For years, people talked about how the housing market in New York City was “recession-proof;” how buyers' desire to live in New York City would always trump any housing problems the rest of the country was experiencing. But as the calendar turned to 2010, it’s pretty clear that New York is facing the same problems as everyone else.

According to experts in the industry, prices for co-ops, condos, and even rentals have slid back, with some areas of the city seeing double-digit decreases.

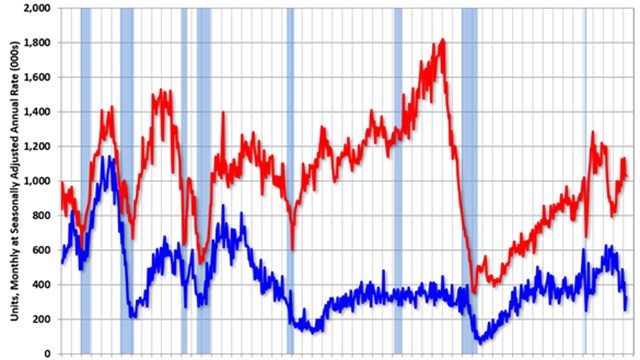

"In general, transactions rose steadily from about 2003 to 2007, then they started to decline about the second quarter of 2008,” says Michael Slattery, senior vice president at the Real Estate Board of New York (REBNY). “Beginning in the second quarter of 2009, sales began increasing quarter to quarter though well below the high points of 2007-2008.”

It's Weird Out There

“Fewer apartments are coming on the market these days, which is what is fueling a frantic sale market at this time,” says Barbara Fox, president of Fox Residential Group. “The sellers who are putting their properties on the market are those people who really need to sell—estates, business transferees, etc. There is very little speculative listing by owners today—just putting a property on the market at a very high price and waiting to see whether it will sell.” She says this is affecting new housing stock as well, since fewer buyers will always mean that developers have less reason to build.

“It seems inevitable that with the 80 percent drop in new housing permits this year, and probably 50 percent or more of the new permits issued in 2008 stalled, that the inventory of new units will decline as will the total available for sale,” adds Slattery.

Which means that the New York City housing market remains very complex and competitive, and for anyone attempting to buy a co-op or condo, having a competent, knowledgeable real estate broker to help navigate the tricky landscape is a necessity.

“As far as competition goes, there is no more competitive market in the country than the New York City real estate market,” says Zhann K. Jochinke, an associate broker for Argo Residential. “Has competition increased with this market? Yes, certainly. Sellers are interviewing several brokers before deciding on whom to list with, and even pitting colleagues at the same firm against each other in their decision. At the same time, those who were successful before and still successful now; our market almost follows an 80/20 rule, with 20 percent of the brokers handling 80 percent of the listings.”

With statistics like these, it’s no surprise that becoming a real estate broker is no longer the popular career path that it once was. It definitely seems that the heyday when everybody was getting their broker's license and making huge commissions hand over fist are over.

“Most brokers have revamped their business model to work with an additional client base, some have partnered with colleagues and a great deal have pursued more educational opportunities to advance their core skills,” says Eileen Spinola, senior vice president at REBNY for education and brokerage services. “There is competition in every business and many have entered the market due to the price point and technology.”

A look at the schools in the area that offer courses for brokers shows that the number of people looking to obtain their brokers license has decreased in the past decade, with last year having some of the smallest numbers in years.

Brokers Adapt

In times of a recession one might think that you’d see an increase in the FSBO (For Sale By Owner) market, with the rationale that the seller is trying to save every penny, but those in the industry say that hasn’t been the case.

“In a strong market, such as that one we had from 2003-2007, which was typically a seller’s market, all one had to do was list an apartment in a publication, hold an open house or two, and it almost sold itself in no time,” Jochinke says. “You didn’t have to have knowledge of the co-op [approval] process, or mortgage products and lenders requirements, or building information, and you didn’t have to educate buyers to the home buying process as banks were basically throwing money at pretty much anyone who could catch it. Now in the current market, where financing can be tough for even well-qualified buyers to acquire, where lenders have increased their requirements for buildings to be approved, and where buyers are now savvy and cautious in proceeding with a purchase, the use of an experienced and knowledgeable broker is worth its weight in gold.”

