The last three apartments in your luxury hi-rise condo were sold to a troika of Russian oligarchs, who all paid well above the asking price. But now those oligarchs are on the sanctions list, and have withheld their monthly maintenance fees for six months and counting, while waiting out the situation at their Black Sea dachas. Three apartments are in serious arrears. What do you do?

While this is an exotic scenario, the underlying issue—non-payment of monthly maintenance fees—can be a real problem, especially for smaller buildings, and particularly in times of economic downturn. While the great majority of co-op and condo residents pay their fees on time and in full with no problem, sometimes that’s not the case. And when it’s not, boards and managers may have to initiate collection proceedings to recoup the missing funds.

Whether the debtor is a Russian oligarch, a disgraced Hollywood mogul, a former Bernie Madoff client, or a regular individual fallen on hard times, having maintenance payments in arrears is a problem for not just the resident in question, but for the whole building—and it’s part of the board’s fiduciary duty to collect what’s owed.

What Happens and Why?

The concept of cooperative housing is that a whole bunch of individuals, acting in concert, have far more purchasing power than just one. Co-ops in particular are considered extremely safe investments, and almost never fail. The flip side of this arrangement is that when one shareholder of the co-op, or one unit owner of the condo, falls behind on payments, the funds have to be made up by the collective in some form. In a huge residential complex with thousands of units, this may not be that big of a deal; in a four-unit brownstone in Brooklyn Heights, one unit owner who falls into arrears can be devastating for the whole building.

“In some cases the association does increase the assessment knowing that some owners will not pay and the association needs the income to fulfill its obligations,” says Robert Johnson, COO of Association Dues Assurance Corporation (ADAC) in St. Clair Shores, Michigan. “In other instances the association adds a special assessment to make up the difference, which will also not be paid by those not paying the regular assessments, so it still falls on the shoulders of the responsible residents. If the delinquency rate goes above 10 percent, the association also faces loss of FHA status, which can make it harder for residents looking to sell their unit.”

There are several reasons why residents might fall into arrears. One might be simple: for whatever reason, owners are unaware that they owe any money. “This could be a new resident who was not aware of the association, or a resident who does not live in the unit and failed to give the association a forwarding mailing address and ‘forgot’ about paying the assessments,” says Johnson. “We have seen some cases where a late fee or fine from the past was either ignored or not known about and the resident continues to pay regular assessments; however, the delinquent balance snowballs because of accumulating late fees or interest that the resident doesn’t know or doesn’t believe they are responsible for.”

Another common reason: protest. “Some residents choose not to pay because they feel the association is not doing what it should be doing, and they believe they have the right to withhold payment of assessments,” Johnson says. Unlike taking to the street or the picket line, however, this is not legal.

Owners tend to be savvy enough now to realize this. “Many years ago, we saw that people didn’t pay their fees for this or that reason, which usually had to do with a dispute with the association,” recalls Jeffrey Sirot, a partner at the law firm of Curcio Mirzaian Sirot LLC, which has offices in New Jersey and New York. He cites another reason, probably the most common, for falling behind: “More recently, and particularly in the late 2000s and even today, almost universally, the people who are not paying are not paying because they’re in financial distress. When the economy is bad, people who were making good salaries start losing their jobs. And most people can’t go very long like that. They don’t have a lot of savings. So they stop paying the maintenance fees because of financial distress.”

Financial difficulty is probably the most common reason for falling into arrears. It’s also the most difficult to fix. A unit owner who stops paying maintenance for financial reasons tends to do so because there is no money left to pay.

Reach Out First

What to do when an owner falls into arrears? The first and most important step is to reach out. There may be a benign reason payments were missed, such as a change of address, or a check being lost in the mail (which does happen every blue moon).

“As an initial measure, communication is a good, inexpensive step,” says Lewis Montana, a partner at Levine & Montana, a law firm in Peekskill. “Perhaps the unit owner is on a vacation, hospitalized, in the military, or other circumstance that might explain a non-payment. The board can then work out a payment plan. Ultimately, collection measures are the remedy for non-payment.”

The debtor may be dodging phone calls, or may explain that he can’t pay because he lost all his money when the Kansas City Chiefs lost to the Tennessee Titans in a wager. Then documents must be filed promptly.

