The first seven months of 2020 have been difficult and uncertain for our country. With the emergence of the COVID-19 pandemic, we are all navigating uncharted waters and doing our best to adapt. Amid this unprecedented challenge, racial tensions and inequities have come into focus that require us to consider whether collection practices within our industry contribute to the problem, or create a perception that might result in liability for boards and managers.

As we considered the impact of traditional collection practices, it became clear that these practices often disproportionately impact both the health and finances of certain minority populations. Being in an industry created to develop, maintain, and improve communities, we must recognize these inequities and make changes to the way we approach delinquent assessment collections. The traditional model of rapid legal action without any meaningful proactive outreach only adds to the unbalanced negative impact on groups who may already be suffering. That is why it is more important now than ever to initiate compassionate collections and provide homeowners with the proper education and means of communication to resolve their delinquent account prior to legal action.

A recent survey from Equity Experts of over 100 presidents and leaders in the community management industry around the nation found that 91% agreed that, given the current social injustices and pandemic, community associations should be more lenient with delinquent homeowners who claim hardships. On top of that, a staggering 81% of participants said that they expect a substantial increase in delinquencies - but over 40% felt that they were unprepared to handle such an increased volume of delinquencies. Given this information, it is crucial to analyze the effects the current social and pandemic environment have on community associations, and the solution to navigating through it and beyond.

Minorities Hit Harder in Both Health & Finance

The health effects - both mental and physical - of COVID-19 are far-reaching across all demographics, but it is clear that certain populations are affected significantly more. The following is from an April 2020 survey by the Pew Research Center:

“Among the public overall, 15% say they personally know someone who has been hospitalized or died as a result of having COVID-19. However, about a quarter of black adults (27%) say they personally know someone who has been hospitalized or died due to having the coronavirus. By comparison, about one-in-ten white (13%) and Hispanic (13%) adults say they know someone who has been so seriously affected by the virus.”

Additionally, APM Research Lab found that black Americans are 3.8 times more likely to die from the coronavirus than white Americans. As concerns mount in these communities about keeping themselves and their loved ones safe, it is understandable that many people may fall behind on their assessments while addressing their health and safety as a more urgent priority. As an industry, we should recognize this potential outcome and be prepared to address their delinquencies with the compassion and empathy they deserve.

To make matters worse, in addition to the virus affecting minorities to a greater degree from a healthcare standpoint, they are also more likely to be impacted by the financial repercussions of the COVID-19 pandemic.

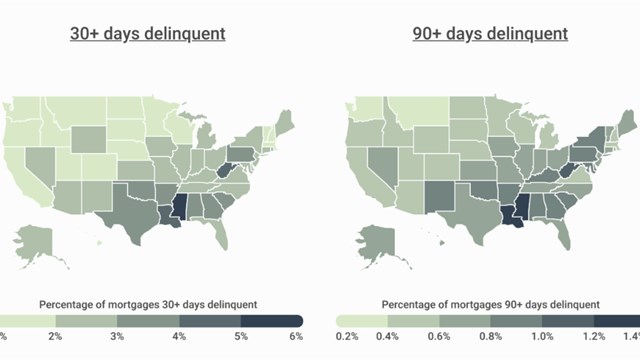

Unfortunately, the global financial impact of COVID-19 will not be fully realized for quite some time, but its impact on our country is already apparent. Despite the moratorium on foreclosures from the CARES Act and other state–level relief bills, the loan delinquency rate is rising sharply in a way it has never done before. As delinquencies begin to rise, we should be prepared to handle these in a better way, both for those who fall behind, and the community associations in which they live. From a May 21st article in USA Today:

“Mortgage delinquencies surged by 1.6 million in April, the largest single-month jump in history, according to a report from Black Knight, a mortgage technology and data provider. The data includes both homeowners past due on mortgage payments who aren’t in forbearance, along with those in forbearance plans and who didn’t make a mortgage payment in April. At 6.45%, the national delinquency rate nearly doubled from 3.06% in March, the largest single-month increase recorded, and nearly three times the prior record for a single month during the height of the financial crisis in late 2008, Black Knight said.”

And while the financial impact of COVID-19 will affect almost everyone in some way, the data also shows that minority communities will feel the impact of these consequences at a much higher rate. A May 2020 study from Pew Research found that nearly 50% of black and Hispanic Americans believe that they will not be able to cover all or some of their bills during the pandemic. Additionally, a large majority of those surveyed, (73% for blacks and 70% for Hispanics) indicated that they do not have adequate savings to cover their expenses for three months. Without those funds, black and Hispanic Americans are going to be looking at an increase in the number of accounts referred to collections.

On top of that, the pandemic has also caused unemployment rates to skyrocket. All races and ethnicities have suffered catastrophic job losses leading to financial burdens for everyone - but the unemployment rate for white Americans is starting to improve at a much faster pace than for other minorities. What this means is that it is very likely that many members of our communities will struggle to pay their association assessments due to unemployment.

