Today, some eight years after the Great Recession, financing for co-op and condominium buildings and individual unit purchases is widely available. The market is overall quite healthy, and though there have been some systemic changes to this part of the financing world as a result of the financial meltdown of the last decade, today’s co-op and condo financing instruments are remarkably similar to what was typical before.

Co-ops vs. Condos - How They Differ

Perhaps the most basic place to begin is to understand the difference between a co-op property and a condominium. Simply stated, when you buy a condominium you are purchasing real property, just as if you’d purchased a stand-alone single-family house. When you buy a co-op, you are purchasing shares in a corporation that owns the brick-and-mortar property and you receive a proprietary lease for the unit in which you will live. These are two very different models of home ownership and require very different financing structures.

Typically, in a co-op building there is a mortgage against the entire property known as the underlying permanent mortgage. The monthly payments for this mortgage are shared by the unit co-operators as part of their monthly maintenance charges. No such mortgage exists in a condominium. In a condominium, each unit is a separate piece of real property, and the common elements – lobby, hallways, physical plant components, and so forth – are owned jointly. Unlike a co-op, for a condo association there is no single piece of property to act as collateral for a loan. This is one reason why monthly maintenance charges in co-ops are generally higher than common charges in condominium associations. It is also one reason why purchase prices of condominiums are generally higher than for co-ops of equivalent size and design.

Financing for Underlying Permanent Mortgages

Underlying permanent mortgages have always been sought-after as a preferred property type by lenders in areas where cooperative apartments are typically found, such as New York City, Chicago and northern New Jersey. Traditionally, they were made by local savings banks with some participation by insurance companies for larger loans of say, $10 million or more. More recently, securitized mortgage lenders known as ‘Wall Street-type lenders’ have participated in this space as well. Some terms required by securitized lenders, such as prepayment restrictions known as ‘yield maintenance’ have made this otherwise well-priced product difficult for co-op boards to access, despite the lower rates generally available through these lenders.

According to Stuart Bruck, director of mortgage brokerage for New York City-based Time Equities, “The standard product for underlying permanent mortgages is a 10-year fixed-rate loan. The best deal available now, due to the fact that the loan-to-value ratio for this product is so low, is an interest-only mortgage for 10 years.”

Barry Korn, managing director of Barrett Capital Corporation, a mortgage banker in New York City, says, “Typically, financing for underlying permanent mortgages today is generally for 10 years on a 30-year payout. Banks are less likely to do interest-only financing, though it is sporadically available.”

Harley Seligman, vice president of National Cooperative Bank (NCB), a national co-op lender based in Arlington, Virginia with offices in New York, California, Ohio, Washington D.C. and Alaska, concurs. “The typical product is a 10-year loan with a 30-year amortization. NCB offers 15-, 20-, and 30-year terms as well, but the loan rate is a little pricier.”

The question arises: Why would a co-op want interest-only financing, forgoing the benefit of paying down and eventually paying off the underlying mortgage and thereby lightening the debt load on the entire property? The answer is that unit purchasers typically look at the current situation rather than what might be 30 years down the road. “As a broker I recommend interest-only,” says Bruck, “because purchasers look not only at value and purchase price, but also at monthly maintenance. Obviously, with no amortization, the shared cost—and therefore the maintenance—is lower, which is attractive to many buyers.”

Other Factors to Consider

When seeking to refinance an underlying permanent mortgage, a co-op board should contemplate a number of factors. They must consider term, interest rate and amortization, but they must also weigh prepayment options and the ability to place secondary financing behind the underlying permanent mortgage. According to Seligman, “There are other factors and terms to consider when refinancing. We discourage longer terms, primarily because we see that these loans often lock the co-op in without options for secondary financing or prepayment. If there is a need for additional financing for any reason, you’re stuck.”

Bruck concurs that when a co-op needs funds for major capital improvements such as boiler or roof repair, “which in reality they will need sometime over a long period, their choice is either to finance or assess.” If you have no ability to prepay—or it is prohibitively expensive, as is the case with mortgages carrying a yield maintenance prepayment clause – and you are prohibited from obtaining secondary financing as well, you have no choice but to assess your shareholders, a move almost universally disliked by cooperators.

“Prepayment terms depend on who the lender is,” says Korn. If you securitize the mortgage, yield maintenance is required, which can be prohibitive. For portfolio lenders, (lenders that hold the loan in their account), prepayment is traditionally a declining penalty starting at say, five percent and declining over the life of the loan to zero.” For this reason, says Bruck, “It’s advantageous to go with a portfolio lender. Also, when you go with a securitized lender down the road, you may need to speak to the loan servicer – and they tend to read the documents very literally. They can be hard to negotiate with. Sometimes it’s even hard to get someone to pay attention at all.”

At NCB, Seligman reports, “Our typical prepayment is yield maintenance, but sometimes we will give a declining penalty.” As a counter to the restrictiveness of yield maintenance, their loans permit secondary financing. “We encourage the co-op to take a line of credit right off the bat,” when an underlying permanent mortgage is taken (more on that later). NCB both holds loans in portfolio and securitizes them. Generally, they try to sell off (securitize) larger loans.

