From the outside, it’s impossible to tell a co-op from a condo–there’s no physical difference between the two. However, as more and more are considering the concept of co-op to condo conversion, real questions about its possible benefits and downsides–indeed the overall feasibility of such an undertaking–arise, starkly pointing out the differences between the two forms of ownership. And as it turns out, more and more experts purport the benefits of condo ownership.

But the Market’s So Good

Can co-op to conversion really become a trend in a city whose real estates values have skyrocketed? Indeed today’s booming market has increased the value of previously unsalable co-ops but, according to Jack Boyajian, president of Virginia-based ROA Hutton which specializes in co-op to condo conversion, "This is a false sense of euphoria; people have a short-term memory." Boyajian uses this to make the distinction that, inherently, co-ops are not as valuable as condos, even in a strong market. "Co-ops are the last to rise and the first to fall in appeal when the real estate market booms," he explains.

Kenneth Jacobs, a partner in the Manhattan and Westchester law firm, Smith, Buss & Jacobs, was the attorney who represented the shareholders in the conversion process of 30 West 90th Street in Manhattan in 1998 (the first ever such conversion in New York State). Jacobs concurs with Boyajian’s assessment, using much the same language. "This is about short-term memories. In 1989 to ‘92, co-op values went way down. Shareholders couldn’t find buyers and sales prices to even cover their loans." So, even though the market is so strong, Jacobs continues, "some day the cycle will change and then that’s where the real benefit of being a condo will come in. It’s a more liquid form of ownership." Gary Brynes, vice president of The Corcoran Group, says, "If the marketplace turns, condos will sell better, easier and for so much more money."

According to Brynes, the comparison between co-ops and condos is so difficult because there are many subtleties to take into account. However, after much research Brynes says, "When comparing apples to apples as much as possible, taking into account similar neighborhoods, apartment sizes, etc., condos are worth 20 to 40 percent more than similar co-ops even when the underlying mortgage is taken into account." Neil J. Binder, a principal of Bellmarc Realty concurs with the premium on condos. "In New York City, condos have been traditionally priced higher than co-ops. The big question is why? So upon analyzing the differences in recent sales, I found several useful facts. In smaller apartments, such as one-bedrooms, there was an average premium of nearly 29 percent for the condominium. I found that several factors contributed to this difference, including underlying mortgage pick-up and a disparity in the cost of the loans. But a large portion of the difference has to do with the right to rent and the ease of sale." Binder continues, "Generally, the marketplace perceives condos as offering unrestricted rental rights, whereas cooperatives are viewed as having very limited opportunities in this area. The ease of sale relates to the additional rules generally levied by co-ops that restrict ownership access, including limitations on financing and the board approval process, itself... The bottom line is that co-ops are cheaper than condos in real cost terms."

David Muelken, vice president of ROA Hutton, backs up the fact that condos are more valuable. His firm, along with Jacobs, Barbara Corcoran and Brynes of The Corcoran Group initiated a series of seminars entitled, "Does Your Co-op Want to Be a Condo?" two years ago. Targeted to co-op board presidents and members, Brynes said while the first was attended by only 25, the last in November of ‘99 recorded about 75 in attendance. Because today’s market is so hot, most live under the assumption, "If it ain’t broke, don’t fix it," Brynes says, but the seminars remain on the back-burner. The seminars touted "The Difference in Value" between co-ops and condos. Seminar data included, "In 1992, the average sale price per room for condos was only 7 percent higher than co-ops. That difference has more than tripled to 27 percent for the first quarter of 1998." Corcoran statistics state that the average price of a one-bedroom co-op was that of $174,000 in 1997, compared to $267,000 for a condo. Likewise, where a three-bedroom co-op was worth $546,000, a three-bedroom condo was worth $879,000. All figures have been adjusted for the underlying mortgage.

An Historical Analysis

With so much to be gained, will the traditional Manhattan co-op go the way of the dinosaur? Not quite. New York’s housing has traditionally been dominated by the co-op. Even in Washington, D.C., the market which has the second largest number of co-ops, the figure is substantially less than that of New York. Why the anomoly? A bit of history is necessary…

Co-ops came to Manhattan in the early 20th Century in the form of exclusive "home clubs" for the social elite. These set-ups allowed the fortunate to weed out "undesirable" neighbors. And while societal concepts would like to put an end to those kinds of purposes, the traditional "cooperative" notion still reigns in areas of Manhattan, typically Park and Fifth Avenues. But that’s not the only reason co-ops are so numerous in the city. A number of factors have contributed to keeping the institution around.

The New York Housing Act of 1927 provided tax incentives for creating co-ops and then labor unions joined the fray and became active in building co-ops for workers. The Great Depression proved disastrous; nearly all went under by 1934. Co-ops appeared back on the scene in the ‘40s and ‘50s again as the result of de facto deregulation.