Traditional Collections’ Negative Impact on Minority Owners

The collective data for black and Hispanic Americans paints a potentially frightening picture: it shows that both groups are more likely to contract COVID-19, and if they do get sick, they are more likely to be hospitalized or die from the virus. They are also more likely to lose their job, but regardless of job loss, are more likely to have a hard time paying their bills - including their association assessments - because of their limited access to capital. All these facts make legal actions, where a large lump-sum payment is often required to stop the action, an especially difficult and worrisome approach to these groups.

Concurrent with these health and financial challenges, we also know that our country is in the midst of addressing social inequalities that have created some financial inequities in the first place. What you may not know is that the traditional legal driven collection methods used by the community association industry makes these problems much worse.

Based on research from our data partner Techcollect, we found that the average cost to a homeowner for a lawsuit or a foreclosure is around $2,500. Alternatively, their data shows that the average cost of collections to a homeowner without legal action is around $500, and that up to 60% of delinquent owners will resolve their account without legal action if given an appropriate opportunity. An article from ProPublica found that most Americans who earn less than $60,000 per year have only $488 – $3,862 in liquid assets, and for black Americans that number is anywhere between two and four times less, depending on income bracket. Using that information, it is clear that most Americans - and certainly minority Americans - do not have the money to pay for traditional legal methods of liens plus lawsuits or foreclosures.

The traditional legal driven collection approach taken by most of our industry, however well-intentioned it may be, has a disproportionately negative impact on minority communities, and is a process that does not work particularly well for any group. The socioeconomic factors discussed above - as well as potential language barriers for certain groups - make legal actions especially difficult for these groups, often resulting in higher negative outcomes and increased financial burdens. It is extremely important for all of us in the community association industry to recognize what the data is telling us and to address it head-on. It is not a choice or an option to consider; it is a clear and unambiguous moral obligation.

Compassionate Collections

To be clear: we are certainly not suggesting that certain racial groups be treated differently than others. Community associations, through their governing documents and day-to-day practices, are inherently focused on equal treatment, and adhering to policies that ensure such treatment.

So how can you address present-day inequalities? Our solution is a more thoughtful and compassionate approach for EVERYONE. This compassionate, proactive, problem–solving approach can take many forms, but should include the following:

A customized, proactive approach. Reaching owners in arrears means not just sending a few letters. Your approach should include phone calls, emails, and potentially even text messages or direct messaging through social media platforms. Historically, pursuing collections usually includes sending the homeowner a single letter to the address provided by the association, and then initiating legal action right away. In 2020, that is both an inefficient and ineffective way to approach delinquent assessments. Using our technology advancement through our partnership with Techcollect, we are now capable of determining the most effective ways to reach out to delinquent homeowners and to collect proactively and compassionately instead of forcing traditional, one-size-fits all methods that just flat-out don’t work for everyone.

In order to initiate a custom proactive approach, finding the information on where to reach homeowners is absolutely essential. Some owners don’t actually live in their HOA - and snail mail is often ignored, lost, or thrown away regardless. Therefore, the inclusion of effective debtor location methods is imperative to a proactive collections approach. Using established partnerships with reliable data vendors, we are now able to find the best phone numbers, physical addresses, email addresses, and even social media accounts to reach delinquent owners.

Finally, offering more comprehensive payment plan options is also vital to a more compassionate collections approach. This includes having bilingual agents who can discuss payment options, educate owners, and guide them to potential resources for financial aid and support. Community associations should update their collections policies to provide these guidelines - but should also make sure that your collections partner is offering payment plans to your homeowners and empathetically educating them as well. What if a homeowner is facing catastrophic financial difficulties? You should be sure that your collection partner is equipped to handle that empathically and effectively.

There are a number of tools and resources available to help associations and collections partners update their best practices, including Equity Experts’ RelEEf, which is designed to help homeowners get back on their feet, and The Hardship Calculator, a free tool to help boards and managers gather relevant information from past-due owners to evaluate them for payment plan consideration. Tools like these help determine the best decision for a community while offering transparency and compassion.

Making Changes in Our Communities

Using the above recovery methods well before considering legal options provides a more level playing field for all association members to become educated and knowledgeable about the debt that they owe and how they can address it. This approach also meets the board’s fiduciary obligations to refer past-due files for collection in a timely manner while avoiding the potential liability of real or perceived discrimination.

Nobody likes collections, but it is a reality of our industry that cannot be ignored. It is our responsibility as community association leaders to have these conversations and move beyond the archaic collection methods that have traditionally dominated our industry. The standard, one-size-fits-all legal–driven approaches of the past have provided mixed results and can be especially difficult to manage for certain demographics. Legal action is an important tool available to community associations, but it should be used only in the context of a comprehensive recovery plan that provides a more proactive approach with more options for resolution. Now is the time to collectively choose a more thoughtful and compassionate path that not only benefits community associations, but society as a whole.

Gar Liebler, CMCA is the Chairman and Visionary of a national real estate conglomerate headquartered in Auburn Hills, Michigan, and has served on various professional boards, charities, and ministries.

Leave a Comment