Effects of the Great Recession...Or Not?

“The Great Recession had absolutely no effect on co-op underlying mortgage lending policies. Lenders are still very competitive for this product,” says Bruck. What has changed may be more a case of some of the issues that existed in the co-op lending arena before the financial collapse have simply gone away with time. The most significant of them is the problem of the low-sold co-op. This is a co-op building where less that a super-majority of shares are owned by owner-occupants, and are instead owned by the converter – usually the former landlord – or an investor who has purchased a large block of shares, usually from the converter. “I have not seen a request on a low-sold co-op in a long time,” says Bruck. “Most of the older co-ops, by virtue of being around for a long while, are now well sold or completely sold.” Seligman also reports that NCB has seen a steep decline in the number of co-ops with this problem over the past 10 years.

“Within the co-op and condo space,” says Korn, “there has been little change in lending criteria and policy since the Great Recession. It’s been pretty consistent. You’re dealing with low loan-to-value ratios and stable properties, but there may be more emphasis now on delinquencies. Banks are more sensitive to delinquencies because of the financial crisis, and look at delinquencies as a percentage of units rather than in absolute dollars. If you have a ten-unit building, and one unit is delinquent for 60 days, that’s 10 percent of the cash flow, and it just won’t fly [with a lender]. They want to see delinquencies under five percent for 60 days.”

For a lending institution, the view might be slightly different. According to Seligman, “What has changed since the Great Recession is what has trickled down from regulations, tougher credit policies and underwriting standards. It’s changed how close an eye we keep on things.”

Unit Financing

Clearly, financing for individual co-op or condo units is widely available today. Nearly all major banks offer this product. Robbie Gendels, vice president and loan officer of the Residential Real Estate Group in National Cooperative Bank's New York office, supplied the following sample terms and conditions for unit financing today:

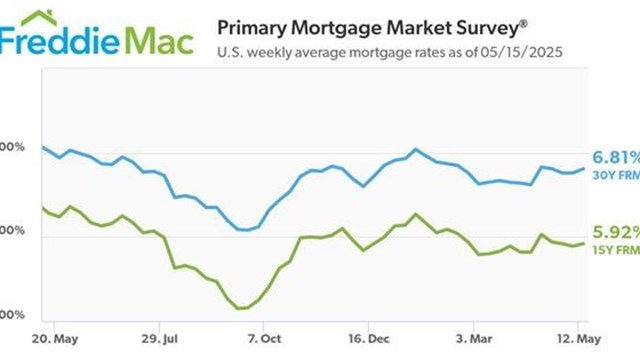

“Banks offer both fixed and adjustable rate loans for co-ops and condo financing,” Gendels says. “Depending on the needs of the purchaser, a bank can structure a loan to meet their needs. Offerings include 30-year fixed rate loans, adjustable-rate loans and interest-only loans (up to seven years) which convert to an amortizing loan. Most consumers are looking for a fixed-rate mortgage in the market these days. They are either looking for a 30-year mortgage to keep their payments low or some consumers are opting to take a 15-year loan to try and pay a loan off early, since rates are still low.”

“Credit scores are very important,” Gendels continues, saying that a 680 credit score or higher is mandatory. “Most lenders have tightened credit parameters and credit scores,” she says. “As concerns individual co-op building financing requirements, every building has its own requirements and guidelines. With respect to banks and requirements for purchases, we have seen an increase in more regulations, increased underwriting and additional document verification for mortgage loans since 2008. The time to underwrite and close a loan has also increased as there are additional requirements for loan estimate and closing document process.”

Secondary Financing

As previously mentioned, maintaining options when securing financing for a co-op property is of the utmost importance. Seligman says his bank allows co-ops to obtain secondary financing. “We often place secondary financing behind another lender’s first,” he says. “We provide that right in our loan documents. We offer both lines of credit, which are variable rate loans, and fixed-rate seconds.”

“Obtaining the credit line,” says Bruck, “is often dependent on whether there is a first mortgage, and whether the first mortgage will permit it. If there is, typically, you have to go back to the mortgagee and get their permission. If they won’t, you have to take unsecured financing.”

Another form of financing available to both co-ops and condos is to provide energy upgrades. This is particularly important for older properties trying to improve their energy performance and to take advantage of local initiatives to improve their carbon footprints. Korn, whose company provides energy project financing for co-ops and condos explains that it differs from other types of financing, as it more closely resembles equipment leasing arrangements. “It’s covered in the budget,” he says. “A lender makes sure that everyone is paying and that the cash flow is there, as they are in an unsecured position which they must be completely comfortable in.”

Whatever your co-op or condo’s needs in the financing arena today, the good news is that it is available. America’s lenders have faith in our residential communities and continue to develop products to improve the financial positions of those communities.

A.J. Sidransky is a published novelist and a staff writer for The Cooperator.

Comments

Leave a Comment