Then came the boom. Richard Hochman, chair of the Rent Guidelines Board (RGB), explains, "Rent regulations in the ‘70s and ‘80s incredibly suppressed the values of rental buildings." Investors came in to buy the properties with conversion in mind.

The solution was a godsend: Convince tenants to buy their apartments at lower "insider prices." If enough buy into the deal, you’ve got yourself a co-op and less rental woes. With a few successes, "the herd mentality took over," says Hochman.

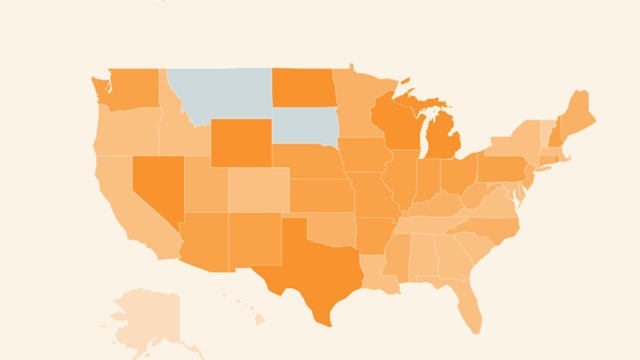

All of these factors contributed largely to the sustenance of New York’s "apparent" housing of choice: the co-op. But elsewhere in the country, people absolutely prefer the ownership arrangement afforded by condos. Several factors contribute to the widespread appeal of condos.

Boyajian spells out the components: "The primary advantage of condo ownership over co-ops is the enhanced value of the former, due to a general aversion of buyers toward co-ops as a consequence of high maintenance and the absence of real property ownership. As a result, a larger market of buyers for condos than for co-ops, all else being equal. Units will sell faster at higher prices and the ultimate consummation of the sale is much simpler and more certain, since no board approval is necessary in a condo sale... and more lenders are apt to provide mortgages to condo buyers or owners for refinancing at lower rates."

So, will these benefits result in an all-out dash to convert co-ops to condos? Absolutely not. The process is not right for all co-ops–some have decided it’s just too much hassle.

The Devil is in the Detail

Robert Grant, director of Midboro Management in Manhattan, explains that the process of conversion is multifaceted. "Technically, you probably need at least 75 percent of the co-op shareholders to approve, but ideally you should try to obtain the consent of 90 percent of the owners of the corporate stock," he says. "This can be achieved by educating the shareholders, investors, holders of unsold shares and sponsors about the benefits, and by retaining the services of experts in this field to direct and coordinate the entire conversion process."

Grant explains that special meetings and written memos can explain the process and benefits, such as drafting special language in the declaration and the bylaws of the new condominium that would give specific consent requirements for leasing, and even for sales. Grant says, "If those documents are properly written, the owner would have an apartment worth about 30 percent more than a comparable co-op apartment, and would have added protection regarding future neighbors." This is all part of the "mass education" process. Boyajian says that the education process is the most time-consuming and difficult part of the conversion process.

The reason a co-op should retain experienced pros is that to ultimately succeed, they will face legal issues, unique tax issues, mortgage underwriting issues, negotiate with lenders to pre-approve new loans for the conversion, and the incredible coordination of paying off every shareholder’s share loan, obtaining new mortgage loans for every "former shareholder" now turned into unit owners, and paying off the cooperative’s underlying mortgage. That’s the first absolute necessity to undertaking the conversion process. If you can’t pay off your co-op’s underlying mortgage, you can’t convert.

Where does the attorney who is guiding the co-op board begin? Grant explains, "First, the underlying mortgage documents must be examined to be sure that there is no prepayment penalty or at least a reasonable prepayment penalty, in order to satisfy the mortgage. The proprietary lease and articles of incorporation have to be examined to review the specific language regarding every issue related to termination of the cooperative corporation."

The central coordinating team has to line up appropriate financing. In some instances the newly formed condominium association may itself provide direct financing. Every single shareholder has to "exchange" their share loan into actual mortgage loans, because condo units are real property with deeds. Grant suggests that these complex lending arrangements are best performed by identifying three or four lenders that already hold most of the end loans (share loans) in the cooperative, and obtain pre-approval from these banks for new mortgage financing to the same borrower in the same unit.

An appraisal from a firm acceptable to all pre-approving lenders must be ordered. Each shareholder must apply and again qualify for a mortgage that will satisfy both their existing share loan and pay off their pro rata portion of the cooperative’s underlying mortgage. While this makes their new mortgage loan greater than their current share loan, there is an important benefit that must be explained to all the stock holders.

