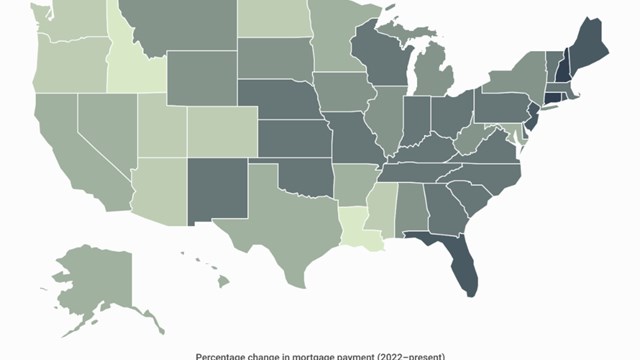

Amid rising mortgage rates and increased financial pressure on American households, one subset of homeowners stands out: those who have fully paid off their homes. A new study from consulting firm Construction Coverage examines mortgage payoff rates for working-age homeowners in the U.S., identifying the areas where residents are most likely to own their homes free and clear before the age of 65. According to the study, of working-age homeowners under 65, less than 28% are mortgage-free nationwide—but not all areas have equal rates of free-and-clear homeownership.

Key Takeaways for the NYC-Newark-Jersey City Metro

- Mortgage-free homeowners aren’t necessarily wealthier: Households with a mortgage have a median annual income of $121,000 nationwide, compared to just over $85,000 for those who have fully paid off their homes. Similarly, NY metro households with a mortgage earn a median of $168,750; those without a mortgage, $132,000.

- Homeowners with mortgages typically have higher home values: Nationally, homeowners with a mortgage report a median home value of $360,000, compared to $250,000 for homes without a mortgage. This trend holds true in the NY metro, where homes owned free and clear have a median home value of $510,000, while mortgaged households are valued at a median $600,000.

- Mortgage payoff rates in the NY metro: Among working-age homeowners in the NY metro, 26.1% own their homes outright, which is below the national average.

The full report includes data for 263 U.S. metros and all 50 states.

Leave a Comment