In the post-recession era, brokers have made several changes to adapt to the new market conditions.

“We’ve seen a dramatic shift away from traditional print advertising, such as the New York Times, which was once a staple of most broker’s exposure, to a greatly expanded use of online media and social networking, where not only are advertising costs more reasonable but the reach is far greater,” says Jochinke, who is also the co-chair of the Manhattan Association of Realtors’ Market Trends Committee. “This also plays to a change in the typical apartment buyer, the generation(s) that are most active are generally those who regularly use the Internet and prefer to research their home purchase that way.”

Another change that’s prevalent at a number of firms is that many brokers have returned to the extended work week; whereas during the halcyon days of the early 2000s a broker may have had a regular day (or two) off every week, most are now almost on call 24/7, and actively work with buyers or are on showings seven days a week. “If you’re not the one willing to cater to someone else’s schedule,” Jochinke warns, “then there’s another broker out there who is.”

For Fox, the secret to survive in this economic climate is simple: “We have to work twice as hard and twice as smart as we ever have,” she says. “We need to be one step ahead of everyone else. You need to be able to analyze and understand the market at any given point in time, and be able to adjust your negotiating and sales techniques to all the day-to-day changes.”

Education Pays

Another way brokers and realtors are girding themselves up in hard times is by expanding their skill set, often with support and guidance from professional organizations. For example, when the market started to show signs of decline in 2006, the the National Association of Realtors (NAR)'s Real Estate Buyers Agent Council (REBAC) launched a foreclosure course to help real estate pros understand the changing market. Since then, the group has revised the course and answered a growing demand for additional education.

“It was terrifically successful,” says Kristen Short, NAR's managing director. “We modified it to reflect the changes in the marketplace. The 2006 course focused on foreclosure opportunities, and since then, we’ve expanded the approach to include the buyer’s side of the transaction. Our program also looks at short sales and what happens before, during and after purchasing bank-owned real estate.” Over the past three years, Short says more than 10,000 NAR members across the country have taken the organization's Short Sales and Foreclosure Certification Program.

There are other educational opportunities for brokers as well. The Distressed Property Institute (distressedpropertyinstitute.com) also provides opportunities for brokers and agents to learn everything they need to assist homeowners struggling with hard times. The course explains how to enter the distressed property market and explains foreclosure and short sales. REBNY itself also offers a Certified Distressed Property Expert (CDPE) course.

Helpful as these courses are however, Short cautions alumni against claiming to be overnight experts. “In this day and age, it’s dangerous to call yourself a Ph.D in these types of transactions,” she says. “A one-day class and a suite of webinars will allow you to be a resource to your clients—not an expert.” Like any new skill learned, Short suggests that the skills learned in these courses can be leveraged for the long-term. “The business aspect of our certification can be applied to other parts of the business,” she says. “For example, learned about real estate auctions can be applied in non-distressed situations as well.”

Looking Up?

The good news is that things may be on the brink of changing. Numbers from the final months of 2009 have shown an upswing and brokers are reporting more activity than this time last year.

According to the ResidentialNYC.com report, New York City’s housing market showed signs of recovery in the fourth quarter of 2009 as the total dollar value of residential real estate sales increased 22 percent to $7.9 billion compared to the previous quarter. The number of transactions for real estate sales citywide (sales volume), increased both quarterly (20 percent) and year to year (17 percent).

“The overall mood and outlook is that there’s a fairly good chance that we’ve seen the worst of things on the residential side, and if there are any further declines they would be small in comparison – possibly up to an another five or eight percent,” Jochinke says. “Sellers and buyers are starting to see things eye-to-eye; listing prices compared to final sales prices are continually having less and less of a spread between them. Brokers have been able to educate their sellers to price accordingly, either at, or slightly below the market, and buyer’s perceptions of value are in line with these numbers.”

So it may be a while yet before Real Estate Broker is the smoking-hot profession it was five or six years ago, it's safe to say that at least as far as New York City is concerned, there will always be a market for competent, knowledgeable industry professionals who can help buyers and sellers alike navigate a complex and often cutthroat landscape.

Keith Loria is a freelance writer, reporter and a frequent contributor to The Cooperator.

Leave a Comment