Condominium boards and managers are often frustrated by unpaid common charges. Once a unit owner falls more than 60 days behind in his or her common charge payments, it is recommended that this problem be turned over to the condominium association's attorneys to resolve. There are a variety of legal methods a condominium association's attorney can use to attempt to collect arrears, but which method or combination of methods is best for a particular situation will vary.

Regardless of which method or methods are used, the first step in the process is sending a Thirty Day Notice of Debt Collection to the unit owner. There are two benefits of sending a notice of debt collection prepared by an attorney. First, it conveys the seriousness of the common charge arrears to the unit owner and helps to ensure compliance with Federal debt collection laws. Second, it provides the unit owner with a breakdown of the amount he or she owes. This may expedite an amicable resolution to the matter, as sometimes owners do not read their monthly common charge statements and do not realize they are in arrears. Being able to examine an itemized list may also motivate an owner to inquire regarding a particular charge he or she isn't sure about before paying it.

In the event payment is not made within the 30-day period provided under the notice of debt collection, the next step is filing a common charge lien against the unit pursuant to New York Real Property Law Section 339-aa. Common charge liens are security interests similar to mortgages. Like a mortgage, a common charge lien is filed in the property records of the Office of the County Clerk where the unit is located. A properly filed lien provides notice to the world that the common charges are owed, and in most cases will prevent the sale or refinance of a unit until the amount owed by the unit owner is paid. In addition, a common charge lien can be foreclosed like a mortgage. That is, a condominium association can start a foreclosure action that will result in an auction sale of the unit with the auction proceeds being used to pay off the common charge arrears.

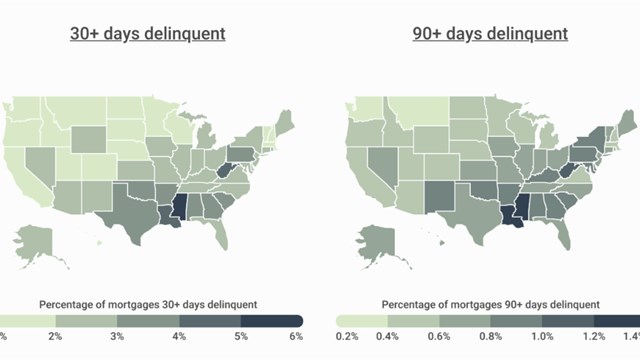

Unfortunately, common charge lien foreclosure actions can drag on for years, and the condominium's lien will be subordinate to a first mortgage filed before it. This puts condominium associations in New York at a great disadvantage compared to other states where a certain period of common charges (e.g., six month's worth) will take priority over mortgages on the unit. Therefore, attorneys representing condominium associations in New York should ascertain whether there is a first mortgage against the unit and the value of the unit, and then consult with their clients in order to determine whether a lien foreclosure action makes sense before proceeding.

Even if the condominium association's attorneys evaluate the situation with their client and conclude that a lien foreclosure does not make sense, they should still file a common charge lien against the unit. As well as making the unit unsaleable, filing the lien will make the condominium association a "secured creditor" under Federal Bankruptcy law. As a secured creditor, a condominium association will receive repayment priority if the unit owner files for bankruptcy protection.

For the past few years, I have generally recommended that condominium associations sue unit owners in arrears in the local city or town civil court for money judgments rather than going the foreclosure route. This is much faster and less expensive and can still result in an auction sale of the unit. It also provides the condominium association with access to other assets, such as bank accounts and wages to satisfy the common charges arrears once a judgment is entered.

Taking this a step further, I have recently begun recommending that lawsuits for money judgments be filed with the Small Claims Part of the local city or town court. While the amount of the recovery is limited by the jurisdictional limit of the Small Claims Part (typically $3,000 to $5,000), it is much quicker and less expensive than regular civil court. Rather than litigating for months or years, your attorney can literally spend a few hours in court at a hearing where a repayment agreement with the delinquent unit owner can often be negotiated. If negotiations with the unit owner fail, your attorney can present your case to a judge or arbitrator who renders a binding decision (and judgment if you prevail), which your attorney will receive in the mail within a few days of the hearing date--quick justice indeed!

Lastly, a little known, but attractive, method to collect common charge arrears is available where a unit owner rents his or her unit to a tenant. Real Property Law Section 339-kk authorizes condominium associations to collect rent payments directly from the tenants of unit owners in arrears. This is accomplished by sending a notice to the tenants pursuant to the statute. Since a tenant's monthly rent for a unit is usually several times the amount of the common charges for the same unit, if the tenant obeys the notice the arrears are usually paid off within two or three months. Unfortunately, the statute does not provide the condominium association with any legal remedy against the tenant if he or she disregards the notice. This flaw in the statute can be remedied by putting language in a condominium association's lease application authorizing the condominium association to sue a unit owner's tenant directly.

It is evident that Real Property Law Section 339-kk, which authorizes condominium associations to collect rent payments directly from the tenants of unit owners, and Real Property Law Section 339-aa, which authorizes lien foreclosures, both need to be amended by the legislature in order to give them more teeth. As written, these statutes require creative lawyering to get results, and leave many condominium associations operating under tight budgets with chronic arrears problems. A few minor revisions to these statutes would dramatically increase their effectiveness, and I hope to petition the New York State Legislature to effectuate these changes in the not so distant future.

Stephen M. Lasser, a partner, practices in the New York City office of the Condominium & Co-op Group of Stark & Stark, where he represents cooperatives, condominiums and homeowners associations throughout the five boroughs of New York City and Westchester, Rockland, Orange, Ulster, Dutchess, Nassau and Putnam counties.

7 Comments

Leave a Comment