Page 7 - NY Cooperator November 2019

P. 7

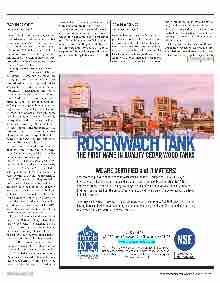

COOPERATOR.COM THE COOPERATOR — NOVEMBER 2019 7 ROSENWACH TANK THE FIRST NAME IN QUALITY CEDAR WOOD TANKS WE ARE CERTIFIED and IT MATTERS! 718.729.4900 43-02 Ditmars Boulevard, 2nd Fl., Astoria, NY 11105 www.rosenwachgroup.com Rosenwach is proud to announce that Rosenwach’s tanks are certified to NSF/ANSI 61 by NSF International, a leading global independent public health and safety organization. NSF/ANSI 61 addresses crucial aspects of drinking water system components such as whether contaminants that leach or migrate from the product/material into the drinking water are below acceptable levels in finished waters. To receive certification, Rosenwach Tank submitted product samples to NSF that underwent rigorous testing to recognized standards, and agreed to manufacturing facility audits and periodic retesting to verify continued conformance to the standards. The NSF mark is our customers’ assurance that our prod- uct has been tested by one of the most respected indepen- dent certification organizations. Only products bearing the NSF mark are certified. thing, overall – but conversely, without the burden of a UPM, the tax deductibil- ity of their maintenance would decline as well. Until the passage of the Tax Cuts and Jobs Act of 2017, higher tax deductibility was viewed favorably. With its provisions limiting the deduction of state and local taxes, the benefits of interest deductions from UPMs has declined. Paying Down a UPM—is it Realistic? While current opinions on debt and its relative benefits and drawbacks are changing, co-op corporations and their professional advisors must make deci- sions in the real world, not in the theoret- ical one. It is unrealistic for most co-op corporations to think they can pay down their UPMs to zero. Like rental apart- ment buildings, co-op properties age, and require both periodic upgrades and major repairs. The replacement of a boil- er, roof, or windows in a private home may be costly, but may be financially manageable for the homeowner without additional borrowing. At the multifam- ily scale, undertaking the same kind of projects can easily run into the millions of dollars. Even with diligent attempts to eliminate the UPM over time, additional debt may be unavoidable. Stuart Bruck is the director of mort- gage brokerage with New York City- based Time Equities, and he says he has never seen a co-op completely pay off their UPM. “I had one co-op on the Up- per East Side I worked with for nearly twenty years,” he says. “They wanted to self-liquidate their UPM. They came very close. Nearly at the end of the term of their UPM they realized they needed to do a considerable amount of work in the building, both in redoing the common areas and in replacing certain building systems. The shareholders didn’t want to be burdened with a large assessment to do that work. In the end they had to abandon their plan to pay off the UPM and refinance the building to get the money to do the needed work.” Harley Seligman is a senior vice presi- dent with National Cooperative Bank in New York City. “Occasionally I see a co-op that has amortized its underlying permanent mortgage. Usually these co- ops fall into two narrow categories: ei- ther they sell off a valuable commercial space on their ground floor and use the proceeds to pay off the UPM, or they are very small co-ops that have self-liquidat- ing UPMs. Sadly, when they come to us it’s because they need to take out a new underlying permanent mortgage to do repairs or upgrades without assessing the shareholders.” They end up back in the same debt position, in other words. While lower debt is a good thing over- all, co-op communities have the power to use the intrinsic value of their property to provide funding when needed. The goal of a debt-free building is admirable, but in reality, it’s unlikely to happen. A co-op corporation’s best hedge against the unex- pected is its ability to borrow. n PAYING OFF... continued from page 6 Noise. In both instances, Soifer and his su- perintendent inspected the apartments and performed what he calls “unscientific noise tests.” Aside from normal footsteps and “the usual apartment noise,” Soifer says they de- tected “nothing that is beyond noise code.” Additionally, both offending apartments were compliant with required floor cover- ings in their units. “But there was no resolu- tion,” recalls Soifer. “So once I’d exhausted my letter-writing and the issue was still not resolved and \[the neighbor\] was still com- plaining, I referred it to Community Me- diation Services.” Offered by the Queens Courthouses, Community Mediation Services is a pro- gram designed to address these very types of hard-to-resolve disputes. According to MANAGING... continued from page 6 continued on page 16