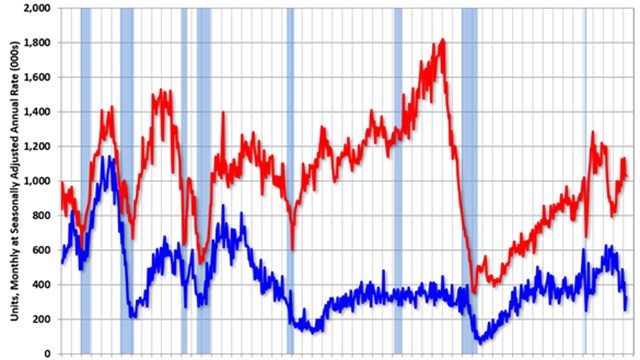

In an August 19 press statement, the Real Estate Board of New York (REBNY) reported that while total investment and residential sales volume increased 11% to more than $3.95 million between June 2020 to July 2020, “These transactions, critical to New York City’s economy, decreased by 52% compared to the same time last year,” highlighting a long road to economic recovery, and underscoring the need for “smart policies and federal aid.”

According to REBNY’s numbers, “July was the second consecutive month that investment and residential sales activity increased since the start of the coronavirus pandemic — a positive sign that the industry is inching towards recovery.” The organization’s Monthly Investment and Residential Sales Report indicates that sales activity — and its accompanying tax revenue — seems to have bottomed out in May, and then began to climb slowly upward over the subsequent two months as New York has gotten a handle on COVID-19 transmission and hospitalization rates.

“As New York State continues to successfully manage the ongoing public health crisis, we must also focus on managing the ongoing economic crisis using strong leadership and smart, thoughtful policymaking based on data,” said REBNY President James Whelan. “As tax revenue remains at historically low levels, federal relief in the form of state and local aid, expanded unemployment insurance and effective management of municipal affairs are critical to saving New York from further economic harm.”

Better...But Not Great

While the tax revenue generated from this month-to-month gain in investment and residential sales increased 16% to $119 million from June 2020 to July 2020, the picture is not exactly rosy. According to REBNY, those numbers still represent a 46% decrease in tax revenue generated compared to July 2019 -- a loss of more than $101 million in tax revenue for the City and State year-over-year.

“The real estate industry, which serves as the fundamental driver of New York City’s economy, generated more than half (53%) of the City’s total annual tax revenue in the last fiscal year,” as per the report, “which is more than double the next closest contributor – personal income tax, which accounts for 21% of the City’s annual tax revenue.”

Other key findings from REBNY’s monthly special report on investment and residential sales include:

From June 2020 to July 2020, total investment sales volume declined 14% to $1.3 billion. This represents a 57% decline year-over-year.

Investment sales transactions increased 21% to 211 from June 2020 to July 2020. However, this represents a 35% decline year-over-year.

From June 2020 to July 2020, total residential sales volume increased 29% to $2.7 billion. However, this represents a 50% decline year-over-year.

Residential sales transactions increased 17% to 2,568 from June 2020 to July 2020. However, this represents a 37% decline year-over-year.

According to the statement, REBNY tracks all transactions by asset class on a monthly basis to monitor the economic health of the industry and the impact of the Coronavirus (COVID-19) crisis on the City and the State’s ability to generate taxes needed for essential government services. That data is used to compile the organization’s Monthly Investment and Residential Sales Report. The report itself is an analysis of official data from the NYC Department of Finance’s Automated City Register Information System (ACRIS) and captures total sales volume, number of transactions and tax revenue.

For more information about REBNY research reports - including the Monthly Investment and Residential Sales Report and Appendix Data, visit go.rebny.com/Reports.

Leave a Comment