Night falls on the city; just as she’s about to close up shop for the day, a broker receives an email from an unknown sender. The sender is interested in purchasing a specific unit in a specific building - so interested, in fact, that they make an offer for immediate, all-cash purchase right in the email. But the broker’s company database does not have a listing for that unit. Perplexed, she searches listings offered by other companies; nothing. She replies to the sender of the email. Thanks for contacting me, she says, but that unit isn’t currently for sale. With all due respect, she asks, why did you send this offer to me? The sender replies that they saw a listing for the unit as a rental some time ago, with the broker named as the listing agent. “But I’m not interested in renting,” the sender continues. “I want to buy, and that’s the unit I want. I thought you might be able to make it happen.”

This is a slightly simplified version of real events, but it happened - and it’s happening more and more frequently. It’s what’s known as an unsolicited offer.

What is an Unsolicited Offer?

Simply put, “An unsolicited offer is an offer that comes to a broker or an owner directly from an interested buyer for a property that isn’t currently on the market,” says Cynthia Keskinkaya, an associate broker with Douglas Elliman, a real estate brokerage firm in New York City.” She says she’s seeing an increasing number of such offers, and believes they are the result of the current severe shortage of inventory for sale.

Until recently, the unsolicited offer phenomenon was more common outside the city than in it. Suburban homeowners have gotten ‘We-buy-for cash’ letters in the mail for years. A quick look at telephone listings and tax rolls gives investors easy access to names, addresses, and contact information. It’s classic direct-mail marketing, and even with only 1% of direct mail recipients responding, the method can produce opportunities.

The direct-mail approach isn’t as useful in locating co-op or condo owners who might become willing sellers if the price is right. Contacting unit owners in apartment buildings is trickier than single-family homeowners, which is why the aggressive buyer in our story above contacted the broker.

But, explains Keskinkaya, this isn’t how most brokers conduct business. “We don’t just make a sale and walk away,” she says. “It’s not a one-off - we have an ongoing relationship with the buyer, who often becomes a seller eventually.” That’s what’s known in the brokerage world as a ‘book of business.’ “[When I have] that relationship with the buyer-turned-owner, when I’m looking for a type of property that's not currently on the market, I can go through past listings and see what didn’t sell, didn’t trade, didn’t get rented, or was taken off the market. I’ll contact those owners to see if they might consider a sale - and of course I contact previous buyers [who are] current owners and ask if they’re interested in selling.”

Why That Unit?

Keskinkaya goes on to say that buyers in today’s market are sophisticated and knowledgeable. They know what they want in terms of location, building type and style, apartment layout, and amenities. By the time they contact a broker, they may have narrowed their search down to a few select buildings - even specific units.

“Sometimes they want a specific layout that really works for them,” says Keskinkaya. “That layout may not be available in the specific building they are interested in, but it may exist in another, similar building. I will contact the owners of the unit directly and ask if they are interested in selling. I also research the sales history of the building and contact agents who’ve sold units there previously to tap into their relationships with clients who bought in the building to see if they are interested in selling.”

Why is Inventory Low?

“It all has to do with supply,” says Keskinkaya. “During the pandemic, we've had a lot of apartment units being rented out instead of being sold, so many of those are rented and off the market. Owners who are satisfied with that rental income are renewing these leases, and that has resulted in an overall lack of inventory of units for sale.”

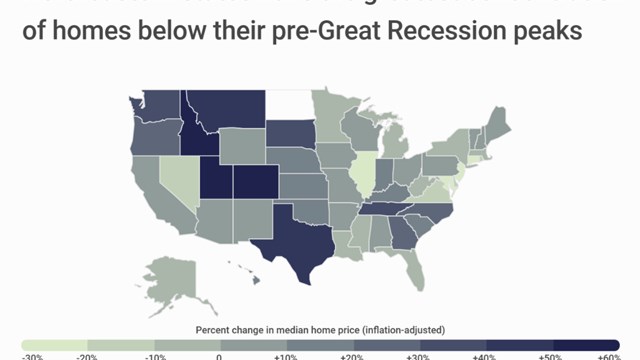

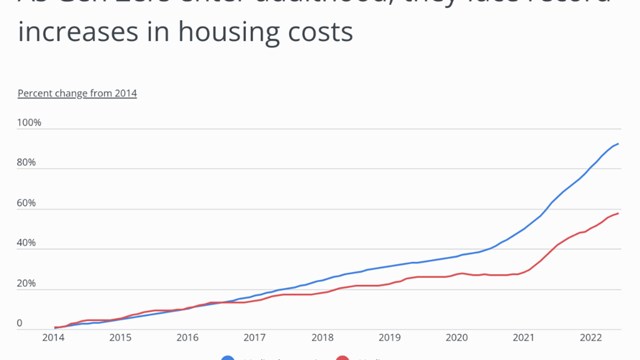

Also, prices are back to pre-pandemic levels in many segments of the market. Buyers are seeing prices going up, and interest rates are rising as well, so they feel pressure to make their move and buy now. Even in less-hot markets where prices are still a bit down, there is upward movement. Market-watchers expect that, barring another major COVID surge, prices on units in those less-prime locations will begin to rise in the spring. The bottom line: more inventory is needed.

Keskinkaya believes unsolicited offers may trend upward in the spring as well, if low inventory continues. “It’s already a trend in the suburbs,” she says, “and with the recovery of the market here, we are expecting the same. There are bidding wars for everything now - so we’ll just have to wait and see how things develop.”

In the meantime, brokers - and even some unit owners and shareholders - may increasingly find themselves the recipients of emails and letters from unknown sources, offering very large sums of money for very much occupied apartments.

Leave a Comment