Grant explains that in a co-op approximately 35 to 40 percent of the stock holders’ maintenance (rent) goes to pay interest and to pay down (amortize) the corporation’s underlying mortgage. That underlying mortgage is a commercial loan which normally carries a higher interest rate than the rate for individual home mortgages. He says, "When the shareholders increase the amount they’re borrowing for their new mortgage, they probably will have lower interest rates than the co-ops’ underlying mortgage, especially if they take out an ARM (adjustable rate mortgage). The decrease in interest rates alone can often cover the cost of carrying a larger loan." In other words, the same dollar amount they are accustomed to paying on their end loan may be adequate to pay for the larger mortgage loan. That becomes part of the financial benefit that the shareholder achieves.

In addition, Grant says, "The apportionment of common charges will usually become more rational during this conversion. In a co-op, the sponsor was able to arbitrarily assign shares based on lower or higher floors, views, renovated or occupied by rent control tenants, or any other factor that affected his sales program. In a condo, the common charges are usually based on the square footage of the apartment and an appurtenant percentage of ownership of the common areas. The common charges in the converted condo will be significantly less than the shareholders’ co-op for the same apartment." A condo unit owner doesn’t have to pay a pro rata share portion of the co-op’s underlying mortgage. Grant says, "That is a savings of 35 to 40 percent of the shareholders’ current monthly maintenance!"

The central coordinating team not only arranges the financing for the new mortgage loans, but also handles the difficult logistical task of coordinating and scheduling the bulk closings on the former loans, on the new mortgage loans and the pay off of the co-op’s underlying mortgage.

They must also address the complex tax consequences of such a conversion, specifically the issue of gains tax. The IRS treats such a conversion as a liquidation of a corporation and creation of realty, and thus is able to charge a gains tax. The valuation of the cooperative is affected by the depreciation calculated and published each year by the co-op’s CPA auditors in the annual financial statement. Therefore shareholders in high-end buildings may have potential capital gains if, after the conversion, their unit is valued as more than $500,000 above their co-op unit’s valuation. Special appraisals must be prepared, which evaluate every apartment, and determine the value of the entire property. The cooperative’s accounting firm will have to be involved, or the co-op will have to hire an accountant with experience in different tax issues related to co-ops and condominiums.

Grant points out an interesting fact: Investors and sponsors often do not have the same tax problem. Investors holding of co-op stock that is being liquidated can qualify to be treated under IRS 1031 as a like kind exchange (because at the time of liquidation they are buying or "swapping" the proceeds for realty in the new condo) in order to avoid gains tax. Additionally, sponsors can potentially minimize or eliminate gains tax problems if they have rent-controlled or rent-stabilized tenants.

Will the Epicenter Crumble?

With such complexities, it’s no wonder many boards have felt that the hassle is too much to handle. Boyajian, though, who has made a business taking care of the complexities, says the process is less painful than it seems. It’s been so successful, in fact, numbers of conversions in certain areas are rapidly increasing. For instance, the firm has recently converted four co-ops in New Jersey. And according to Muelken, "A dozen more are in the works." Likewise, New York’s outerboroughs are showing interest in making the switch. Muelken says, "Queens and Brooklyn are hot areas. We’re in discussion with three buildings that I know of."

Boyajian describes "core" Manhattan as the epicenter (this includes classic co-op areas such as Central Park West and Park Ave.) and the outer areas (such as New Jersey, Queens and Downtown– SoHo, the Village, etc.) as the "periphery." He concludes that within ten years, the periphery will begin making the move towards conversion. He estimates that in 30 years, the epicenter will start to pick up on the trend. Accurate assumption? According to Jacobs, "New York City may not be the ripest place to consider conversion. Manhattan building are still quite concerned about who their neighbors are."

So what’s the difference between core Manhattan and, say, New Jersey? Jacobs says the best candidates for conversion are those buildings in limbo. Those that have a tough time finding financing and where owners can’t rent are more in line with the peripheral market. He says, "Who your neighbors are is less important on a practical matter outside. Most buildings are not high-end, they’re middle class; if you have the cash, you’re in." Right now Manhattan is hot so there’s not so much impetus to go the conversion route any time soon. But, again, as Jacobs says, "Some day the cycle will change and than that’s where the real benefit of being a condo is recognized." He continues, "It wouldn’t be so bad to pinpoint a few forward-looking board members and tell them to prepare for the future. Boards should look to get the most liquidity and the most value."

For What it’s Worth

Collectively, the professional fees need to carry off such a conversion could range between $1,500 and $2,000, and even $4,000, per unit. What would induce cooperative shareholders to undertake this challenging transformation? The immediate answer is a 30 percent premium in the value of their apartment. Other reasons may include having a very low underlying mortgage to pay off, or having a building that is not distinguished from neighboring buildings, and therefore not competitively valued. In the latter case, the unfavorable market valuation of the co-op apartments within the neighborhood can help persuade a broad-minded board.

According to Grant, "A knowledgeable and cutting edge managing agent that has the perception to propose this daring concept, and the connections to put together the right professional team, can take a building and transform it into a highly valued distinguished property."

Leave a Comment