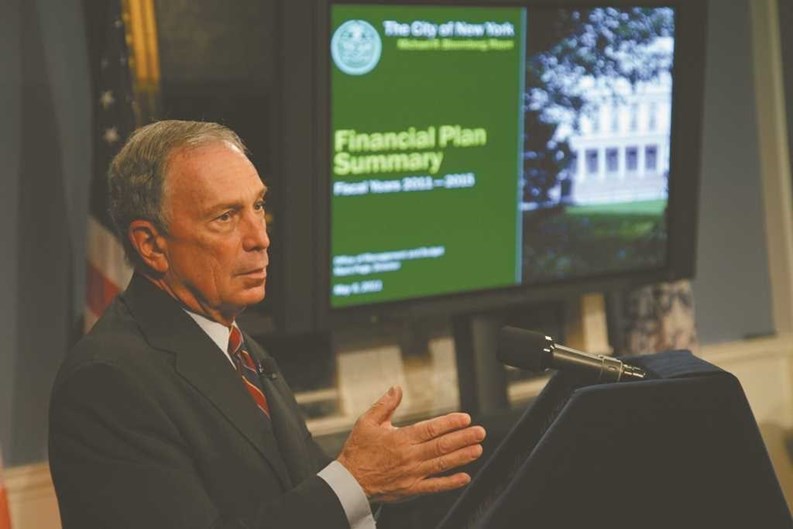

Earlier this year, Mayor Michael R. Bloomberg presented his Fiscal Year (FY) 2012 Executive Budget and an updated four-year financial plan. The mayor outlined the plan, which costs $64.7 billion and would balance the budget with a claim, he said, of no tax increases for New Yorkers. However, the budget does call for the elimination of more than 6,000 teaching positions, and a slew of other controversial cuts.

The budget details the expanding gap between strong city support for services and declining state and federal support for services, which has forced city taxpayers to cover the increasing costs of services. Further, much of the increase in cost for services is dictated by state and federal mandates. The Executive Budget relies on $5.4 billion in savings for FY 2012 generated by ten rounds of cost control actions taken by city agencies since 2008 and the use of $3.2 billion of expense funding saved in FY 2011. This $3.2 billion was used to prepay expenses in FY 2012 in order to prevent further service reductions.

Mayor Bloomberg pointed out that the continually improving economy as well as responsible budgeting has kept the city in a better fiscal position than most cities, however he noted that state and federal disinvestment continues. The mayor also stated that one of the main reasons that the city is doing better than other cities is the fact that New York City has $5.4 billion in savings, as well as a growing economy. Bloomberg did note that despite this proactive fiscal planning, the city still needs to commit nearly $2 billion in additional funds to cover state and federal funding losses.

State Cuts Impact City Schools

The mayor's proposed budget includes the controversial elimination of more than 6,000 teachers from New York City schools—this is the largest teacher layoff since the fiscal crisis of the 1970's. Mayor Bloomberg says these cuts became a necessity after New York Governor Andrew Cuomo and the New York State Legislature enacted a $132 billion budget in March which closed a $9.8 billion budget deficit. This was achieved in part by cutting $4.6 billion that New York City had previously received for schools, Medicaid and other social services. According to the mayor, the state Medicaid cuts also cost the city an additional $2.2 billion in federal matching funds.

“We are in better shape than most cities...” Bloomberg said in a statement, “but we are not an island. We are not immune to the realities in Albany and Washington. And the reality is, both places are keeping more of our tax dollars to close their own budget deficits. I am sympathetic to their need for budget cuts, but actions taken to close their deficits came without changing the burdens they impose on city taxpayers.”

Mayor Bloomberg pointed out that in order to prevent catastrophic personnel losses to the city's school system the budget does provide a major increase in funds dedicated to education, with an increase of $2 billion in funding compared to last year. However, despite the city's continued financial commitment to education, the state and federal cuts and the need to balance the budget mean that reductions in the city's teaching force is still required. The 6,000 teaching positions slated to be eliminated will be achieved through attrition and layoffs.

