Once again, a push to pass legislation requiring co-op boards to disclose their reasons for rejecting would-be shareholders is afoot in the New York State Senate. The bill is sponsored by housing committee chairman Brian Kavanagh, a Democrat representing the 26th senatorial district, which covers lower Manhattan and some neighborhoods in northwest Brooklyn. The new rules would require that co-op boards provide a written explanation for turning down an applicant wishing to purchase shares in their building.

Basis for Denial

It may surprise some to know that currently, boards aren’t required to provide any such explanation. They can reject a prospective buyer for no reason - or any reason, so long as it’s not discriminatory or otherwise of bad faith.

“A board can reject a buyer for many reasons,” says Dennis Greenstein, a partner at Manhattan-based law firm Seyfarth Shaw. “The most common reason is financial. Many buildings may also reject purchasers who are buying a unit as a pied-a-terre, or who may wish to have their college-aged children occupy it.”

With an eye toward promoting long-term ownership and primary residency, co-op boards seek stability. As members of a cooperative corporation, shareholders may be required to shoulder occasional capital expenses. Boards want to feel certain that when those expenses come up and shareholders are called up to contribute - usually in the form of an assessment - they have the wherewithal to cover their share. Along those same lines, many co-op communities want to promote just that: community. They want owners who occupy their apartments full time, rather than seasonally, or as a crash pad whenever they happen to be town, or worse yet, as a rental property with a revolving door of tenants and their guests. Being majority owner-occupied promotes a feeling of pride of ownership, and encourages accountability to the community that more tenuous relationships simply don’t.

Philip Simpson, an attorney with Robinson Brog, a firm also based in New York, points out that, “Co-op boards can reject prospective purchasers for any reason that is not prohibited by the discrimination statutes. Financial ability is probably the most common.” Simpson says he’s seen a new trend in board denials recently. “I have seen denials, or issues raised, when the board views the purchase price as too low. A low purchase price will affect values throughout the building, because it will become a comparable sale the next time an apartment comes on the market, or someone wants to refinance their unit’s mortgage. The ‘price-is-too-low’ is generally viewed as a legal reason to reject a sale.”

License to Discriminate?

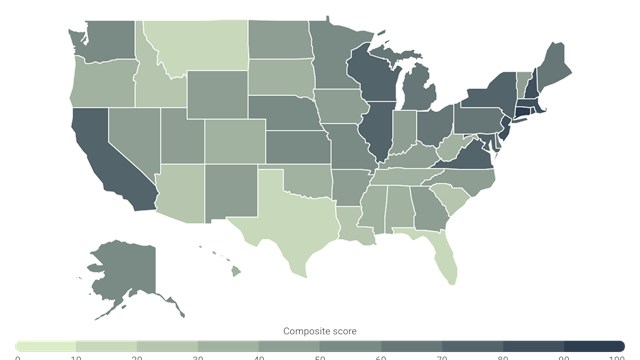

The stated reason for the new legislation is to prevent discrimination - and while certainly no ethical person would object to that goal, some industry groups and individuals have questioned whether the bill will accomplish that, or whether it’s the best way of doing so.

Simpson says in fact, “New York City presently has the broadest scope of protection for groups of people against whom co-op boards might discriminate.” While a buyer who’s been turned down for a co-op purchase might have a tough time proving that the rejection was discriminatory if the board isn’t required to state its reason for it, Simpson points out that “If a prospective purchaser in a protected class is turned down and sues, the co-op board may well have to articulate a reason in response to the lawsuit.”

In general, Simpson describes a three-step process for analyzing such cases alleging intentional discrimination: “The three-step process requires that, first, the plaintiff establish a prima facie case of discrimination. If the plaintiff sustains this burden, the defendant must offer rebuttal evidence articulating a legitimate, independent, nondiscriminatory reason for its actions. Once defendant does so, in order to prevail plaintiff must prove, by a preponderance of the evidence, that the defendant's stated reasons are only a pretext for discrimination.”

In short, explains Simpson, if a member of a protected class is turned down by a co-op board and then sues the so-op under existing case law, showing that she/he was objectively qualified (had the financials, intended use as a primary residence, no reason to believe there would be objectionable behavior) and was turned down, if there’s an inference that there was unlawful discrimination (if someone not in the same protected class successfully purchased, for example), then the co-op board will have to come forward with legitimate reasons for the denial. The upshot is that, if sued, a co-op board cannot stay silent about their reasons for rejecting an applicant.

Is New Legislation Needed?

With current New York City anti-discrimination regulations for housing among the toughest in the nation, Greenstein considers whether additional legislation is necessary. “I do not believe so,” he says. “We represent a significant number of cooperative corporations, and over decades of counseling them I have not had more than a handful of complaints alleging discrimination relating to the rejection of purchasers.” Out of those, he notes that “In each instance, the state and city commissions found no wrongdoing. The legislative reasons given for this law rely on a belief that admissions committees ‘generally’ decide if a purchaser will be rejected or accepted, and assumes a bias or unfair motivation which led to rejection.”

“While admissions committees do play an important role in many buildings, it’s a board decision,” continues Greenstein. “Another reason for the legislation is the belief that by not being required to give the reason, a board can invent a reason later on if they are challenged. Supporting actions to prevent and punish boards that discriminate should not be based upon such assumptions - and particularly that people serving on boards as volunteers will potentially fail to tell the truth, whether it be at commission hearing or before a judge gathering the facts and hearing the testimony. There are plenty of remedies for the parties who feel they have been discriminated against, and there are a number of decisions by the commissions and courts which support such action. I feel that this legislation is not necessary, will encourage litigation, and discourage people from serving on the boards of cooperatives.”

Will it Stand?

The more esoteric question perhaps is whether, if passed, such a law would stand the scrutiny of the judicial review. “On its face,” says Simpson, “requiring that people with lesser financials be accepted would not seem to impair the integrity of contracts, because no existing contract is being interfered with. But I would expect co-op owners to push back hard on such a proposal, because it would be asking that existing co-op owners take on additional financial risk,” relative to possible financial emergencies the co-op might experience in the future.

Greenstein concurs. “Not without legislation, and if enacted, I do not see it standing if the cooperative is a private cooperative. There are cooperatives - such as Mitchell Lama co-op buildings - which have legal requirements limiting incomes of eligible purchasers and the sales prices of apartments. The shareholders of a number of these buildings have voted to have them go private,” in recent years.

Comments

Leave a Comment