“ADAC always recommends beginning the collection process within 45 days,” says Johnson. “At 15 and 30 days late, the association can send late notices to the resident, and if it remains unpaid for 45 days, [they] can send the case to ADAC. This time frame may be longer if the association’s governing documents or bylaws specify the timeline of action steps, and in such cases ADAC has often recommended the association attempt to amend that.”

The reason for this is simple: the longer the association delays in taking action, Johnson says, the less likely it is to collect in full. “If an association decided to offer ‘exceptions’ based on loss of income or other hardship, it is the association board that would make that decision —and preferably it comes in the form of a resolution giving all residents who fit into the specified categories the same grace. The association board should never give some residents preferential treatment over others or show favoritism, and a board resolution would keep that from happening.”

Montana suggests a different time frame: “For cooperatives, many lenders still use the old ‘Aztech’ form of recognition agreement. The Aztech form requires the board to notify the secured party lender of any default involving an amount equal to or exceeding three months maintenance payments. Otherwise, it is the board that generally sets the policy as to when collection will commence against a unit in arrears of maintenance, common charges, or HOA assessments. The managing agent – if there is one – will usually follow the policy and contact the association’s attorney.”

The board may decide to allow a grace period, or let the owner not pay X number of months’ fees, in order to get that owner back on track. This leniency “seems to be common,” Johnson says. “It also seems that what begins as grace or help often turns into enabling or failure to collect at all, because people will always have one excuse or another why they can’t pay.”

Sirot agrees. “The critical factors for being successful in collections are starting at an early stage in the process, and being very diligent,” he explains. “What that means is, within 60 to 90 days or non-payment, the matter has to be referred to legal, and legal enforcement has to begin. Most people do not have more than a few thousand dollars in a bank account. So once somebody owes $4,000 or $5,000, if it’s referred to legal at that time, the odds of collecting go down exponentially. If you refer somebody to legal when they owe a smaller amount of money, even if it was necessary to do it two or three times a year, the odds of collecting are far better.”

When It’s Just Not There

Even the best-laid plans go awry. Sometimes people who are in debt simply cannot make themselves whole. What then?

“Consequences are severe,” says Sirot. “Because when you live in a condominium, or virtually any homeowners’ association, the relationship with the association is contractual. Which means the master deed and the bylaws… those are contractual provisions that you’ve agreed to. And those provisions allow the association to take your home, the same way your mortgage company of your bank can take your home. We have very similar rights. So if you don’t pay, we’re going to attempt to collect the money first, generally, and that’s by filing a lawsuit to get a judgment, and then we’ll try to take money out of a bank account or garnish wages. But if there’s no money to take, then you would foreclose—and we can take back the home.”

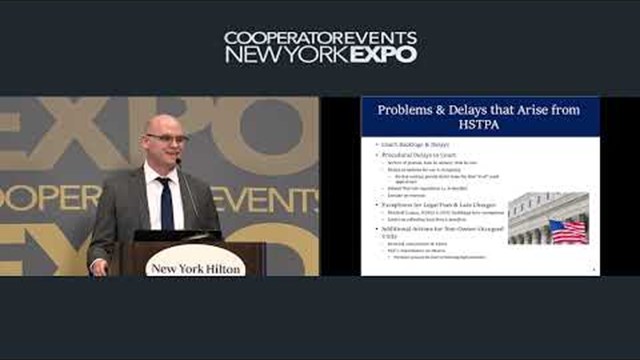

This is not common, but it can be devastating when it happens—not least because of the length of time it takes to repossess and sell the unit to someone with the ability to pay. “In the height of the [financial] crisis in 2008, and really all the way through to 2013 or 2014, that process would take longer and longer, and it was by design,” Sirot says. “It was a political decision to slow the process down, because everybody was being foreclosed on. It was taking up to three or three-and-a-half years, from the beginning of a foreclosure to the end. That timeline has now been substantially reduced. Some of those impediments have been softened, and it’s generally taking me under a year now. So if you don’t pay, within a year you’re going to lose your home.”

Greg Olear is a freelance writer and novelist, and a frequent contributor to The Cooperator.

Leave a Comment