Cuts to Firehouses, Senior

Centers, Libraries

The federal government, which is presently facing the largest deficit in its history, has cut aid to New York City in excess of $1 billion. This drop in federal aid will result in severe cuts to libraries, senior citizen centers, AIDS patient housing, child-care programs and cultural amenities, just to name a few. Additionally, Mayor Bloomberg announced that he would seek the New York Fire Department assistance in reassigning personnel so that 20 fire companies could be eliminated. The closing of the 20 firehouses and reassignment of the personnel would result in saving the city more than $55 million. Despite criticism from FDNY unions and local politicians, claiming that these closings and cuts would result in a dangerous public safety hazard, the mayor pointed to the fact that fire fatalities in the city are at a record low.

Real Estate Taxes

Bloomberg spoke of how the economy is improving and pointed to the fact that business tax-revenue will reach $5.75 billion during the next fiscal year. This exceeds the $5.41 billion collected during 2008, the worst year the city faced during the recent financial crisis. The financial plan predicts that real estate tax revenue will total $17.7 billion during 2012, which is an increase from $16.8 billion in 2011. New York City’s income-tax collections are anticipated to increase to $8.2 billion, up $600 million from 2011. The mayor warned however that increased revenue won't keep up with the higher costs of operations.

Consulting Costs Controversy

New York City Comptroller John C. Liu believes that the mayor would not have to make such deep cuts if the city did not rely so much on outside consultants. Comptroller Liu, in an emailed response to the Mayor's budget proposal said, “It should be noted that throughout the economic crisis, city agencies have spent billions of dollars on high-priced outside consultants resulting in runaway spending on technology-related contracts.” Comptroller Liu continued, “The continued lack of oversight of subcontractors working on city projects has resulted in the city being bilked out of millions of dollars, dollars that could have been better utilized elsewhere.”

The comptroller added that he would, “scrutinize and restructure when necessary” each administration contract to find savings that might restore some of the funds to prevent proposed teacher and social-service cuts.

The New York City Council agreed with the city comptroller and will seek cost savings in the city's contracts by negotiating with outside consultants and seeking concessions from unions. Councilman Dominic Recchia (D-47, Brooklyn), who also is chairman of the Council's Finance Committee says, “This is going to be a very difficult negotiation. We won't allow the mayor to hurt the core services.”

Mayor Bloomberg says that the outside consultants are, “an easy target for critics,” and disagrees with Comptroller Liu and the City Council saying that the city hires consultants when it seeks expertise that agencies lack or to fill temporary gaps in staffing.

However, critics are becoming more vocal in their opposition to hiring outside consultants, especially since the U.S. Attorney for the Southern District of New York has indicted 11 people in connection

with the CityTime project, a project that was designed to computerize the municipal payroll. U.S. Attorney Preet Bharara said, regarding the indictments that, "The CityTime project was corrupted to its core by one of the largest and most brazen frauds ever committed against the City of New York."

Indeed, the CityTime project was initially supposed to cost the city $70 million but ballooned to more than $700 million. The federal prosecutor alleged that contractors and consultants siphoned off more than $94 million in kickbacks and ill-gotten gains. Reddy and Padma Allen, CEO and CFO respectively, at Technodyne, a major subcontractor working on the CityTime project, reportedly fled to their native India and abruptly shut down the company in June, leaving more than 200 of its employees jobless. Technodyne had received more than $450 million for their work on the CityTime project. The Allens left the country after receiving grand jury subpoenas to testify about the project.

“New Yorker’s can hope that this will eventually lead to restitution for the hundreds of millions of dollars paid on an out-of-control project, years overdue and, ten-fold over budget,” Liu said.

Liam P. Cusack is associate editor of The Cooperator.

Leave a Comment