the city’s last bastion of affordability.”

Liam P. Cusack is the Associate Editor of The Cooperator.

2 Comments

Leave a Comment